Cumulative Loss Ratio at 86.2% from January to November

Far Exceeds 80% Break-Even Point

As of last month, the loss ratio for automobile insurance at major non-life insurance companies exceeded 92%.

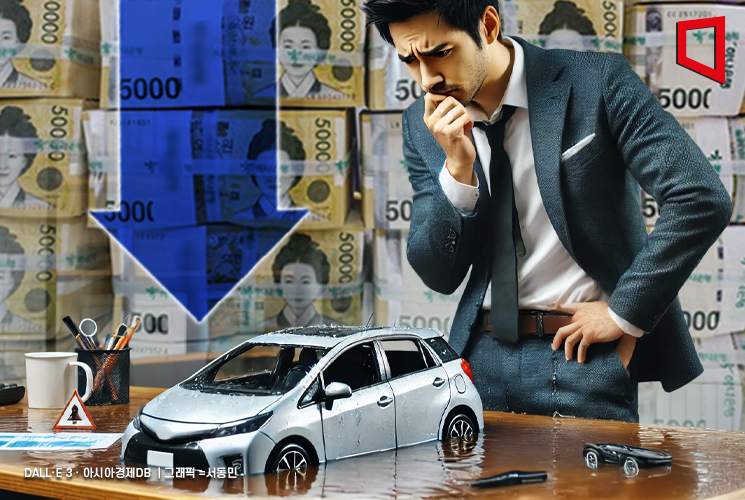

The loss ratio for automobile insurance has surged to 92%, causing insurance companies to deliberate on raising premiums. Photo by The Asia Business Daily Database

The loss ratio for automobile insurance has surged to 92%, causing insurance companies to deliberate on raising premiums. Photo by The Asia Business Daily Database

According to the non-life insurance industry, the automobile insurance loss ratio for the four major companies-SAMSUNG Fire & Marine Insurance, Hyundai Marine & Fire Insurance, DB Insurance, and KB Insurance-was recorded at 92.1% last month, based on a simple average of the four companies.

This figure is down by 0.3 percentage points compared to the same month last year, but it still remains above 90%. In the industry, the loss ratio corresponding to the break-even point for automobile insurance is generally considered to be around 80%.

The cumulative loss ratio for January to November this year was 86.2%, up 3.8 percentage points from the same period last year.

The loss ratio has continued to rise due to four consecutive years of premium reductions and an increase in the average loss per claim. Additional factors such as higher repair fees and rising costs for parts and repairs have also contributed to this trend.

An industry official predicted, "Due to seasonal factors such as heavy snowfall and icy conditions, the loss ratio is expected to continue rising for the time being."

As deficits in automobile insurance expand, the non-life insurance industry is moving to raise premiums next year.

SAMSUNG Fire & Marine Insurance has officially begun considering an increase in automobile insurance premiums for next year, and other non-life insurers are also weighing the extent of potential increases.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.