Foreign Ownership Limits Vary Widely Among Telecom Giants

Mandatory Treasury Share Cancellation Could Usher in New Stock Price Phase

MSCI Passive Fund Inflows Remain a Key Variable

The stock prices of the three major telecommunications companies, which have experienced mixed fortunes due to a series of recent security incidents, are expected to reach another inflection point. This is because the three companies have vastly different levels of leeway regarding the "foreign ownership limit," which could act as a variable in the mandatory cancellation of treasury shares in the future. Since the foreign ownership ratio is also a factor that regulates the inflow of global passive funds, attention is focused on how it will affect the stock price trends of these companies going forward.

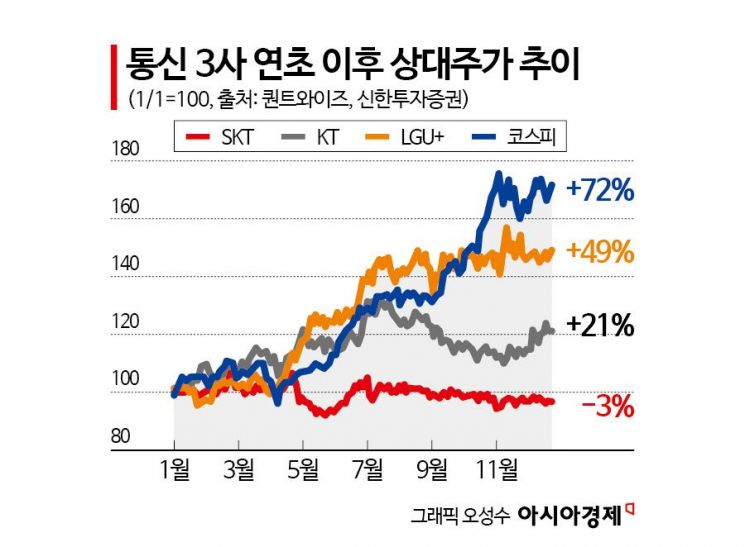

All three leading domestic telecom stocks-SK Telecom, KT, and LG Uplus-came under scrutiny this year due to hacking incidents in the first half. However, the market's response has varied. According to the Korea Exchange on the 26th, LG Uplus surged by 49% from the beginning of this year to December 24, ranking first among the three telecom companies in terms of stock price increase. Last month, its intraday price jumped to 16,500 won, setting a new 52-week high.

During the same period, KT rose by about 21%, delivering a less impressive performance compared to LG Uplus. However, as the stock price has found support near the 50,000 won level, analysts believe the upward trend has not yet reversed. In contrast, the situation for SK Telecom is challenging. Despite the KOSPI soaring over 70% this year in a festive atmosphere, SK Telecom alone fell by more than 3%, being shunned by the market. Since November last year, its highs have been steadily declining.

As concerns over hacking, which weighed on telecom stock investment sentiment in the second half of this year, gradually subside, the securities industry is optimistic about a rebound in telecom stocks next year. In particular, with the full implementation of the separate taxation of dividend income at a maximum rate of 30% starting next year, all three telecom companies are highly regarded as high-dividend companies, with payout ratios exceeding 40%.

Kim Aram, Senior Researcher at Shinhan Investment & Securities, said, "Excluding hacking, the telecom sector is relatively free from performance and regulatory risks, and the total shareholder return (TSR) of 6-7% is also attractive. Basically, all three companies are expected to see moderate stock price increases, but KT is the top pick." KT's TSR forecast for next year is 6.7%, the highest among the three telecom companies.

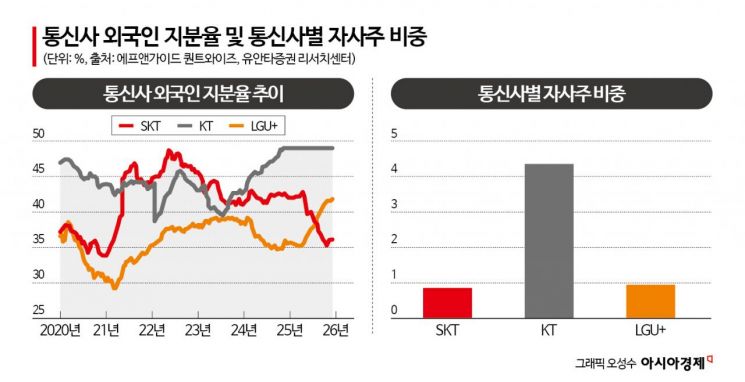

However, a variable is that, although foreigners have recently turned to net buyers of KOSPI stocks this month, there are not many telecom shares left for them to buy. This is because, under the Telecommunications Business Act, foreign ownership in Korea's three telecom companies is limited to 49%. For example, in the case of KT, foreigners have already purchased all 123,490,626 shares, which is 49% of the total 252,021,685 listed shares, making additional purchases impossible. In contrast, LG Uplus and SK Telecom still have some room, with foreign ownership ratios at 41.77% and 36.11%, respectively.

With the mandatory cancellation of treasury shares imminent, the diminished remaining foreign ownership quota could hinder the telecom companies' efforts to expand shareholder returns. When the foreign ownership ratio is close to 49%, canceling treasury shares reduces the number of outstanding shares, which inevitably causes the legal limit to be exceeded. In this case, foreign shareholders are prohibited from exercising voting rights, and the company is ordered to reduce the foreign ownership ratio to within 49% within six months. In fact, SK Telecom exceeded the foreign ownership limit in 1999 and was fined 250 million won by the Ministry of Information and Communication at the time.

The inflow of global passive funds is also a concern. Morgan Stanley Capital International (MSCI) adjusts the inclusion ratio when the remaining quota (Foreign Room) relative to the foreign ownership limit is depleted, which is relevant for both KT and LG Uplus. Lee Seungwoong, a researcher at Yuanta Securities, explained, "If the foreign ownership ratio exceeds 47.29%, the stock becomes subject to exclusion. LG Uplus has already entered the MSCI reduction range since December."

Kim Hongsik, a researcher at Hana Securities, also pointed out, "This year, KT's shareholder return rate was about 1-2% higher than that of SK Telecom and LG Uplus, but this is due to the weakness that, unlike other companies, KT cannot immediately cancel its treasury shares because the foreign ownership limit has been reached." However, he added, "As a result, there is a greater possibility that all shareholder returns will be paid out as dividends. Assuming a pre-tax expected dividend yield of 5%, the stock price could rise to as much as 76,000 won within the first half of 2026."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.