Brand Royalties Up 28% in Five Years

Olive Young's Share Rises from 8% to 18%

CJ Olive Young is emerging as a key profit driver for CJ Group's holding company. As demand for indie brand cosmetics leading the 'K-beauty' trend is flocking to Olive Young, the company has become a core revenue source for the holding company. This surge in demand for indie brand cosmetics is driving Olive Young's annual sales to an expected 5 trillion won this year, and the rapid increase in sales is also causing CJ brand royalty payments to rise quickly.

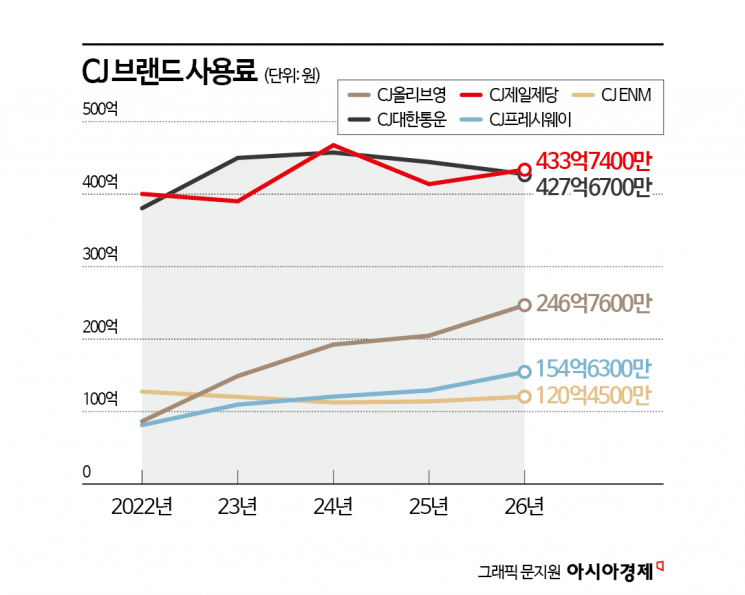

According to the Financial Supervisory Service on December 24, royalty payments made by major CJ affiliates to the holding company are projected to increase by about 28%, from 107.6 billion won in 2022 to 138.3 billion won next year. Brand royalty payments rose to 121.8 billion won in 2023, 135 billion won last year, and are tallied at 130.5 billion won this year.

Brand royalty payments are fees paid by each affiliate to the holding company for the use of the CJ trademark. The calculation method is 0.4% of sales after deducting advertising and promotional expenses, and the amount automatically fluctuates depending on sales volume and cost structure. All contracts with affiliates have been concluded as private contracts. The disclosed amounts are projections that may change depending on future business conditions.

The most notable affiliate is CJ Olive Young. Its brand royalty payments increased from 8.651 billion won in 2022 to 14.889 billion won in 2023, and 19.236 billion won last year. Next year, they are expected to reach 24.676 billion won. This represents nearly a threefold increase in just five years. The proportion of CJ Olive Young's payments in the total brand royalties is also expanding rapidly. While it accounted for only 8% in 2022, it is projected to rise to 17.8% next year, more than doubling its share in just a few years.

The driving force behind this growth is the strengthening of its core business competitiveness. CJ Olive Young continues to hold the top spot in the domestic offline cosmetics distribution market and has become a must-visit shopping destination for foreign tourists. In fact, the cumulative purchase amount by foreign visitors at offline stores nationwide from January to November this year exceeded 1 trillion won. Industry experts predict that CJ Olive Young's annual sales will surpass 5 trillion won for the first time this year. Since sales growth directly translates into increased brand royalty payments, the holding company now regards Olive Young as a representative "star affiliate."

The growing share of CJ Freshway is also noteworthy. Its brand royalty payments rose from 8.122 billion won in 2022 to 10.951 billion won in 2023 and 12.053 billion won last year. Next year, they are expected to reach 15.463 billion won. Its share of the total brand royalties increased from 7.6% to 11.2% over the same period. This is attributed to rising sales in the foodservice ingredient distribution and catering business sectors.

CJ CheilJedang, a food affiliate, accounts for around 30% of total brand royalty payments. Its brand royalty payments were 40.029 billion won in 2022, 39.01 billion won in 2023, and 46.757 billion won last year. This figure is expected to increase slightly from 41.381 billion won this year to 43.374 billion won next year. Although its share will decrease from 37.2% to 31.4% over the same period, the amount remains steady at around 40 billion won annually. Its business structure, which is centered on overseas sales, continues to support the holding company's cash flow.

CJ Logistics' brand royalty payments increased from 38.055 billion won in 2022 to 45.739 billion won last year, but are expected to decrease to 42.767 billion won next year. Its share of the total will also drop from 35.4% to 30.9% over the same period.

The media affiliate CJ ENM is also experiencing stagnation. Its brand royalty payments fell from 12.746 billion won in 2022 to 11.248 billion won last year. Next year, the figure is expected to remain at around 12 billion won. This is attributed to the burden of content production costs and intensifying competition in the global media market.

An industry insider commented, "Brand royalty payments directly reflect the performance of each affiliate. The recent figures show where the center of profit generation is shifting within CJ Group." The source added, "However, since the disclosed figures are projections, the actual numbers may vary depending on economic trends and changes in the consumer environment."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.