Government Real Estate Supervision Task Force Holds 4th Council on Illegal Activities

Ministry of Land Identifies 1,002 Suspected Illegal Transactions

Cases Referred to Police and National Tax Service

The Ministry of Land, Infrastructure and Transport announced on the 24th that, as a result of its special investigation into abnormal real estate transactions in the second half of this year, it identified 1,002 suspected illegal transactions and referred them to relevant agencies such as the National Tax Service and the police.

This investigation focused on abnormal housing transactions in Seoul and Gyeonggi Province (1,445 cases) reported between May and June this year, cases with signs of price manipulation among transactions reported between March and August (437 cases), and cases with unusual trends among transactions reported between January and July (334 cases). The results were announced at the "4th Real Estate Illegal Activity Response Council" held under the supervision of the Government Policy Coordination Office's Real Estate Supervision Task Force.

This is the third abnormal transaction investigation conducted this year. Unlike the first and second rounds, which were limited to Seoul, this round expanded its scope to include Gwacheon, Seongnam (Bundang and Sujeong Districts), Suji District in Yongin, Dongan District in Anyang, and all areas of Hwaseong. Among the 1,445 cases, 673 suspected illegal transactions and 796 suspected illegal acts were identified.

Buyer A purchased an apartment in Seoul for 13 billion won, financing 10.6 billion won through an interest-free loan from his father. Due to the excessive borrowing from a related party, the case was reported to the National Tax Service. In related-party financial transactions, authorities examine whether a loan agreement exists and whether appropriate interest is paid to determine legality. In another case, B borrowed 700 million won from Saemaul Geumgo for corporate operating funds and then purchased an apartment for 1.75 billion won. Since the loan was used for purposes other than originally intended, the case was reported to the Ministry of the Interior and Safety.

Among abnormal transactions in Seoul and Gyeonggi Province in the first half of this year, the most common type was illicit gift transfers or excessive borrowing among related parties, as in A's case, accounting for more than 60% (812 out of 1,308 cases). False reporting of price or contract date followed with 290 cases, and misuse of loan funds for purposes other than intended with 197 cases. There were also some cases of illegal inflow of overseas funds and unqualified visa holders engaging in rental business.

So-called "price boosting," where a transaction is reported at a high price and the contract is canceled after a certain period, led to the identification of 161 suspected illegal acts in 142 transactions. Of these, 10 cases were referred to the police for investigation. The most common violations were false reporting of contract dates or deliberately inflating or deflating transaction amounts (up/down contracts), with 86 cases, followed by suspected cases of unreported income tax or false reporting of transaction amounts, with 58 cases.

In one case, C and his wife reported selling an apartment in Seoul to a corporation where he serves as an inside director for 1.65 billion won. This transaction was reported at a higher price than the previous one. After maintaining the contract for nine months, they canceled it and then signed a new sales contract with a third party for 1.8 billion won. Since the contract was canceled in August last year without the return of the deposit or interim payment, and there was a special provision in the contract for possible cancellation, the case was suspected to be a false report and referred to the police for investigation.

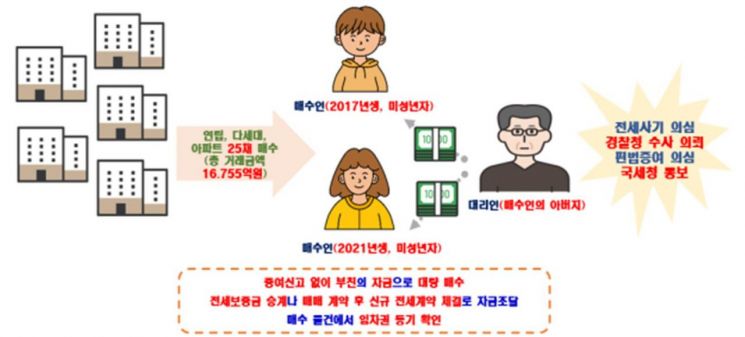

In the investigation of unusual trends, 187 transactions and 250 suspected illegal acts were identified. In addition to the Seoul metropolitan area, regions with concerns of illegal activities such as Busan and Daejeon were also investigated. A brother and sister, aged 4 and 8, purchased a total of 25 properties, including multiplex and multi-family houses and apartments, for 1.6755 billion won in a region of South Gyeongsang Province. Their father, D, acted as their agent, securing funds and signing contracts. He financed the purchases by either taking over jeonse deposits or signing new jeonse contracts after each sales contract. Since the siblings are minors with no income and no gift tax filing by the father, the case was suspected of illicit gift transfer and reported to the National Tax Service.

Cases of suspected illicit gift transfers and jeonse fraud uncovered through a special real estate trend investigation. Provided by the Ministry of Land, Infrastructure and Transport

Cases of suspected illicit gift transfers and jeonse fraud uncovered through a special real estate trend investigation. Provided by the Ministry of Land, Infrastructure and Transport

In this case, three provisional registration orders for leasehold rights were confirmed. Considering that the children have no ability to return deposits, the case was suspected to be jeonse fraud and referred to the police for investigation. In a newly built apartment complex in Seoul, there was a case where a sales right was reported at a price 600 million to 800 million won lower than neighboring complexes, which was reported to the National Tax Service.

The Ministry of Land, Infrastructure and Transport stated that it is also conducting a special investigation into transactions reported in the second half of this year. For transactions reported in September and October, the investigation will expand to include not only regulated areas in Seoul and Gyeonggi Province but also areas of concern for the "balloon effect," such as Guri and Namyangju. Starting next year, the reason for contract cancellation will be categorized, rather than written in free form, to allow for more detailed analysis of market-disturbing activities. Currently, the reason for cancellation is written as a subjective answer.

Kim Kyu-cheol, Director General for Housing and Land at the Ministry of Land, Infrastructure and Transport, said, "We will continue to respond strictly to speculative and illegal transactions through special investigations into abnormal real estate transactions," adding, "We will strive to create a market environment where genuine buyers can trade with confidence."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)