Sectoral Return Divergence Without Clear Market Leaders

December's Traditional Stock Market Off-Season

In December, the returns of exchange-traded funds (ETFs) have been distributed across various sectors rather than being concentrated in a specific industry. With no clear leading stocks, sector rotation is occurring in the market.

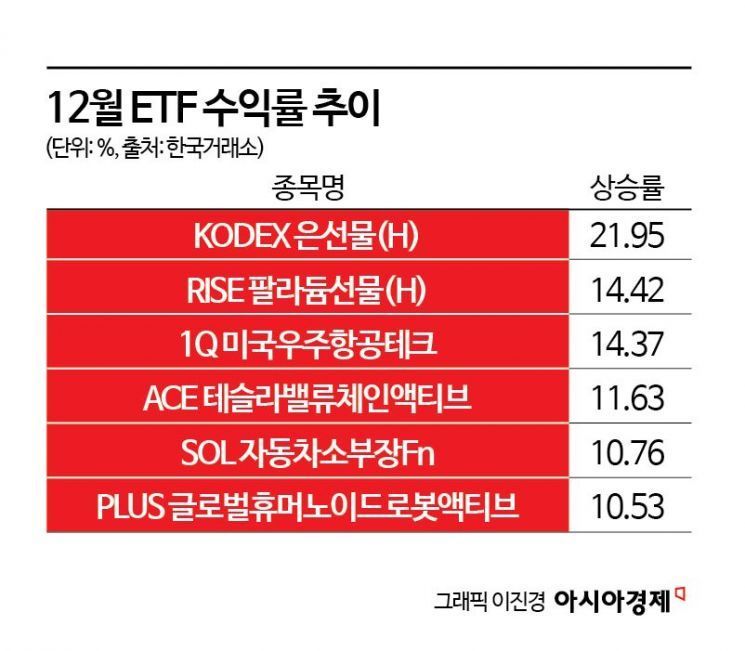

According to the Korea Exchange on December 18, the top-performing ETF for this month (from the 1st to the 17th) was KODEX Silver Futures, which posted a return of 21.95%. This was followed by RISE Palladium Futures (14.42%), 1Q US Aerospace Tech (14.37%), ACE Tesla Value Chain Active (11.63%), SOL Auto Components Fn (10.76%), and PLUS Global Humanoid Robot Active (10.53%).

Among ETFs with returns exceeding 10%, there was almost no overlap in their constituent stocks. The only exception was that the top two performers were both categorized as commodities. Additionally, PLUS Global Humanoid Robot Active and ACE Tesla Value Chain Active both include Tesla in their portfolios, but that is the only commonality. The 1Q US Aerospace Tech ETF tracks the 'Across US Aerospace Tech Index' as its underlying index.

The reason for this diversification in returns is attributed to the absence of leading stocks. Last month, the ETF market was dominated by the bio sector, with all of the top 10 ETFs being bio-related. This was due to a series of positive developments, such as the successful large-scale technology transfer by ABL Bio. Furthermore, concerns over an artificial intelligence (AI) bubble led investors to view bio stocks as a safe haven, which was another major factor.

However, this month, even the bio sector has posted lackluster returns due to profit-taking and other reasons. Both the KOSPI and KOSDAQ have also experienced heightened volatility. Since the beginning of the month, the KOSPI has fluctuated between the 3,890 and 4,170 levels during intraday trading, while the KOSDAQ has hovered around the low 900s to near 940. In particular, the ongoing debate over an AI bubble has contributed to the sector rotation phenomenon.

Lee Jonghun, Head of ETF Management at Korea Investment Management, stated, "There is currently no 'clear leading stock' driving the domestic stock market, and the direction of leading sectors is shifting in short cycles, which is widening the gap in sector returns. The rotation market, where sectors such as semiconductors, automobiles, bio, and robotics rise in short cycles, is intensifying."

An official from Mirae Asset Management explained, "The current market environment is characterized by sector rotation through ETFs, with no distinct leading stocks. Sectors are being influenced by individual events, such as physical AI, real assets, security, and infrastructure."

Seasonal factors are also at play. December is traditionally a sluggish month for the stock market. It is common to see weak performance due to capital gains tax and major shareholder requirements, as well as year-end settlements by institutions and foreign investors. Lee Jonghun noted, "There may be increased volatility due to decreased trading demand from foreign and institutional investors related to year-end settlements, as well as selling pressure from major shareholders seeking to avoid capital gains tax."

Yook Donghui, Head of ETF Product Marketing at KB Asset Management, said, "December is a period when year-end rebalancing, profit-taking, and tax issues converge, so there is a seasonal tendency for rotation among themes and asset classes rather than aggressive bets on a single sector. In the short term, this can make it appear as though sector concentration has eased."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.