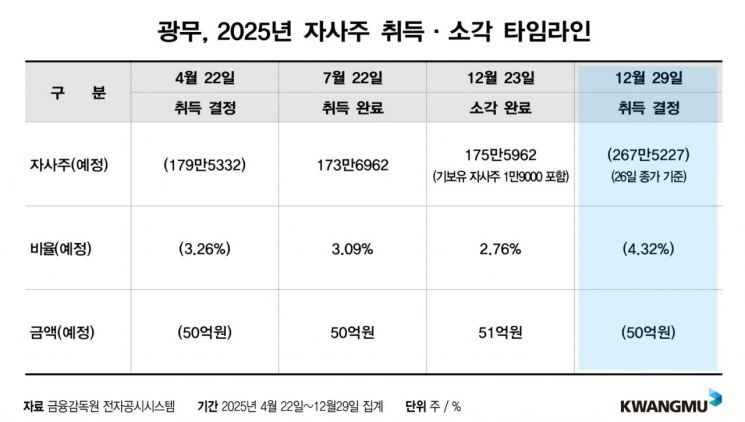

KOSDAQ-listed company Kwangmoo has decided to cancel 5.1 billion won worth of treasury shares recently acquired and to purchase an additional 5 billion won worth of treasury shares. This decision aims to enhance shareholder value.

On the 29th, Kwangmoo announced through a disclosure that it has decided to acquire treasury shares worth 5 billion won. The number of shares to be acquired was set based on the closing price (1,869 won) on the business day prior to the board resolution, which was December 26. The final quantity may change depending on future stock price fluctuations. The treasury share acquisition will take place from December 30, 2025, to March 29, 2026, and will be carried out through Korea Investment & Securities.

The company expects that this treasury share purchase will help mitigate stock price volatility and serve as an opportunity to enhance future growth potential.

This is the second treasury share acquisition by Kwangmoo this year. In April, the company also acquired treasury shares worth 5 billion won (1,736,962 shares). The shares acquired at that time, along with 19,000 shares already held, were canceled on December 23. The total number of canceled shares was 1,755,962, accounting for 2.76% of the total issued shares. As a result, Kwangmoo's total number of issued shares decreased from 63,635,826 to 61,879,864.

A Kwangmoo representative stated, "The treasury share acquisition will not be a one-off event; we plan to continue acquiring treasury shares of a similar scale in the future. Rather than large-scale treasury share purchases, acquiring an appropriate amount multiple times will be more effective in stabilizing the share price and enhancing shareholder value." He added, "The company is reviewing new business opportunities from various angles to secure mid- to long-term growth engines, and is selecting candidates based on core criteria such as technological competitiveness, market growth potential, and financial stability. We plan to proceed carefully within the scope that does not undermine the company’s financial structure or shareholder value."

The company has sufficient capacity for additional treasury share purchases and new business ventures. As of the end of the third quarter of this year, cash and cash equivalents (including deposits at financial institutions and financial assets) stood at 124.9 billion won, and liquidity reaches 160 billion won when including listed shares of other companies. The company’s financial soundness also far exceeds the industry average. The current ratio was 881.13% in the third quarter, up 320.71 percentage points from 560.42% in the same period last year.

In contrast, during the same period, the debt ratio fell from 18.58% to 9.21%, and the dependence on borrowings decreased from 6.03% to 4.44%, dropping by 9.37 percentage points and 1.59 percentage points, respectively.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.