Financial Services Commission to Raise Internet Bank Lending Ratio to Mid- and Low-Credit Borrowers from 30% to 35% by 2030

KakaoBank Only Internet-Only Bank Among Top Three to See Increase in Non-Performing Loans

Asset Quality Indicators Such a

As the Financial Services Commission announced the expansion of lending to mid- and low-credit borrowers as a key inclusive finance initiative in its work report, internet-only banks are expected to face even greater burdens. This is due to the increase in so-called 'non-performing loans'-loans with no yield, often referred to as 'empty loans'-and the deterioration of asset quality indicators such as delinquency rates, all while household lending remains restricted. Internet-only banks are seeking breakthroughs by expanding foreign currency products and strengthening their platform businesses, but there are analyses suggesting that their growth momentum will be curbed for the time being.

According to the financial sector on December 24, the Financial Services Commission plans to gradually raise the target for new loans to mid- and low-credit borrowers by internet-only banks from the current 30% to 35% by 2030, increasing the target ratio by 1 percentage point each year. This measure aims to reinforce the core function of inclusive finance in line with the founding purpose of internet-only banks, which is to support mid- and low-credit borrowers who have been marginalized by mainstream financial institutions. However, with growth already slowed by household lending regulations and concerns mounting over asset quality due to an increase in non-performing loans, the burden on internet-only banks is inevitably increasing.

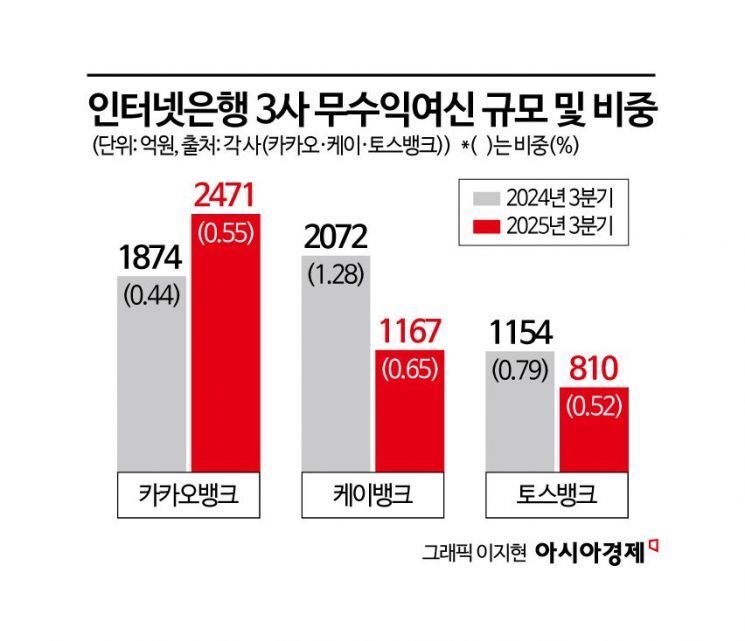

Meanwhile, asset quality indicators currently vary among internet-only banks. KakaoBank is the only one among the three internet-only banks (KakaoBank, K Bank, and Toss Bank) to see increases in both non-performing loans and substandard and below loans. Non-performing loans are loans for which both principal and interest are difficult to recover, commonly referred to as 'empty loans.' These are characterized by being overdue for more than three months or having principal and interest payments suspended due to debt restructuring or court receivership, resulting in no income. In the financial sector, these are classified as non-performing loans, which are considered even more problematic than substandard and below loans.

According to KakaoBank's third-quarter business disclosure, its non-performing loans (combined household and corporate) for the third quarter of this year stood at 247.1 billion won, with a ratio of 0.55%. This represents an increase from 187.4 billion won (0.44%) in the third quarter of last year. Asset quality indicators also worsened. KakaoBank's delinquency rate for the third quarter of this year was 0.51%, up 0.03 percentage points from 0.48% in the same period last year.

Substandard and below loans also increased. The non-performing loan ratio (NPL) refers to the proportion of loans that are overdue for more than three months and are considered difficult to recover. KakaoBank's substandard and below loans (combined household and corporate) for the third quarter of this year amounted to 250.2 billion won, with a ratio of 0.55%. This is an increase of 61 billion won and 0.11 percentage points from 189.2 billion won and 0.44% in the same period last year, respectively.

KakaoBank has the largest volume of loans to mid- and low-credit borrowers among the three internet-only banks, which is believed to be the reason for the relatively rapid increase in both substandard and below loans and non-performing loans.

At Toss Bank, the volumes of non-performing loans and substandard and below loans have decreased, but the delinquency rate has actually risen. For the third quarter of this year, Toss Bank's non-performing loans (combined household and corporate) stood at 81 billion won (0.52%), down from 115.4 billion won (0.79%) in the third quarter of last year. Substandard and below loans (combined household and corporate) also decreased by 24.2 billion won, from 154.5 billion won to 130.3 billion won during the same period, and the non-performing loan ratio dropped by 0.21 percentage points from 1.05% to 0.84%. However, the delinquency rate rose from 0.99% in the third quarter of last year to 1.07% in the third quarter of this year.

In contrast, K Bank saw a slight improvement in its overall asset quality indicators. For the third quarter of this year, K Bank's non-performing loans (combined household and corporate) stood at 116.7 billion won (0.65%), down from 207.2 billion won (1.28%) in the same period last year. Substandard and below loans (combined household and corporate) also decreased from 135.5 billion won (0.84%) to 96.4 billion won (0.54%) during the same period. The delinquency rate also improved from 0.88% to 0.56%.

A financial industry official stated, "With growth in household lending restricted, it has become inevitable to expand business lending, such as to individual business owners. However, in the current economic slowdown, the risk of delinquency is rising, particularly among vulnerable borrowers. From next year, as productive finance becomes more prominent, managing delinquency rates and ensuring asset quality will become major tasks for the financial sector."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)