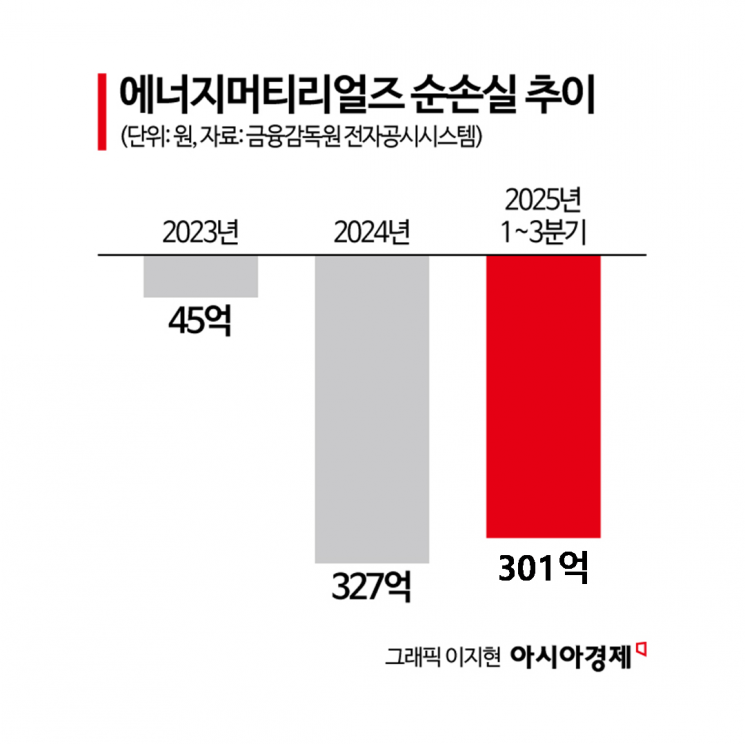

Cumulative Net Loss of 30.1 Billion KRW in Q3

Established in 2020... Losses Increased Since 2023

"Battery Recycling Market Conditions Remain Unfavorable"

GS Engineering & Construction's battery recycling subsidiary, which the company had identified early on as a new growth engine and invested in accordingly, recorded a net loss of over 30 billion won through the third quarter of this year. As the sluggish secondary battery market took its toll, the urgency of selling the subsidiary has increased.

According to the Financial Supervisory Service’s electronic disclosure system on December 22, Energy Materials, GS Engineering & Construction’s battery recycling subsidiary, posted an accumulated net loss of 30.1 billion won for the third quarter of this year.

Losses have been snowballing year after year since 2023. In 2023, the company recorded a net loss of 4.5 billion won, but last year, the loss surged to 32.7 billion won. The even bigger problem is the decline in revenue. The company posted sales of 3.1 billion won in 2023, which dropped to just 600 million won last year, and then reached 1.4 billion won this year.

The company’s main business is the pre-processing of used batteries from electric vehicles and manufacturing process scrap, including dismantling, crushing, and powdering. It was established in 2020, with Heo Yunhong, CEO of GS Engineering & Construction, serving as head of the new business division. In January 2023, the company changed its name from Enerma to Energy Materials and set up a mass production line in Pohang, North Gyeongsang Province.

The overall downturn in the secondary battery industry is cited as the direct cause of the poor performance. Battery production has declined due to the so-called "electric vehicle chasm"-a temporary stagnation in demand. As a result, demand for recycling has also decreased, dealing a direct blow to the company’s results. In addition to the Trump administration’s removal of electric vehicle purchase subsidies, concerns about the secondary battery industry have grown recently as the European Union decided to ease its 2035 new car carbon emission reduction target from the original 100% to 90%. A GS Engineering & Construction official stated, "Recently, the overall battery recycling industry has been underperforming, with prices of minerals such as lithium and cobalt plunging."

Disputes with the labor union also had an impact. In March, the union refused to work on certain processes and initiated a lockout, disrupting factory operations. Although a settlement was reached after a month, significant damage had already been done to the company’s operations.

The poor performance is also expected to affect GS Engineering & Construction’s rebalancing plans. According to recent reports from the investment banking industry, GS Engineering & Construction is seeking to attract equity investment in Energy Materials to reduce its debt ratio. The entire stake in the company-including the 77.65% held by GS Engineering & Construction and the 22.35% owned by private equity fund manager Genesis Private Equity-is up for investment. The company’s estimated enterprise value is 400 billion won. In August, GS Engineering & Construction sold its 100% stake in its water treatment subsidiary GS Inima to Abu Dhabi National Energy Company (TAQA) of the United Arab Emirates for 1.2 billion dollars (1.677 trillion won). On December 17, the company issued hybrid securities recognized as capital, worth 200 billion won, using the entire amount to repay debt.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)