Governor Kazuo Ueda Announces at Press Conference on the 19th

Highest Interest Rate Since August 1995

Responding to Weak Yen, High Inflation, and US-Japan Rate Gap

BOJ Official Appeals: "If We Don't Raise Rates Now, the Yen Will Fall Further"

The Bank of Japan (BOJ), Japan's central bank, has raised interest rates as widely anticipated by the market. As fears over year-end "yen carry trade unwinding" intensified, Kazuo Ueda, the hawkish (favoring monetary tightening) BOJ Governor who ultimately made the decision to hike rates, has come into the spotlight.

On the 19th, Governor Ueda held a press conference and announced the decision to raise the policy interest rate by 0.25 percentage points, from the current 0.5% to around 0.75%. The new policy rate will take effect starting on the 22nd. This marks the second rate hike this year, following one in January, and the 0.75% level is the highest since August 1995, a span of 30 years. Even within Japan, this latest rate hike is being analyzed as a swift response to persistent inflation driven by a weak yen and the widening interest rate gap between the US and Japan.

Kazuo Ueda, Governor of the Bank of Japan, is speaking at a press conference announcing the interest rate hike on the 19th. Bank of Japan.

Kazuo Ueda, Governor of the Bank of Japan, is speaking at a press conference announcing the interest rate hike on the 19th. Bank of Japan.

A Scheduled Step... Unanimous Decision

Regarding the background of the rate hike, Governor Ueda explained, "Next year, there is a high possibility that companies will raise the minimum wage." He further stated, "Many members at the meeting pointed out the possibility that the weak yen could impact prices." In fact, it is known that all nine policy board members unanimously agreed on this rate hike.

Major media outlets have analyzed that Governor Ueda's decision to raise rates was a scheduled step. Mainichi reported on the announcement, stating, "The BOJ judged that the economic impact of US tariff hikes on Japan was smaller than initially expected, and that companies would be able to implement sufficient wage increases next year." The report added, "In addition, growing concerns about inflation due to the weak yen also supported the decision to raise rates." Nihon Keizai Shimbun (Nikkei) also commented, "This hike has increased the precision of policies aimed at achieving price stability targets," and described it as "a decision that further advances financial normalization."

From the morning of the policy decision meeting, major media outlets simultaneously published articles predicting that the BOJ would raise rates. Ahead of the results, Quick, a financial data company affiliated with Nikkei, noted, "Major morning papers are already using definitive language regarding the rate hike. It is suspected that information may have been leaked from the BOJ in advance."

Nippon Television (Nittere) asserted that the rate hike was inevitable, saying, "It is a situation where a hike must be implemented immediately," and pointed out, "The rapid depreciation of the yen is one of the main causes of the current high inflation." Nittere also reported, "Currently, the US policy rate is 3.50-3.75%, while Japan's is 0.5%, resulting in a significant US-Japan interest rate gap." The report added, "A BOJ official even said that if rates are not raised now, the yen will depreciate further, underscoring the sense of urgency."

Was a Rate Hike Deemed Urgent? Announced Earlier Than Expected

While the rate hike was anticipated, some analysts note that its timing was earlier than the market had expected. After Japan's previous rate hike at the beginning of this year, Japanese securities firms such as Nomura Securities had predicted an additional hike would come in January of next year.

However, on the 1st of this month, Governor Ueda attended a meeting with business leaders in Nagoya and commented on the agenda for the upcoming monetary policy meeting, saying, "I would like to make an appropriate judgment regarding the issue of a rate hike." This effectively signaled an upcoming rate increase. As a result, securities firms quickly revised their forecasts, moving up their expected timing for a rate hike to this month.

He further stated, "Even if we raise the policy rate, it is merely an adjustment within an accommodative financial environment," and added, "It is a continuation of the efforts by the government and the BOJ to ultimately achieve success." This essentially indicated that the latest rate hike is largely in line with the newly launched Takaichi administration's policy stance.

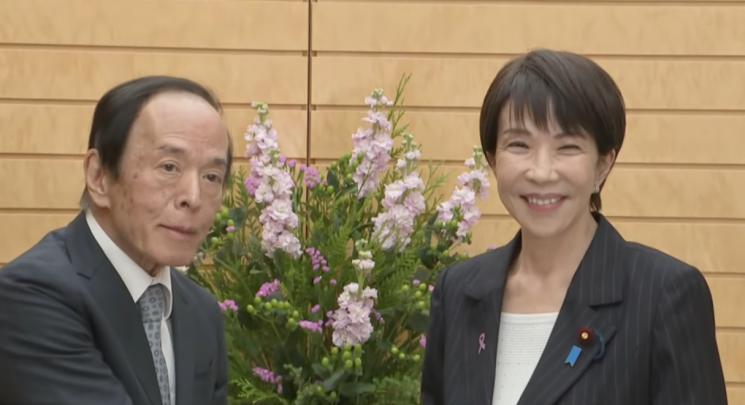

On the 18th of last month, Sanae Takaichi, the Prime Minister of Japan, and Kazuo Ueda, Governor of the Bank of Japan, met and shook hands. The two discussed matters related to interest rate hikes on that day. ANN.

On the 18th of last month, Sanae Takaichi, the Prime Minister of Japan, and Kazuo Ueda, Governor of the Bank of Japan, met and shook hands. The two discussed matters related to interest rate hikes on that day. ANN.

Kazuo Ueda, the BOJ's First Academic Governor... A Mandate to Raise Rates

In fact, raising the policy rate is considered Governor Ueda's mandate. Born in 1951, Governor Ueda is the first academic to serve as BOJ Governor. Traditionally, the post has been filled by insiders from the central bank or officials from the Ministry of Finance, which is equivalent to the Ministry of Economy and Finance in Korea. However, Ueda briefly served as a BOJ policy board member from 1998 to 2005 before returning to academia.

Amamiya, then Deputy Governor, later recalled that during Ueda's tenure as a policy board member, he paid close attention to him, describing Ueda as an "idea man." When Governor Ueda implemented his first rate hike last year, Japan's inflation rate had already exceeded 2% and the interest rate gap with the US was widening. Nevertheless, the BOJ maintained a conservative stance and refrained from raising rates. As the negative effects of the prolonged weak yen became more pronounced, Amamiya reportedly considered Ueda the right person for the job and supported his appointment. After Ueda was nominated as Governor, the BOJ officially announced at a monetary policy meeting that it would end its large-scale easing policy. The mission assigned to him was "to raise rates and manage the side effects."

Hints at Further Hikes... Silent on Neutral Rate

Given this background, it is highly likely that Governor Ueda will continue to pursue further rate hikes. However, he avoided mentioning specific figures regarding the neutral rate at the press conference. When asked about the neutral rate, he replied, "There is considerable variation in the estimates, so it is difficult to specify a concrete figure in advance," but added, "There is still some distance between the current policy rate and the lower bound of the estimated neutral rate." This suggests that he believes the current rate has not yet reached a neutral level. He also stated, "I do not believe that the gradual rate hikes so far have produced a strong tightening effect."

For now, he maintains that the pace and timing of further hikes will be determined by market and financial conditions. Governor Ueda stated that he will continue to monitor asset markets and credit flows, and will gradually adjust the degree of monetary easing as needed.

However, Nomura Securities forecasts that Governor Ueda will not be able to maintain a rate hike stance indefinitely. The firm predicts that once the policy rate reaches around 0.75%, there is a high likelihood that the core consumer price index (CPI) will slow to below 2% year-on-year. As a result, Nomura Securities expects that the BOJ will likely pause further rate hikes and take a breather around the second half of next year.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.