The Financial Supervisory Service has provided guidance to companies and external auditors on important considerations for preparing and disclosing financial statements, as well as for the external audit process, ahead of the settlement of accounts for the 2025 fiscal year.

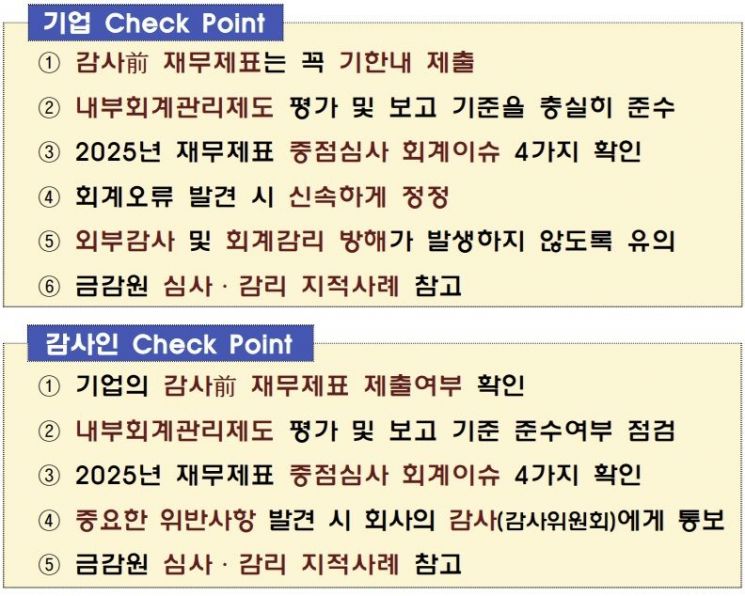

According to the Financial Supervisory Service on December 22, listed companies, unlisted companies with total assets of at least 500 billion won, financial companies and business groups subject to disclosure, and business report submitting companies under the Capital Markets Act with total assets of at least 100 billion won are required to submit their pre-audit financial statements, prepared in-house, to both their external auditor and the Securities and Futures Commission within the statutory deadline.

If companies violate submission obligations-such as failing to submit pre-audit financial statements by the deadline or omitting all or part of the required documents due to unfamiliarity with regulations or carelessness-measures such as the appointment of an auditor may be imposed.

Starting from the 2025 fiscal year, the "Standards for Evaluation and Reporting of Internal Accounting Management Systems" will be mandatory. Accordingly, companies must publicly disclose, in their internal accounting operation status report, the control activities and inspection results aimed at preventing and detecting financial fraud such as embezzlement. External auditors are also required to assess whether the operation status report has been prepared in accordance with the "Standards for Evaluation and Reporting of Internal Accounting Management Systems." If management does not correct incomplete or inappropriate content in the operation status report, the external auditor must state the reason in the audit report.

The Financial Supervisory Service has also identified key accounting issues to focus on during the 2025 financial statement review. These include: accounting for investor commitments, accounting for the issuance and investment in convertible bonds (CBs), disclosure of supplier financing agreements, and impairment of investments in subsidiaries and affiliates. The Financial Supervisory Service plans to select companies for review based on these issues after financial statement disclosure.

In addition, the agency emphasized the need for prompt voluntary correction of past accounting errors. If errors resulting from mistakes or a lack of understanding of standards-classified as "negligence"-are corrected quickly, the matter can be closed with a warning or lighter action. However, if the violation is deemed intentional or grossly negligent, strict sanctions will be imposed through inspection. On the other hand, the agency stated that voluntary corrections will result in mitigated penalties.

The Financial Supervisory Service also stressed the importance of avoiding any interference during external audits, reviews, or inspections. For example, refusing, delaying, or submitting false documents may result in severe sanctions equivalent to those for intentional accounting fraud. The agency warned that it will strictly respond to any acts of interference in audits or inspections by utilizing digital inspection techniques.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.