"Offline Retail Regulations Created a Dominant Coupang Ecosystem"

Years of Hypermarket Restrictions Have Weakened Offline Retail

Experts Call for Reform of Current Laws

Homeplus, the second-largest hypermarket operator in South Korea, now stands at a critical crossroads, while a recent customer information leak at Coupang, the largest e-commerce platform, is further shaking up the retail industry and signaling a major upheaval in the market. There is a growing call to level the playing field, as more than a decade of heavy regulations on large-scale retailers has entrenched a Coupang-centered monopolistic distribution structure.

According to the retail industry on December 26, Homeplus is set to submit its self-rescue plan, which includes the sale of Homeplus Express, by December 29. Initially, Homeplus sought a "pre-packaged M&A before approval of the rehabilitation plan," but after failing to find a buyer, the company now plans to proceed with an M&A after the court's approval.

Industry insiders believe that the current Homeplus crisis is largely due to worsening business conditions caused by regulations on the offline retail sector. Once the second-largest hypermarket operator, Homeplus faced a liquidity crisis due to management difficulties and filed for corporate rehabilitation with the Seoul Bankruptcy Court in March.Homeplus's revenue, which stood at 6 trillion won in 2016, remained unchanged at 6 trillion won last year.Taking inflation into account, this effectively represents negative growth.

This is because the Distribution Industry Development Act (the Distribution Act), implemented in 2013 to protect small neighborhood stores and traditional markets, directly hit the industry by introducing regulations such as restrictions on new store openings and bans on holiday operations for large hypermarkets and SSMs (super supermarkets).

During this period, the domestic retail market rapidly shifted toward e-commerce platforms, led by Coupang. Coupang's revenue grew from 1 trillion won in 2016 to 41.3 trillion won last year, a fortyfold increase. Kurly's revenue jumped from 17.3 billion won to 2.1956 trillion won last year, a 127-fold increase.

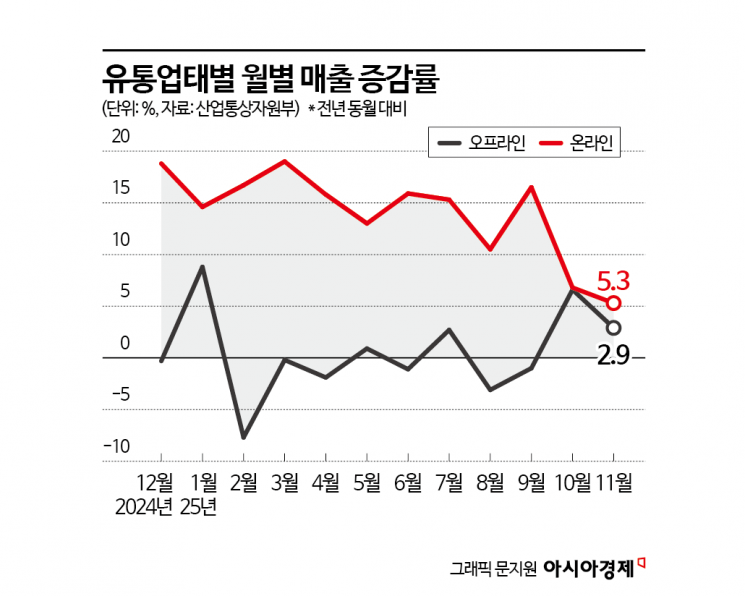

According to the Ministry of Trade, Industry and Energy, the share of offline sales, which accounted for about 70% in 2016, dropped to 45.9% as of last month. The number of hypermarket stores last month stood at 368, down 0.5% from the same month a year earlier. Sales per store also fell by 8.6%.

The National Emart Labor Union (Emart Union), in a statement regarding the Coupang data breach that began with the question, "Who created this monster?" said, "Coupang has achieved rapid growth and established a dominant retail ecosystem as more than 13 years of offline retail regulations coincided with the COVID-19 pandemic," and urged, "Even now, we hope to see fair competition between online and offline, responsible foreign companies and domestic Korean companies, as well as rational regulations and government-level support for the development of the retail industry for the benefit of consumers."

Experts argue that current regulations on hypermarket operations should be eased. Lee Jongwoo, professor of business administration at Ajou University, said, "Weekends are crucial for hypermarkets, but the regulations have dealt a heavy blow to consumer perceptions," emphasizing, "The Distribution Act should be abolished as soon as possible and the industry should be guided toward a competitive structure rather than sanctions." Lee Eunhee, professor of consumer studies at Inha University, commented, "Offline regulations have further intensified the shift to online," adding, "Given the current competition between online and offline, a four-year extension of the Distribution Act is not desirable."

Some analysts point out that the shift is driven more by consumer demand for the convenience of online shopping than by the regulations themselves. Choi Chul, professor of consumer economics at Sookmyung Women's University, said, "While it is true that government regulation of offline stores has affected the growth of hypermarkets, the growth gap widened because offline retailers failed to match the convenience of online e-commerce," adding, "Offline retailers still have strengths over online in certain categories such as fresh food, so it would have been important to leverage those advantages."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)