The domestic fund market has grown by 23.5% so far this year. The fund market is expected to continue its growth trend next year, centering on equity funds, fund of funds, bond funds, and mixed asset funds.

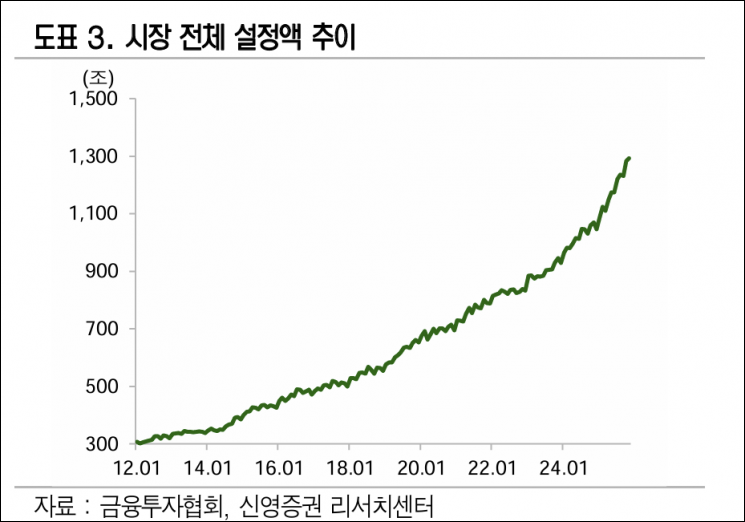

According to an analysis by Shin Young Securities on December 17, the total principal amount set in the domestic fund market reached 1,292.1 trillion won, up 23.5% or 246.18 trillion won from the end of last year. Funds investing only in the domestic market amounted to 835 trillion won, while overseas investment funds grew to 457 trillion won.

Oh Kwangyoung, a researcher at Shin Young Securities, explained, "Since the fund market surpassed the 1,200 trillion won mark in July, it has maintained this level for five consecutive months. Since first surpassing the 1,000 trillion won mark in May last year, it has remained above that level for 19 months."

He added, "Despite concerns over U.S. tariff policies, the global stock market rebounded due to increased interest in global big tech, including artificial intelligence (AI), and the possibility of progress in U.S.-China trade negotiations. As the domestic stock market surged on expectations for the new administration, investor sentiment improved."

Equity funds, which saw the largest inflow of investment capital since 2007, grew by 57.9% since the beginning of the year. Due to increased market liquidity, money market funds (MMFs) and bond funds, which have become popular products amid strong investor interest, also saw significant growth. Bond funds increased by 30.4% this year.

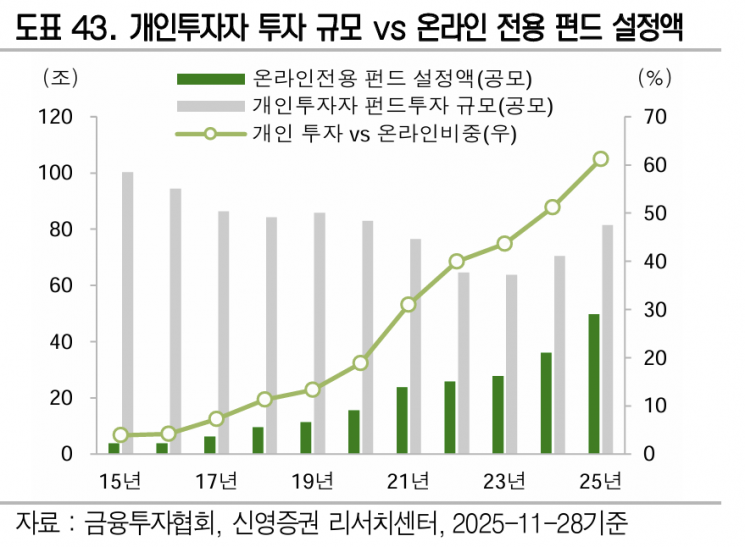

Researcher Oh highlighted the following characteristics of this year's fund market: ▲ inflow of investment capital centered on ETFs ▲ strong investor interest in bond ETFs ▲ liquidity concentrated in MMFs ▲ increased interest in retirement pension funds, dividend funds, and gold funds ▲ and a rise in individual investors' fund investments through online channels.

He analyzed, "This year, capital flows into equity funds were largely driven by investor interest in overseas stock markets, especially the U.S. market. In the second half of the year, capital inflows into domestic equity funds also increased significantly due to expectations for the new administration."

He continued, "Since the beginning of the year, there has been a net inflow of 34.8135 trillion won. Breaking down the capital flows between exchange-traded funds (ETFs) and equity funds, ETFs saw a net inflow of 36.6846 trillion won from the start of the year to the end of last month." He added, "Equity funds recorded a net outflow of 1.8706 trillion won since the beginning of the year, marking a net outflow for the third consecutive year."

Researcher Oh predicted, "Next year's fund market will show improved trends in line with the asset market. The domestic ETF market, which has shown growth centered on equity and bond ETFs, will continue to grow next year, focusing on various investment theme ETFs and active ETFs." He also anticipated, "With the retirement of the baby boomer generation approaching, pension-related products will increasingly become a core part of the fund market. Key products for the default option, such as TDFs and EMPs, are expected to grow alongside an increase in reserves as we move through the end and beginning of the year."

He advised, "Attention should be paid to government policy-related products and systems. Discussions are underway regarding the introduction of a fund-type retirement pension system to improve the rate of return on retirement pensions, and this system could have a significant impact on the fund market." He further recommended, "The comprehensive investment account (IMA) offered by securities firms could also have a direct or indirect impact on the fund market. It is important to monitor various funds such as the National Growth Fund and interval funds."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.