Multiple Pie Brands, Including Chamm Bungeoppang, Enter Growth Trajectory

Orion's global pie product lineup is entering a full-fledged expansion phase. In overseas pie markets, which have traditionally been centered around Choco Pie, emerging brands such as Chamm Bungeoppang and Fresh Pie are making their presence felt with double-digit growth rates. While mega brands continue to provide a stable revenue base, multiple brands within the pie category are now entering a growth phase, according to industry assessments.

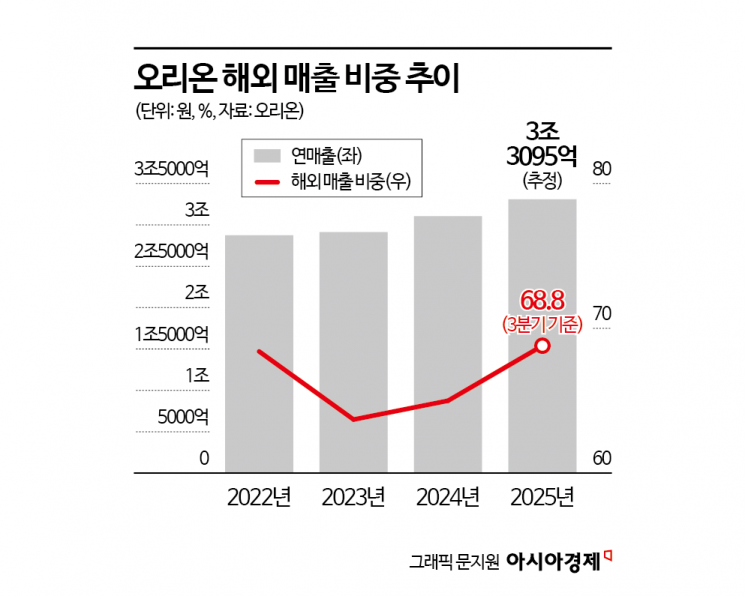

According to financial information provider FnGuide on December 29, Orion's estimated annual sales for this year are 3.3095 trillion won, up 6.6% from the previous year, with operating profit forecast at 550.9 billion won, a 1.4% increase. As of the cumulative third quarter of this year, overseas sales accounted for 68.8% of the total, and analysts expect that Orion is likely to achieve annual overseas sales of 2 trillion won again this year, following last year.

Orion's overseas business has accounted for roughly two-thirds of total sales over the past three years. Annual sales have steadily increased from 2.8732 trillion won in 2022 to 2.9124 trillion won in 2023, and 3.1043 trillion won in 2024, with the overseas sales ratio at 68.4%, 63.7%, and 65% respectively during the same period. This stable overseas sales structure is regarded as the foundation for Orion’s mid- to long-term growth.

The absolute scale of overseas sales is driven by mega brands. As of last year, Orion had nine global mega brands, including Choco Pie, Oh! Gamja, Swing Chip, Yegam, Goraebab, Custard, Poca Chip, My Gummy, and Choco Songi, based on overseas sales volume. These brands have established a solid foundation for Orion’s overseas business by maintaining stable sales in key markets such as China, Vietnam, and Russia.

On top of this structure, the growth of emerging pie brands is becoming increasingly prominent. While Chamm Bungeoppang and Fresh Pie are still smaller in absolute sales compared to the mega brands, they are rapidly expanding their share in the overseas business with double-digit growth rates. This is leading to the assessment that the Choco Pie-centered pie sales structure is gradually diversifying. In fact, global sales of major pie brands-Choco Pie, Custard, Chamm Bungeoppang, and Fresh Pie-reached 617 billion won in the third quarter, a 16% increase from 534 billion won in the same period last year. As a result, the growth rate of the pie category within Orion’s overall sales also reached 15%.

Among them, Chamm Bungeoppang is cited as a representative high-growth case. Since its domestic launch in 2011, it has built brand awareness in Asian markets such as China and Vietnam, established local production in China in 2019, Vietnam in 2024, and expanded to Russia this year. Along with the expansion of production bases, both the number of export destinations and export volumes are increasing simultaneously.

In particular, growth in the U.S. market stands out. After entering more than 300 Costco warehouse stores in the United States earlier this year, Chamm Bungeoppang’s U.S. export value from January to November increased by 366% compared to the same period last year. This is seen as evidence of the growth potential of brands beyond Choco Pie in the U.S. pie market.

Growth continues in Asian markets as well. Chamm Bungeoppang, launched in Vietnam in 2024 under the local brand name "Bong Bang," saw sales increase by 150% year-on-year as of November. Analysts attribute this to the product’s differentiated texture, reminiscent of rice cake, and its adaptation to local consumer preferences.

Fresh Pie is also strengthening its presence in the overseas pie portfolio. As of November this year, Fresh Pie’s sales in Russia increased by 35% compared to the previous year. This indicates that a structure is forming in which multiple brands within the pie category are growing simultaneously.

The industry is paying close attention to this as a "post-Choco Pie growth strategy." While Choco Pie remains the core driver of overseas sales, there is a consensus in the industry that it will be difficult to sustain long-term growth solely with a single brand. Accordingly, Orion’s strategy to foster multiple brands within the same pie category is regarded as an efficient expansion method, allowing the company to leverage both its accumulated brand assets and global production infrastructure.

An Orion official stated, "We are expanding our global pie portfolio by introducing products such as Custard, Chamm Bungeoppang, and Fresh Berry to overseas markets, including Choco Pie, which generates about 600 billion won in annual sales," adding, "We will continue to enhance the global status of 'K-Pie' abroad."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.