Consumer Sentiment Index for December at 109.9, Down 2.5 Points

Expectations Weaken as Living Costs and Exchange Rates Rise

Upward Trend Continues in Specific Regions... Housing Price Outlook CSI Surpasses 120

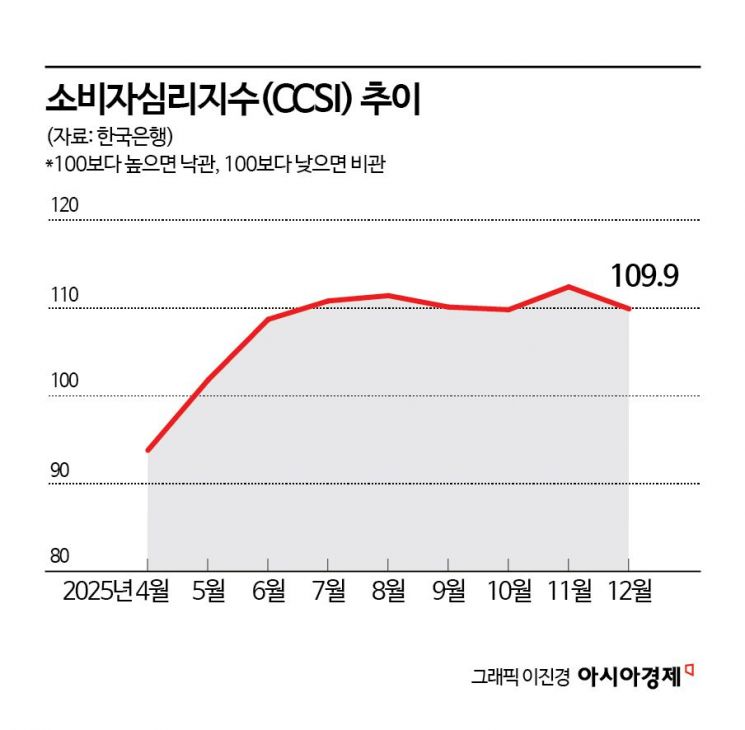

The Consumer Composite Sentiment Index (CCSI) for December reversed course and declined after just one month. This is the largest drop since December of last year, when consumer sentiment plummeted due to the 12·3 Martial Law crisis. The decline is attributed to a significant increase in the cost of living and a recent sharp rise in the exchange rate, both of which have dampened consumer confidence.

Consumer Sentiment Index at 109.9... Expectations Weaken as Prices and Exchange Rates Rise

According to the “December 2025 Consumer Survey Results” released by the Bank of Korea on the 24th, this month’s CCSI stood at 109.9, down 2.5 points from the previous month. The CCSI is a comprehensive index reflecting consumers’ perceptions of the overall economy. It is calculated using six key indices that make up the Consumer Sentiment Index (CSI), including current living conditions, household income outlook, and consumer spending outlook. When the CCSI is above 100, it indicates that consumers’ subjective expectations for the economy are more optimistic than the historical average (from 2003 to December 2024); when it is below 100, it reflects a more pessimistic outlook.

Until November of last year, the CCSI remained above 100, but in December, consumer sentiment plunged to 88.2 due to the 12·3 Martial Law crisis. At that time, the index fell by 12.5 points. The CCSI continued to stay below the baseline until April of this year, but in May, it rose above the baseline as trade risks eased following the United States’ reciprocal tariff suspension and expectations for the launch of a new government. Subsequently, thanks to improvements in consumer spending and robust exports, the index hovered around the 110 level from July onward and rose to 112.4 last month, marking the highest level in eight years. Lee Hyeyoung, Head of the Economic Sentiment Survey Team at the Economic Statistics Department 1 of the Bank of Korea, commented, “This month’s CCSI declined compared to the previous month due to a greater increase in the cost of living and heightened exchange rate volatility. The magnitude of the drop is also the largest since December of last year. However, consumer expectations remain high, with the index still around the 110 level, which is above the historical average.”

High Exchange Rate Drives Future Economic Outlook CSI Down 6 Points... Housing Price Outlook CSI Rises Again

By category, the Current Economic Assessment CSI, which compares the current situation to six months ago, dropped 7 points to 89. This was due to a perceived deterioration in economic conditions stemming from rising prices of daily necessities such as agricultural, livestock, and fishery products, as well as petroleum products. The Future Economic Outlook CSI, which forecasts the economy six months ahead compared to now, fell 6 points to 96, reflecting concerns about the continued high exchange rate. The decline was driven by both the surging exchange rate and worries about external uncertainties, such as the potential reevaluation of the artificial intelligence (AI) industry. The Housing Price Outlook CSI climbed back above 120 to 121, rebounding from 122 in October. Lee noted, “Since the 10·15 measures, the pace of increase in apartment sales prices nationwide and in the Seoul metropolitan area has slowed, but upward trends have persisted in certain regions, resulting in another 2-point rise.”

The expected inflation rate for the next year, which reflects consumer expectations for price increases over the coming year, remained unchanged from the previous month at 2.6%, as the consumer price inflation rate held steady. The expected inflation rate for three years ahead rose by 0.1 percentage point from the previous month to 2.6%, while the five-year expectation remained at 2.5%.

When asked which items would most influence consumer prices over the next year, respondents most frequently cited petroleum products (45.8%), agricultural, livestock, and fishery products (45.0%), and public utility fees (36.7%). Compared to the previous month, the proportion of responses citing petroleum products increased by 15.3 percentage points, while the shares for agricultural, livestock, and fishery products (-6.0 percentage points) and rent (-5.1 percentage points) declined.

This survey was conducted from the 9th to the 16th of this month, targeting 2,500 urban households nationwide, with responses collected from 2,268 households.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)