Bank of Korea Releases "2025 Comprehensive Survey on Currency Usage by Economic Agents"

Cash spending accounts for 17.4%... Down from 2021

Higher ratio among older adults and low-income groups

45.8% oppose a "cashless society"

The average monthly cash spending per person in South Korea was found to be around 324,000 won. This marks a decrease of nearly 200,000 won compared to four years ago. On the other hand, the amount of cash held for purposes such as emergency funds has actually increased during the same period. The amount of transaction cash people carry in their wallets has also seen a slight rise.

324,000 won per person: Average monthly personal cash spending decreases... "Increase in non-cash payment methods"

An employee is holding a 50,000 won bill at the Hana Bank Counterfeit Response Center in Jung-gu, Seoul. Photo by Yonhap News Agency

An employee is holding a 50,000 won bill at the Hana Bank Counterfeit Response Center in Jung-gu, Seoul. Photo by Yonhap News Agency

On December 28, the Bank of Korea announced the results of its "2025 Comprehensive Survey on Currency Usage by Economic Agents," conducted among individuals and businesses. The findings showed that the average monthly cash spending by both individuals and businesses has decreased compared to 2021. This is attributed to the expanded use of non-cash payment methods such as credit cards.

For individuals, the average monthly cash spending per person was 324,000 won, a 36% decrease compared to four years ago (506,000 won). The share of cash spending out of total monthly expenditures also dropped by 4.2 percentage points to 17.4% over the same period. Most people (80.1%) spent less than 500,000 won in cash per month. By age group, those in their 60s and older spent 20.8%, while those in their 70s and older spent 32.4%, indicating higher cash usage among older generations. By income, individuals with a monthly household income of less than 1 million won had a high cash spending ratio of 59.4%.

For businesses, the average monthly cash spending was 1,127,000 won, a significant decrease from 9,117,000 won in 2021. The share of cash in total expenditures was also minimal at 1.9%. Most businesses (97.3%) spent less than 5 million won in cash per month. By industry, manufacturing saw a sharp decline to 2,200,000 won from 4,700,000 won four years ago, mainly due to reduced cash spending for routine expense payments. By number of employees, companies with 10 to less than 50 employees saw their cash spending drop sharply to 800,000 won from 19,200,000 won over the same period.

644,000 won per person: Personal cash holdings increase... "Impact of interest rate declines and economic uncertainty"

In contrast, the amount of cash held by both individuals and businesses increased due to falling interest rates and heightened economic and business uncertainty.

The average cash holdings per person were 644,000 won, a 47.7% increase compared to four years ago (436,000 won).

In particular, cash held for emergency purposes averaged 541,000 won per person, a 52.8% increase from 354,000 won over the same period. By income, individuals with monthly household incomes below 1 million won saw their emergency cash holdings rise from 182,000 won to 436,000 won. By age, those in their 70s and older (599,000 won) and those in their 50s (591,000 won) held relatively higher amounts. By employment status, the self-employed (653,000 to 663,000 won) held significantly more cash.

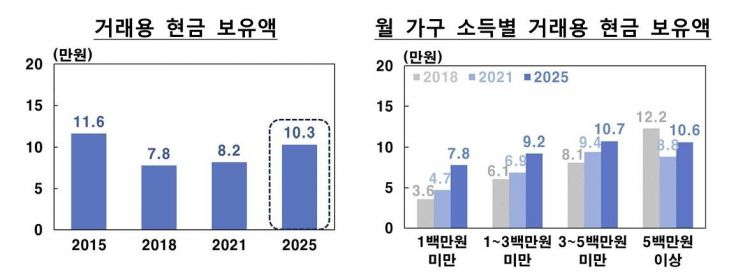

For daily transactions such as purchasing goods, the average amount of transaction cash held was 103,000 won, a 25.6% increase from 82,000 won over the same period. Cash holdings increased across all income brackets, and by age, those in their 60s held the most at 122,000 won. When asked about future intentions, the majority responded that they would reduce their cash holdings if deposit interest rates rise (42.9%), while 42.8% said they would increase their cash holdings if economic uncertainty expands. A Bank of Korea official stated, "It has been confirmed that future changes in interest rates and economic uncertainty continue to have a significant impact on individual cash demand."

For businesses, average cash holdings were 9,778,000 won, a 108.3% increase compared to 2021 (4,695,000 won). The percentage of companies holding more than 10 million won in cash rose by 6.4 percentage points to 12.8% over the same period. The most common reason for increased cash holdings was "increasing liquid assets to prepare for emergencies amid greater uncertainty in the business environment" (36.3%). This was followed by "increased cash receipts due to higher sales" (30.2%) and "maintaining anonymity through cash transactions" (17.8%). When asked about future intentions, 29.1% of businesses said they would not reduce their cash holdings even if deposit interest rates rise, compared to 25.4% who said they would, indicating businesses are less sensitive to interest rates than individuals.

"Inconvenience for the financially vulnerable": 45.8% oppose a cashless society... Institutional guarantees needed

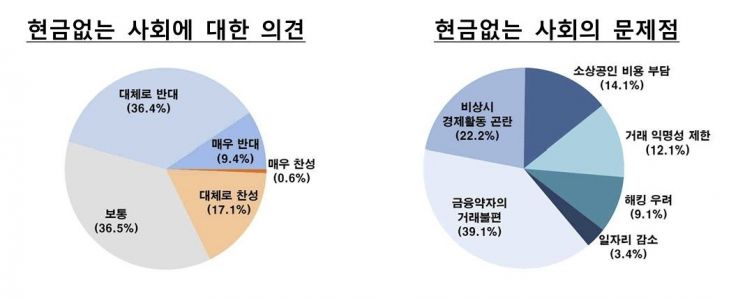

Regarding a "cashless society," 45.8% of respondents expressed opposition, far exceeding the 17.7% in favor. The most common reason was concern that transactions would become inconvenient for the financially vulnerable (39.1%), followed by concerns that economic activity would become difficult in emergencies (22.2%). For these reasons, the majority (84.1%) believe the likelihood of cash disappearing is low. Among businesses, 29% opposed a cashless society, compared to 16.3% in favor.

As for institutional guarantees of the "right to choose cash," which is the right to freely use cash in transactions, a majority (59.1%) responded positively. This is an increase from the 49.6% recorded in the 2022 survey. However, the percentage of people who experienced a refusal to accept cash payments in the past year fell to 5.9% from 6.9% in 2021.

Meanwhile, this survey was the first to integrate the previously separate "Cash Usage Behavior Survey" and "Currency Usage Satisfaction Survey," which had been conducted every three years. The survey period was from April 10 to August 11, and the subjects included 2,000 individuals aged 19 or older, 1,210 general businesses with five or more employees, 930 major cash-handling businesses such as stores in traditional markets and convenience stores, and 100 financial institutions.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.