The development of quantum computing technology is rapidly shifting from a focus on fundamental and original technologies to commercial technologies that can be applied to actual industries, such as hardware, software, and services. Over the past decade, South Korea ranked third in the world in terms of the average annual growth rate of quantum computing patent applications.

According to the Intellectual Property Office on December 22, a total of 9,162 quantum computing patent applications were filed with the IP5 (South Korea, United States, China, Europe, and Japan) between 2014 and 2023, recording an average annual growth rate of 40.7%.

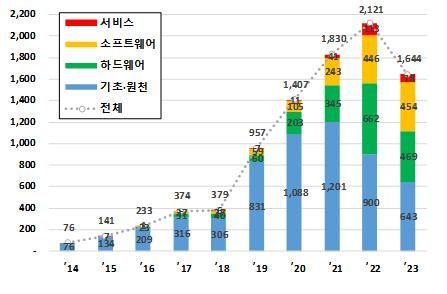

Patent trends by quantum computing technology filed with IP5 from 2014 to 2023. Provided by the Intellectual Property Office

Patent trends by quantum computing technology filed with IP5 from 2014 to 2023. Provided by the Intellectual Property Office

During this period, the number of annual applications fluctuated as follows: 76 in 2014, 141 in 2015, 233 in 2016, 374 in 2017, 379 in 2018, 957 in 2019, 1,407 in 2020, 1,830 in 2021, 2,121 in 2022, and 1,644 in 2023.

In particular, commercial technologies led the overall growth in quantum computing patent applications, recording a remarkable average annual growth rate of 86.0% from 2015 to 2023. In contrast, patent applications for fundamental and original technologies showed a relatively lower average annual growth rate of 26.8%. The growth rate of commercial technologies was more than three times higher than that of fundamental and original technologies.

This indicates that, globally, quantum computing technology is moving beyond the stage of basic research and is increasingly being implemented in hardware, software control, and commercialization, thereby enhancing its potential for industrial application.

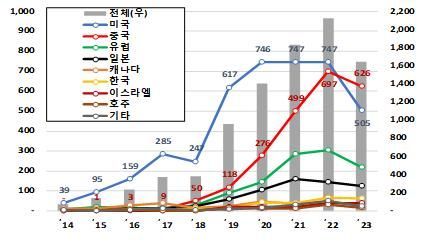

In terms of the total number of quantum computing patent applications by country, the United States led with 4,187 applications (45.7%), followed by China with 2,279 (24.9%), Europe with 1,127 (12.3%), Japan with 656 (7.2%), Canada with 277 (3.0%), South Korea with 248 (2.7%), Israel with 140 (1.5%), and Australia with 95 (1.0%).

These figures show that the United States and China together account for over 70% of all patent applications, clearly leading the global technology race. Notably, these countries are intensively expanding their patent filings not only in fundamental and original research but also in commercial technologies related to hardware and software.

Trends in Patent Applications for Quantum Computing Technology by Country. Provided by the Intellectual Property Office

Trends in Patent Applications for Quantum Computing Technology by Country. Provided by the Intellectual Property Office

South Korea's share of quantum computing patent applications remains lower than that of other countries. However, in terms of average annual growth rate, South Korea ranks third at 58.5%, closely following China (123.7%) and Israel (109.1%), and is quickly catching up with the leading countries in the quantum computing field. Above all, South Korea has seen a steady increase in patent applications for commercial technologies focused on hardware and software, indicating that it has entered the early diffusion stage of industrialization.

Meanwhile, the main applicants show that patent competition is intensifying among global leading companies. Between 2014 and 2023, IBM (1,120 applications) and Google (680 applications) ranked first and second, respectively, in the number of quantum computing patent applications, establishing themselves as dominant players in the field.

Following these companies, Origin Quantum (605 applications), Microsoft (404 applications), Baidu (373 applications), IonQ (227 applications), Fujitsu (184 applications), Tencent (177 applications), D-Wave (175 applications), and IQM Finland (126 applications) were also listed among the top patent applicants.

Among them, Chinese companies such as Origin Quantum (131.8%), Baidu (108.4%), and Tencent (91.7%) recorded average annual growth rates of over 90% in patent applications, indicating their rapid rise. In addition, emerging companies such as IonQ and IQM Finland are expanding their global market influence with differentiated technology strategies, including proprietary hardware platforms and customized architecture design.

This demonstrates that competition in quantum computing technology is spreading from global big tech companies to specialized startups and emerging firms, signaling a diversification of the technology ecosystem and a rapid expansion of the industrialization base.

Jung Jaehwan, Director General of the Intellectual Property Information Bureau at the Intellectual Property Office, stated, "Given the intensifying global competition for quantum technology supremacy, particularly between the United States and China, it is crucial for domestic companies to adopt a strategic approach that links research and development with patent acquisition in order to secure leadership during the early diffusion stage of the quantum industry." He added, "The Intellectual Property Office will closely monitor patent trends in advanced and emerging industries, including quantum computing, and support technology innovation based on intellectual property so that Korean companies can strengthen their competitiveness in the global market."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.