Domestic credit rating agencies, including Korea Investors Service, have assessed Korea Zinc's plan to invest in an integrated smelter in the United States as an opportunity to strengthen its business competitiveness and secure long-term growth drivers. However, they noted that while financial indicators may improve in the short term, it is inevitable that debt will increase during the course of medium- to long-term investment execution.

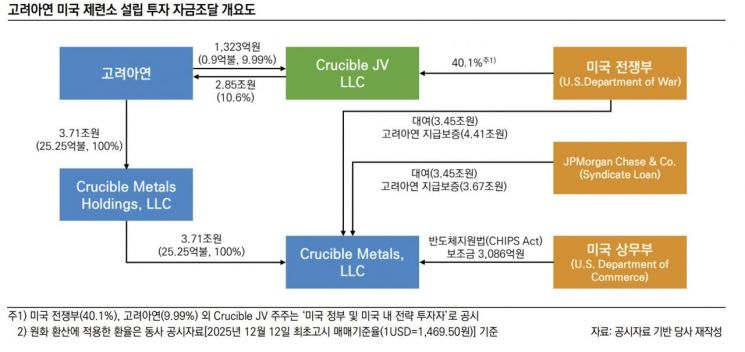

On December 22, Korea Investors Service stated this in its report, "Korea Zinc Capital Increase and Announcement of Integrated Smelter Investment Plan in the United States." Previously, Korea Zinc announced a rights offering and an investment plan to build an integrated non-ferrous metal smelter in the United States. The rights offering will be conducted through a third-party allocation, raising a total of 2.8508 trillion won. The total expected investment is approximately 10.9 trillion won, and capital raising will be accompanied by external borrowing.

First, Korea Investors Service said, "From a business perspective, expanding the production base in the North American market will strengthen competitiveness and enable the company to secure long-term growth drivers. Collaboration with the U.S. government and strategic investors in the United States has increased Korea Zinc's importance within the supply chain. The company’s strategic position will also be enhanced by entering key national industries such as defense."

From a financial perspective, the large-scale capital inflow from the rights offering is expected to improve financial indicators in the short term. However, in the medium to long term, the financial burden is projected to increase. Korea Investors Service stated, "As funds are sequentially spent on acquiring the smelter site, establishing facilities, construction investment, and initial operating expenses during the course of business execution, cash will be quickly depleted. In addition, with further external borrowing increasing the financial burden, there is uncertainty regarding the smelter’s operating rate and profitability, as full-scale commercial operation may not begin until after 2029. This suggests the possibility of sustained financial burden over the medium to long term.

Additionally, Korea Investors Service mentioned that MBK and Young Poong have filed an injunction to prohibit the issuance of new shares the day after the board of directors meeting, in protest against the method of Korea Zinc’s rights offering. The agency added that it will continue to monitor the progress of the rights offering and the direction of the management rights dispute.

?

Previously, NICE Investors Service also analyzed in its report last week, "Korea Zinc’s Decision to Invest in a U.S. Smelter," that "this investment is expected to enhance business competitiveness and expand Korea Zinc’s presence in the U.S. market." According to NICE Investors Service, the U.S. smelter in which Korea Zinc is investing will have about 50% of the production capacity of Korea Zinc’s Onsan Smelter and will produce 13 types of non-ferrous metals and sulfuric acid for semiconductors.

From the perspective of financial stability, NICE Investors Service also projected that while the short-term impact will be limited, in the medium term, free cash flow generation will be restricted and the financial burden will increase. As of the end of September, Korea Zinc’s consolidated debt ratio stood at 96.3%, and its net debt dependence was 23.6%, indicating overall strong financial stability. NICE Investors Service evaluated, "Until the smelter construction is completed in 2029, the debt ratio is expected to rise and net debt dependence to increase, thereby expanding the financial burden."

Korea Ratings also stated in a report released last week that "given the 10.9 trillion won investment scale for establishing the U.S. smelter, an increase in the financial burden is inevitable." However, it also diagnosed, "It is positive that business competitiveness and profitability are expected to improve over the medium to long term." Korea Ratings projected, "Securing a local smelter in the United States will solidify Korea Zinc’s position as the world’s leading non-ferrous metal smelting company, and increased production of rare metals will contribute to the inclusion in the U.S. security supply chain, thereby enhancing business competitiveness and profitability over the medium to long term."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.