Impact of Contraction in Overseas Commercial Real Estate Market

Proactive Risk Management Leads to Reduction in Distressed Assets

The value of overseas distressed real estate assets held by domestic financial companies reached 2 trillion won. However, since these assets account for only a small portion of the total, and financial institutions are reducing their exposure to distressed assets to prepare for potential risks, the likelihood of this leading to a systemic crisis is considered low.

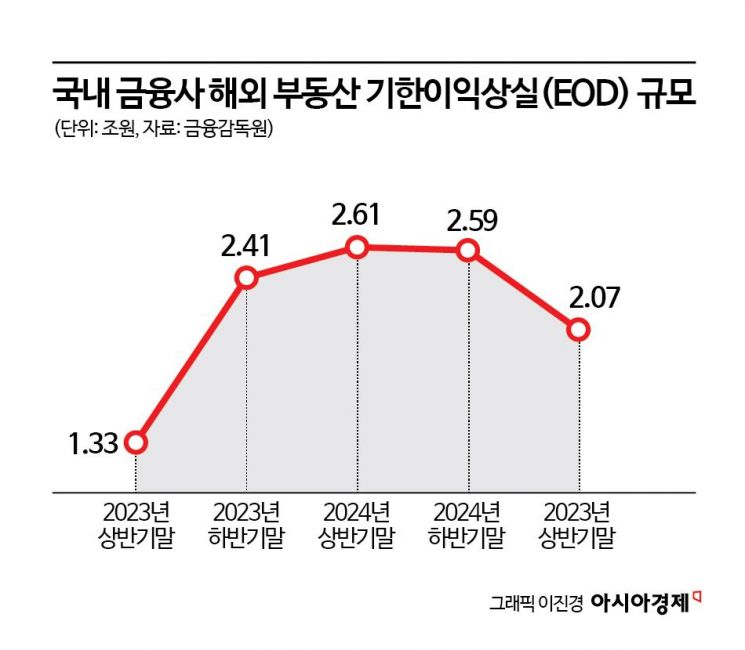

According to the "Status of Overseas Real Estate Alternative Investments by Financial Companies as of the End of June 2025," released by the Financial Supervisory Service on December 19, the total amount invested by domestic financial institutions in overseas single real estate projects in the first half of this year was approximately 31.6 trillion won. Of this, 2.07 trillion won, or 6.56%, triggered an Event of Default (EOD).

An EOD means that the creditor (financial institution) acquires the right to recover the loan from the debtor before maturity. It is a kind of "stop-loss" measure to prevent further investment losses.

The EOD volume of overseas real estate held by domestic financial companies increased significantly from 1.33 trillion won at the end of the first half of 2023 to 2.59 trillion won at the end of last year, but was reduced in the first half of this year. The increase in distressed overseas real estate assets was attributed to a sharp contraction in the commercial real estate market, especially in the United States. However, the scale has decreased this year as financial companies have proactively recognized losses and moved to clean up distressed assets in preparation for risks.

An official from the Financial Supervisory Service explained, "The overseas commercial real estate market is showing signs of recovery, rebounding from its low point due to improved investment sentiment. However, the office sector may continue to face vacancy pressures and price adjustment risks, so ongoing monitoring will be necessary."

As of the first half of the year, the total outstanding balance of overseas real estate alternative investments by the financial sector was 54.5 trillion won, down 1 trillion won from the previous quarter. This represents about 0.7% of the total assets of the financial sector, which stand at 7,488.3 trillion won.

By sector, insurance accounted for 30.4 trillion won, or 55.7%; banks for 11.4 trillion won, or 21%; and securities firms for 7.3 trillion won, or 13.4%. By region, North America accounted for 33.6 trillion won, or 61.6%; Europe for 10.2 trillion won, or 18.7%; and Asia for 3.5 trillion won, or 6.4%.

An official from the Financial Supervisory Service emphasized, "Although domestic financial companies have relatively high exposure to the office sector, the investment volume is limited compared to total assets, and capital buffers are sufficient, so the risk of systemic contagion is low. We will enhance soundness management by encouraging proper loss recognition and up-to-date appraisals, especially for projects with unusual trends or high loss rates."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.