Surging International Bean Prices Drive Up Import Unit Costs

Weaker Won Spurs Sharp Rise in Import Value Even at Steady Volumes

Coffee Industry Enters a Structural 'High-Cost Era'

On the 22nd, participants are tasting coffee at the 10th Seoul Coffee and Tea Fair held at the aT Center in Seocho-gu, Seoul. Photo by Kang Jinhyung aymsdream@

On the 22nd, participants are tasting coffee at the 10th Seoul Coffee and Tea Fair held at the aT Center in Seocho-gu, Seoul. Photo by Kang Jinhyung aymsdream@

This year, South Korea's coffee import value surpassed 2 trillion won for the first time ever. The sharp increase was driven by a surge in international coffee bean prices and the depreciation of the Korean won, which amplified the effect of exchange rates. As coffee consumption continues to expand, warnings are growing that the cost structure of the entire coffee industry is fundamentally changing alongside this quantitative growth.

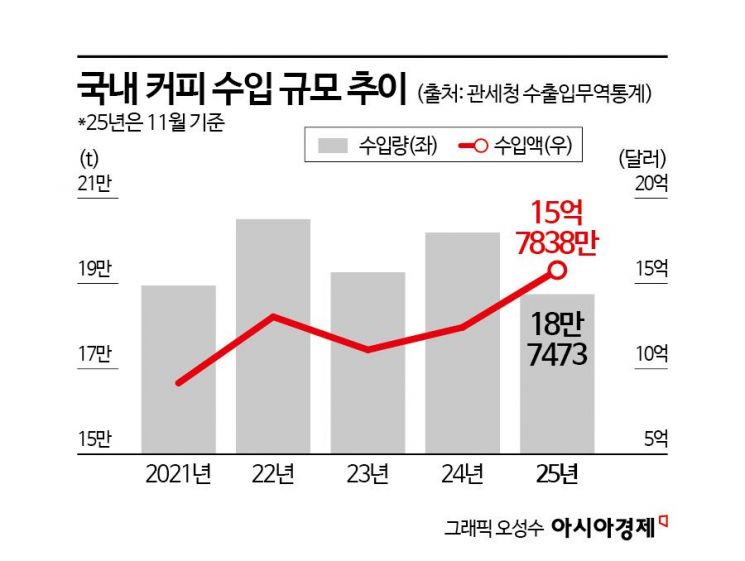

According to export and import trade statistics from the Korea Customs Service on the 23rd, the value of coffee bean imports as of November this year reached 1.57838 billion US dollars (about 2.34 trillion won), a 38.3% increase compared to the same period last year (1.14156 billion US dollars). While coffee import value has steadily increased over time, this year's rise is significant because the import structure shifted due to external factors such as international coffee bean prices and exchange rates. In fact, the volume of coffee bean imports has not changed much from last year. The volume for the same period this year was 187,473 tons, a decrease of 0.08% compared to 187,631 tons in the previous year.

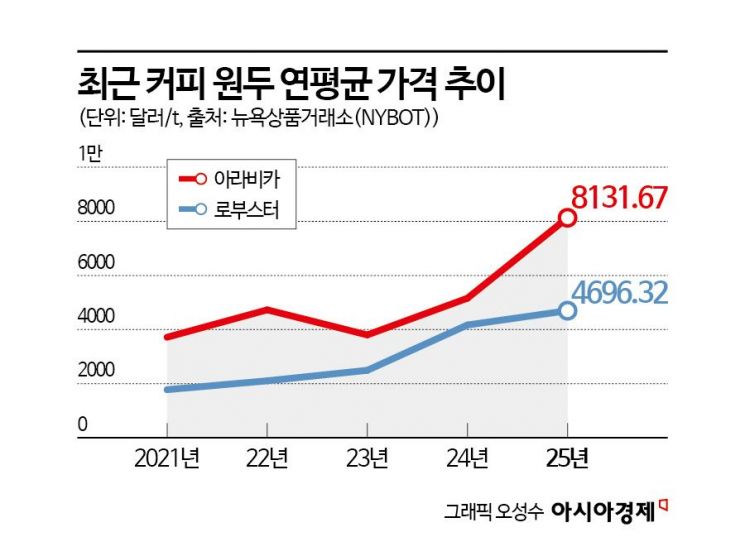

The starting point for this year's sharp increase in coffee import value is the rise in international coffee bean prices. The global coffee market entered a phase of structural instability this year as climate risks manifested all at once. Brazil, the largest producer of Arabica coffee, experienced repeated droughts, abnormal heat, and heavy rains, increasing uncertainty about crop yields. Major producers in Central and South America also faced plant diseases and rising production costs. Vietnam, the largest producer of Robusta coffee, likewise saw its supply capacity constrained due to climate change and increased labor and logistics costs.

These production disruptions are being recognized not as short-term variables but as structural risk factors. As climate change becomes a constant, it has become difficult for coffee bean prices to return to normal levels as quickly as in the past. In reality, international coffee prices remained high throughout the year, directly driving up the domestic unit import price of coffee beans.

On top of this, the effect of exchange rates due to the depreciation of the Korean won further amplified the increase in import value. Coffee beans are a representative imported raw material traded mostly in US dollars. As the won-dollar exchange rate remained high throughout the year, the import cost in won terms rose significantly even for the same volume of beans. The simultaneous rise in international bean prices and exchange rates has resulted in a "double cost pressure" becoming a reality.

In fact, this year's increase in coffee import value was overwhelmingly driven by unit price and exchange rate effects rather than by import volume. While the increase in volume was relatively moderate, the combined impact of rising bean prices and exchange rates caused the import value in monetary terms to surge. This clearly demonstrates that the domestic coffee market is an industry directly exposed to international raw material and currency environments.

The expansion of domestic coffee demand supports this interpretation. Coffee has become deeply embedded in everyday life, from specialty coffee shops and convenience stores to delivery, offices, and home consumption. Coffee has established itself as a product with relatively stable demand despite economic fluctuations, resulting in a structure where import demand does not easily decline even amid rising prices. Additionally, the increased consumption of premium beans such as specialty, single-origin, and decaffeinated varieties has also contributed to raising the average unit import price.

For this reason, although the domestic coffee market appears to be growing externally, cost burdens are accumulating rapidly. While the rise in international bean prices and exchange rates affects all businesses equally, the ability to absorb these costs varies greatly. Unlike large franchises, small roasteries and independent cafes find it difficult to absorb exchange rate fluctuations and bean price increases on their own, which inevitably increases pressure on profitability. In fact, industry insiders continue to point out that price hikes are unavoidable due to the combined burden of bean prices, exchange rates, and rising labor costs. However, since the cost of beans accounts for only a limited portion of the price of a cup of coffee, consumer resistance to price increases is also growing.

The bigger issue is that these changes in cost structure are unlikely to be temporary. Production instability due to climate change and exchange rate volatility are becoming near-constant risks in the medium to long term. Accordingly, there are calls for more structural response strategies, such as expanding long-term contracts, diversifying sourcing regions, and managing exchange rate risks, rather than simply passing on the cost pressure of beans to coffee prices.

An industry official stated, "The ability to respond to variables such as international bean prices and exchange rates has become a key factor in determining the competitiveness of the industry," adding, "To ensure stable growth, it is necessary to secure transparency in cost structures and establish industry-wide strategies to manage currency and raw material risks."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)