Fostering 10,000 Deep Tech Startups and Targeting 40 Trillion Won in Venture Investment

Expanding Venture Company Status to Include Mid-Sized Enterprises

Policies to Attract Top Domestic and Global Talent

Incentivizing Venture Investment from Private Sector and Pension Funds

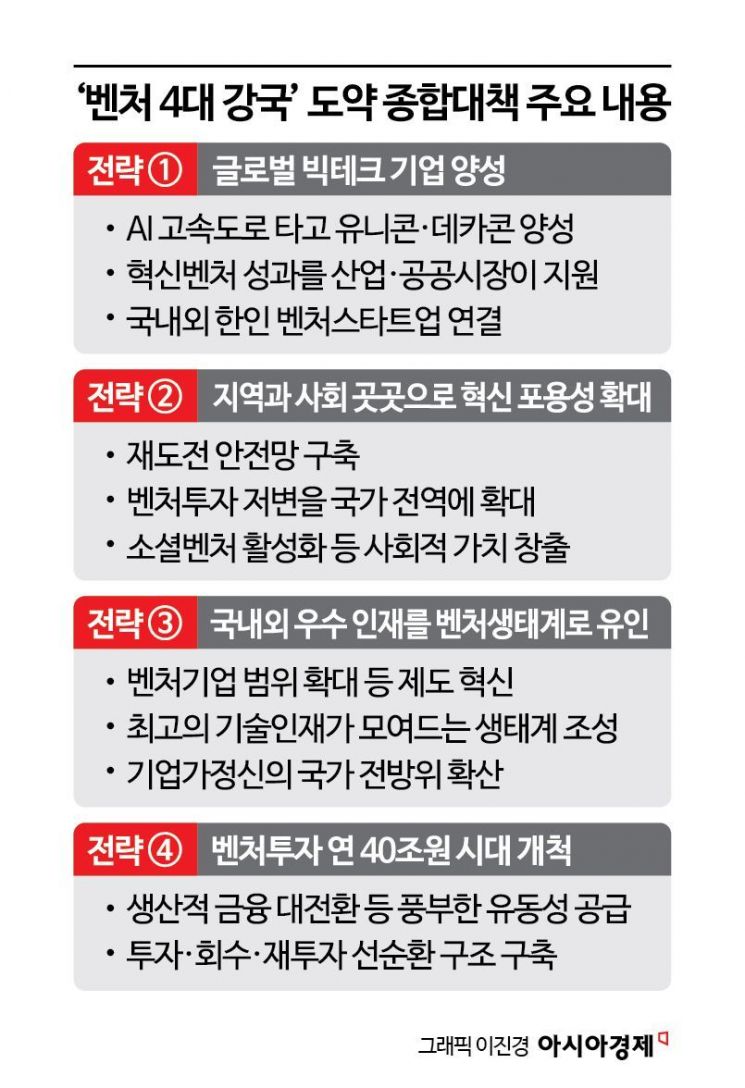

All government ministries are joining forces to propel the country into becoming one of the world’s top four venture powerhouses. The plan goes beyond supplementing individual sectors or addressing isolated issues; it aims to reorient the national growth strategy around ventures from four perspectives: technology, region, talent, and capital.

On December 18, the Ministry of SMEs and Startups announced the “Comprehensive Plan for Becoming a Top Four Venture Powerhouse” in a joint briefing with related ministries at the Korea Federation of SMEs in Yeouido, Seoul. Through this initiative, the government set targets to foster 10,000 artificial intelligence (AI) and deep tech startups, create 50 unicorns (unlisted startups valued at over 1 trillion won) and decacorns (unlisted startups valued at over 10 trillion won), and enter the global venture investment market with an annual scale of 40 trillion won.

This comprehensive plan was developed in light of Korea’s structural challenges, such as the demographic cliff, slowing growth, and stagnation in industrial advancement. The government determined that it must fundamentally shift the national strategy to encourage the challenge and innovation of “K-Venture.” The plan goes beyond short-term support, aiming to establish a sustainable venture growth structure so that ventures can function as the core engine of national growth.

First, the government will formalize a national-level venture innovation control tower, including the establishment of a consultative body involving the National Assembly, government, and industry. A comprehensive portal will be built to promote entrepreneurial spirit, and a “Senior Venture Fund” will be created to encourage established ventures and entrepreneurs to invest in emerging ventures and startups. The government will legislate a Venture Week and brand companies achieving 100 billion won in sales as the “Venture Milestone Club,” spreading venture achievements as national assets.

Policies to attract top domestic and international talent will also be strengthened. The scope of companies recognized as ventures will be expanded to include mid-sized enterprises, and the culture of venture investment contracts will be restructured to align with global standards. The pre-approval right will shift from “unanimous consent” to a “collective consent” system, and the use of split contracts will be encouraged. The multiple voting rights system will also be rationally improved.

Support will be provided for technological innovation and market development, paving the way for Korean ventures to grow beyond unicorns and decacorns into global big tech (large information technology companies). To supply liquidity, a national pension account dedicated to venture investment will be established, with the Korea Venture Investment Corp. (KVIC) assuming initial losses. An operating committee for the mother fund, involving multiple ministries, will be set up to enhance transparency and encourage participation from statutory funds, retirement pensions, and global capital in venture investment.

Guidelines will be introduced for applying risk weights (RW) when banks contribute to policy funds, and securities firms will be required to supply venture capital, including investments in unlisted ventures, with a focus on large investment banks (IBs). By easing regulations on external fundraising and overseas investment, the government will activate corporate venture capital (CVC) and promote strategic investments by large and mid-sized companies. The age limit for investee companies will be relaxed from 7 to 10 years, and the tax credit rate for corporate contributions to venture mother funds will be increased.

Measures to activate the exit market are also included. The merger and acquisition (M&A) platform for SMEs and ventures will be upgraded, and the scale of M&A funds and guarantees will be significantly expanded. M&A guarantees will increase from 30 billion won this year to 200 billion won by 2030. Various secondary funds, including general secondary and limited partner (LP) share liquidity funds, will be expanded to vitalize the intermediate exit market.

Additionally, to foster global big tech companies, the government will strategically allocate government-secured graphics processing units (GPUs) to ventures and startups, launch next-generation unicorn discovery and development projects, expand the B2G (business-to-government) market, and establish a new headquarters to support those making a second attempt at entrepreneurship.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)