Chinese Government May Attract K-pop to Boost Domestic Demand

Entertainment Sector Correction Seen as Opportunity;

Mid- to Long-Term Investment Prospects Remain Strong

As the Chinese government prioritizes domestic demand recovery, there is a growing possibility that K-pop will emerge as a key content driver to boost consumption. Accordingly, analysts in the securities industry suggest that investment opportunities in entertainment stocks may arise.

On December 19, Kim Jihyun, a researcher at Shin Young Securities, stated, "Given China's policy direction and the need to revitalize regional consumption, K-pop is being reconsidered not just as cultural content, but as a tool that can play an economic role."

China is expected to focus on domestic economic recovery by increasing household incomes in both urban and rural areas. At the "2025 Central Economic Work Conference" held on December 10-11, expanding domestic demand was presented as the top priority among the eight key policies discussed.

The Communist Party of China’s theoretical journal "Qiushi" also cited remarks by Chinese President Xi Jinping, emphasizing the need to address weaknesses in the consumption sector and to make domestic demand a major driving force for economic growth. In this context, the principle of "common prosperity," which aims to reduce income and asset gaps and expand the middle class, was once again highlighted.

Amid these developments, large-scale concerts are gaining attention as an effective means of revitalizing local economies. Such concerts attract a high proportion of out-of-town attendees, making them particularly effective at boosting regional consumption. K-pop artists, with relatively low accommodation costs and strong cultural affinity, are well-suited for tour concerts, including in third- and fourth-tier cities.

In smaller cities, the proportion of out-of-town audiences is even higher, resulting in a significant influx of tourists. These visitors typically stay for two to three days and spend between 500 and 2,000 yuan, not only on concert tickets but also on meals, transportation, and tourist attractions, providing tangible benefits to the local economy.

There are real-life examples of this effect. The "Strawberry Music Festival" hosted by the Dongguan city government in Guangdong Province attracted 80,000 attendees and generated an economic impact of 290 million yuan, accounting for about one-twentieth of the city's total tourism revenue.

However, there are restrictions on the activities of K-pop groups with Japanese members in China. For instance, Le Sserafim, under HYBE, had to cancel a fan signing event in Shanghai due to the presence of two Japanese members. Similarly, Hi-Fi Un!corn, under FNC, canceled a concert in Macau for the same reason. Recently, several fan meetings and performances involving groups with a high proportion of Japanese members have also been canceled. On the other hand, as seen in the case of the "Close Your Eyes" fan meeting in Hangzhou, which was held without Japanese members, limited activities are still possible.

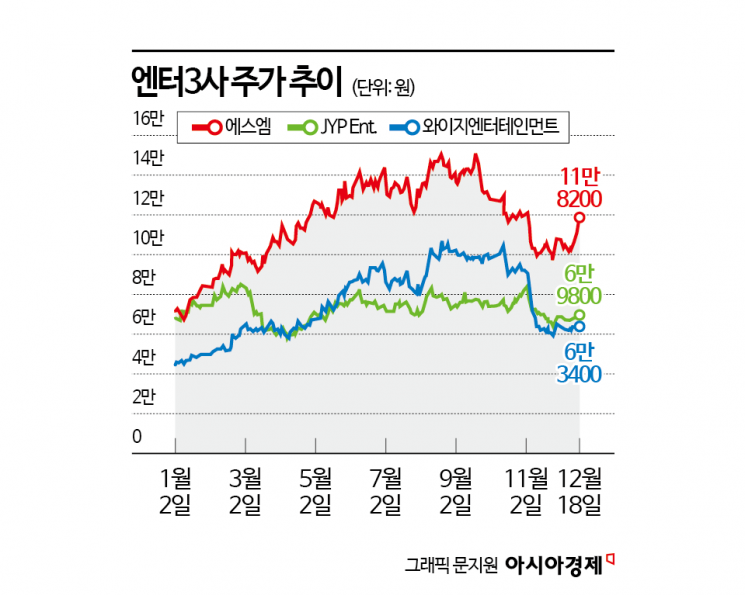

Analysts believe that investment strategies targeting the entertainment sector, which has recently undergone a correction, remain valid. Kim noted, "The average price-to-earnings ratio (PER) for the domestic entertainment sector has dropped from 30 times to below the historical low of 20 times. Excluding HYBE, SM Entertainment, JYP Entertainment, and YG Entertainment are around 16 times. This does not reflect the lifting of the Korean Wave ban at all."

He added, "Given China’s policy needs to expand domestic demand and revitalize regional consumption, a gradual, limited easing of the Korean Wave ban-excluding Japanese members-may proceed based on economic necessity rather than diplomatic events. This could create mid- to long-term opportunities for entertainment companies with artist lineups that can flexibly adapt to the structure of activities in China."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)