A Total of 31 Companies Driving Price Increases Under Investigation

Suspected Tax Evasion Amounts to 1 Trillion KRW

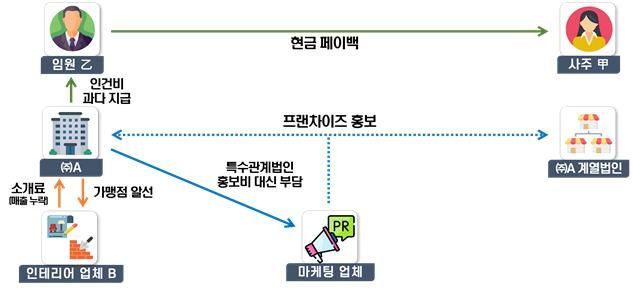

Company A, a food service franchise headquarters, generated profits through hidden price increases (shrinkflation), maintaining menu prices while reducing food portions. A also shared advertising and promotional expenses for franchise marketing with an affiliated company, but unfairly supported the affiliate-operated by the owner’s family-by paying approximately 4 billion KRW in advertising costs that should have been borne by the affiliate. In addition, A introduced franchisees to interior company B for store renovations and received referral fees, but concealed these transactions by failing to issue tax invoices, thereby omitting sales from its records. The National Tax Service plans to thoroughly investigate both A and the owner’s family for covering joint expenses and improperly diverting corporate funds.

On December 23, the National Tax Service announced it would conduct tax investigations into 'market disruption tax evaders'-those who have fueled inflation and made life more difficult for ordinary citizens through unfair practices such as price collusion, while evading legitimate tax obligations and securing illicit gains.

Andeoksoo, Director of the National Tax Service Investigation Bureau, is briefing on the tax investigation of 'market disruption tax evaders' at the Government Sejong Complex on the 23rd. National Tax Service

Andeoksoo, Director of the National Tax Service Investigation Bureau, is briefing on the tax investigation of 'market disruption tax evaders' at the Government Sejong Complex on the 23rd. National Tax Service

The current investigation targets a total of 31 companies that have contributed to rising prices, including 7 monopoly or oligopoly firms engaged in price collusion, 4 importers exploiting tariff quotas, 9 franchises practicing shrinkflation, and 11 companies causing exchange rate instability through improper foreign currency outflows. The total amount of suspected tax evasion by these companies is estimated at approximately 1 trillion KRW.

The first group under investigation comprises monopoly or oligopoly firms that, disregarding the difficulties faced by ordinary citizens, used non-market methods such as price collusion and abuse of market dominance to inflate prices well above normal market rates, thereby securing excess profits compared to industry peers.

According to the National Tax Service, these companies determined the order of winning bids with colluding firms through methods such as drawing lots or ladders, engaging in 'market-sharing contracts.' They paid colluding companies a fee equivalent to 10% of the contract amount as a reward for dropping out of bids, received false tax invoices, and recorded these as company expenses.

Also under investigation are importers who, amid global supply chain instability, benefited from tariff quotas to import raw materials at lower costs but did not reflect these savings in their selling prices, thereby maximizing profits. Anduksoo, Director of the National Tax Service Investigation Bureau, explained, "These companies inserted related-party corporations operated by the owner’s children into the distribution process and unfairly shared profits by supplying tariff-reduced raw materials at low prices. They also handled shipping, logistics, and customs clearance for related-party corporations importing tariff quota items, but reported these import agency services as VAT-exempt rather than taxable, thereby evading value-added tax."

The investigation also includes 'shrinkflation franchises' in the food service sector-such as chicken and bakery chains with high consumer spending-who have deliberately distorted consumer choices by quietly reducing product sizes while keeping prices unchanged, seeking private gain through manipulative practices.

According to the National Tax Service, the companies under investigation inserted affiliated companies into the supply chain, purchasing raw and subsidiary materials at prices higher than market value, despite being able to transact directly with suppliers. They also shared profits by paying excessive goodwill fees when acquiring franchise locations owned by the owner’s family.

Also under investigation are companies that improperly transferred corporate funds overseas to acquire expensive foreign assets, thereby increasing unnecessary demand for foreign currency, or used offshore accounts-originally intended to facilitate foreign currency inflows-to illegally transfer funds abroad.

The National Tax Service believes that these companies used corporate funds not only to send children abroad for study, but also to relocate entire families and purchase luxury assets such as high-end real estate, luxury condos, and yachts, which is inconsistent with public expectations. In particular, some provided free payment guarantee services to wholly owned overseas subsidiaries, enabling them to borrow large amounts of foreign currency from domestic banks. These loans were then used to acquire assets such as golf courses worth hundreds of billions of KRW, which are unrelated to business operations.

Director An stated, "Through this tax investigation, we will rigorously scrutinize market disruption tax evaders who have caused upward pressure on prices and exchange rates, thereby increasing market instability and securing illicit gains beyond the scope of normal economic activity. If, during the investigation, we uncover criminal acts such as destruction of records or concealment of assets in violation of tax law, we will refer these cases to law enforcement agencies for prosecution, ensuring that those responsible face criminal penalties such as imprisonment or fines commensurate with their offenses."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.