Decaffeinated Coffee Sales Surge Over 50% Year-on-Year

From Premium to Low-Cost Brands... Affordable Coffee Drives Growth

Stricter Standards for "Decaffeinated" Labeling to Test Market Competitiveness

As survey results indicate that the average Korean drinks more than one cup of coffee per day, coffee consumption has become deeply embedded in daily life in Korea. Now, consumer interest is shifting from “how much coffee to drink” to “which type of coffee to choose.” Recently, as more people focus on health management, sleep quality, and overall condition, decaffeinated coffee, which allows for reduced caffeine intake, is emerging as a new alternative.

The coffee shop industry is responding to this trend by expanding its range of decaffeinated products and strengthening related marketing efforts, competing to capture demand. Decaffeinated coffee, once considered a “special option,” is now being recognized as a category that consumers select to suit their lifestyle.

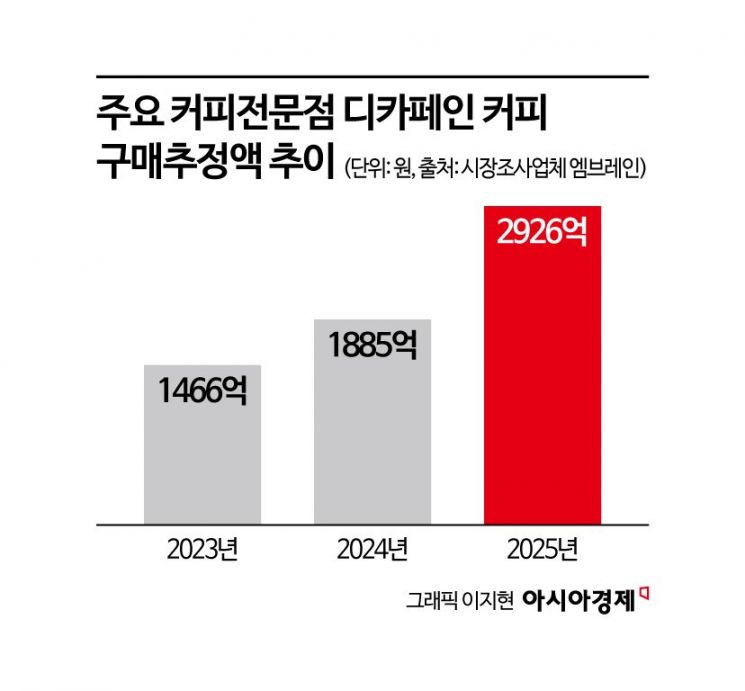

According to a market analysis by Embrain of purchase data from 11 major coffee chains, the estimated purchase amount for decaffeinated products reached 292.6 billion won over the past year as of September, marking a 55.2% increase compared to the same period last year. This figure is more than double the 146.6 billion won recorded in 2023.

This is interpreted as a reflection of consumer sentiment to control caffeine intake without giving up the taste and aroma of coffee. According to the survey, 62.5% of respondents agreed that “decaffeinated coffee is good because you can enjoy the taste of coffee while reducing caffeine intake,” while 48.4% said that “even those who are not sensitive to caffeine consider decaffeinated coffee a good option.” The industry interprets this not simply as a health trend, but as an extension of “psychological return on investment (ROI)” consumption, where consumers prioritize psychological satisfaction relative to the amount spent.

By brand, the decaffeinated coffee market is expanding rapidly, especially among premium coffee brands. The estimated purchase amount for decaffeinated beverages at Starbucks reached 156.6 billion won in 2025, a 52.8% increase from 102.5 billion won the previous year. During the same period, Twosome Place also saw a 48.4% growth, from 28.4 billion won to 42.1 billion won.

However, in terms of growth rate, low-cost coffee brands are seeing even steeper increases. The estimated purchase amount for decaffeinated coffee at MegaMGC Coffee rose by 92.0% year-on-year, from 25.6 billion won to 49.1 billion won. Compose Coffee saw a 127.2% increase, from 6.0 billion won to 13.7 billion won. Considering that choosing decaffeinated options often incurs additional costs, it is analyzed that low-cost brands, with their relatively lower price burden, have lowered the entry barrier for the spread of decaffeinated demand.

Decaffeinated coffee is now perceived as an option chosen based on individual preference or circumstance. In particular, starting in March next year, only coffee made from beans with a residual caffeine content of 0.1% or less will be allowed to be labeled as “decaffeinated,” as standards are set to be revised. As a result, the market is expected to enter a phase of competition focused on quality and reliability.

An industry official stated, “Decaffeinated coffee has established itself as a new pillar of coffee consumption, going beyond a simple trend,” adding, “After the standards are strengthened, each brand’s management of coffee beans, processing technology, and pricing strategy will determine competitiveness.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)