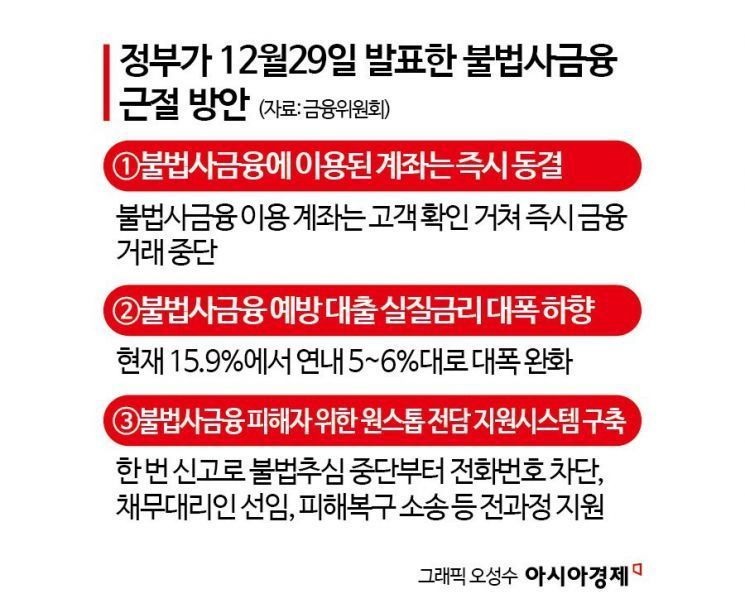

Strengthening Related Systems to Eradicate Illegal Private Lending

Immediate Suspension of Financial Transactions for Reported Accounts

Effective Interest Rate on Loans to Prevent Illegal Private Lending Drastically Lowered from 15.9% to Around

On the morning of the 29th, Lee Eokwon, Chairman of the Financial Services Commission, inspected the performance of illegal private loan countermeasures at the Seoul Financial Welfare Counseling Center Central Center in Dongjak-gu, Seoul. He listened to opinions from field experts and related institutions, and announced additional policy improvement measures to eradicate illegal private loans. Financial Services Commission

On the morning of the 29th, Lee Eokwon, Chairman of the Financial Services Commission, inspected the performance of illegal private loan countermeasures at the Seoul Financial Welfare Counseling Center Central Center in Dongjak-gu, Seoul. He listened to opinions from field experts and related institutions, and announced additional policy improvement measures to eradicate illegal private loans. Financial Services Commission

The government is moving to swiftly freeze bank accounts used in illegal private loan transactions in order to completely eradicate illegal private lending. It will also support victims in filing lawsuits to recover criminal funds frozen in these accounts, enabling them to get their money back quickly. In addition, the effective interest rate for illegal private loan prevention loans, which previously reached 16%, will be significantly lowered to around 5-6%.

Immediate Suspension of Financial Transactions for Reported Illegal Private Loan Accounts

On the morning of the 29th, Lee Eokwon, Chairman of the Financial Services Commission, announced these measures during a field meeting on “Eradicating Illegal Private Lending through Strengthening the Role of the Financial Sector” held at the Seoul Financial Welfare Counseling Center in Dongjak-gu, Seoul.

According to the Financial Services Commission, going forward, when a victim reports illegal private lending to the Financial Supervisory Service, or when the Financial Supervisory Service becomes aware of an account used for illegal private lending through tips or other means, the use of that account will be suspended promptly. Afterward, the financial institution will verify through enhanced due diligence (EDD) whether the account is legitimate. If no issues are found, transactions will be restored; if it is confirmed that the account was used for illegal private lending, transactions will be blocked.

Chairman Lee stated, "When the Financial Supervisory Service receives a report of an account to which victims have transferred funds under various pretexts such as interest, principal, late fees, or extension fees, it will notify the relevant bank. The bank will then verify the actual account holder, the purpose of the transaction, and the source of the funds." He added, "Until this customer verification is completed, financial transactions will not be allowed." He further stated, "Criminal funds frozen in these accounts will be returned to victims in connection with police investigations, and we will support free lawsuits for recovery through the Korea Legal Aid Corporation."

The effective interest rate for illegal private loan prevention loans, currently at 15.9%, will also be lowered. These loans, which are supplied at an annual scale of about 200 billion won, are available even to those excluded from the financial system, such as individuals in arrears, but the low recovery rate has kept interest rates high. Starting this year, the government will lower the interest rate for these products to 12.5% per annum and introduce a payback system that returns 50% of the interest paid upon full repayment, reducing the actual interest burden to about 6.3%. In particular, for socially disadvantaged groups such as basic livelihood security recipients, low-income earners, and self-support workers, the interest rate will be reduced to 9.9% per annum, and the actual interest burden will be lowered to around 5% upon full repayment.

One-Stop Dedicated Support System to Provide Rapid Assistance to Victims

A one-stop dedicated support system for victims of illegal private lending will also be established. Previously, even if victims reported to the government or related agencies, it was difficult to understand the roles and procedures of each institution, and there were shortcomings in progress updates and follow-up management after reporting. From now on, once a victim reports illegal private lending, a system will be in place to provide integrated support for all recovery procedures, including stopping illegal collection, blocking related phone numbers and accounts, appointing a debtor representative, requesting a police investigation, and filing lawsuits for the return of unjust enrichment.

The Financial Services Commission plans to assign a dedicated case manager from the National Financial Support Center for People in Need when a victim reports a case to the Financial Supervisory Service, supporting the victim throughout the entire process of reporting, requesting investigation, and legal remedy, which may be difficult to handle alone. Chairman Lee emphasized, "In the past, the reporting process for illegal private lending was complicated, and many victims gave up midway due to insufficient progress updates and follow-up management. Going forward, regardless of the reporting channel, a dedicated case manager from the National Financial Support Center for People in Need will be assigned to assist with the entire recovery process."

Initial response measures will also be strengthened to ensure that damage from illegal collection activities is stopped immediately. Currently, before a debtor representative is appointed (which takes about 10 days), the Financial Supervisory Service sends a warning text to illegal collectors, notifying them of the appointment of a debtor representative and impending legal action. In the future, Financial Supervisory Service staff will directly call and verbally warn the collectors. In addition, if a loan contract is deemed antisocial and thus subject to principal and interest invalidation, the Financial Supervisory Service will issue an invalidation certificate in its name to notify the illegal private lender.

Measures will also be implemented to prevent consumers from being exposed to illegal private lending when using online loan brokerage sites or banner advertisements. In the past, during the process of sharing borrowers' phone numbers with some lenders through online loan brokerage or advertisements, there have been cases of exposure to illegal private lending. Going forward, the use of safe numbers within loan brokerage sites will be mandatory to prevent borrowers' phone numbers from being transmitted or exposed to lenders.

Meanwhile, on this day, the Financial Services Commission and the Journalists Association of Korea announced “Reporting Standards for the Prevention of Illegal Private Lending and Excessive Debt Damage.” These standards prioritize the protection of victims' human rights and interests.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)