DB Securities stated on December 17 that the decline in nonfarm payrolls in the United States during October and November lends weight to the possibility of additional interest rate cuts by the Federal Reserve (Fed).

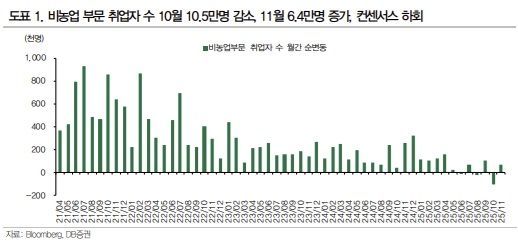

The number of nonfarm payroll jobs in the U.S. decreased by 105,000 in October and then increased by only 64,000 in November. Over the two months combined, there was a net decrease of 41,000 jobs. Park Sungwoo, a researcher at DB Securities, explained, "It was already expected that employment would decline in October due to the impact of federal government retirement programs, but the scale of the decrease was larger than anticipated."

Private sector jobs increased by 52,000 in October and 69,000 in November, respectively. He noted, "There has been some recovery from the sluggish performance in July and August, but as Fed Chair Jerome Powell mentioned, we should also consider the possibility that monthly employment statistics are being overstated."

The unemployment rate stood at 4.56% as of November. In particular, the U-6 rate, which is classified as the broader unemployment rate, jumped significantly from 8.0% in September to 8.7% in November, indicating a deterioration in overall labor market conditions, according to Park. He also assessed that, although the reliability of the statistics has somewhat declined due to factors such as the government shutdown, the overall trend of weakening labor demand is clear.

DB Securities expects that weak new job demand in the U.S. will justify further interest rate cuts down to a neutral level. Park explained, "Solid economic growth and the possibility of structural job reductions due to the spread of AI could act as constraints on additional rate cuts. However, since the neutral interest rate felt by vulnerable sectors such as low-income groups may be much lower, the policy stance of further rate cuts down to around 3% is likely to remain valid."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)