Shrinking Study Material Market Amid Declining School-Age Population

Profitability Worsens Due to Rising Labor and Raw Material Costs

Intensifying Digital Competition Spreads Pressure for Price Hikes

The price of study materials is rising again. As the market contracts due to a declining school-age population, companies are turning to price hikes to defend their profitability, which has been under prolonged pressure from rising labor and raw material costs.

According to the education industry on December 17, Hansol Education will increase the monthly fees for all subjects, including Korean and mathematics, for its home-visit learning programs starting in January next year. The increase will range from 3,000 won to as much as 19,000 won. By major product, the prices will rise as follows: 'Amazing Korean Land' (from 76,000 won to 95,000 won), 'Amazing Math Land' (from 79,000 won to 95,000 won), and 'Amazing Korean Language' (from 55,000 won to 58,000 won). Hansol Education explained, "Due to ongoing increases in labor, consumer prices, and raw material costs, we have had no choice but to raise tuition fees." Jangwon Education, a company specializing in Chinese character education, will also raise monthly fees for all subjects by about 3,000 won starting next year.

There are signs that this trend of price increases may spread across the market. The so-called 'Big 3' study material companies-Kyowon, Daekyo, and Woongjin Thinkbig-are reportedly considering raising their fees as well. An official from one education company said, "We do not have immediate plans to raise prices, but we are leaving open the possibility of an increase in the first half of next year and are reviewing it internally." All of these companies also raised their monthly fees last year.

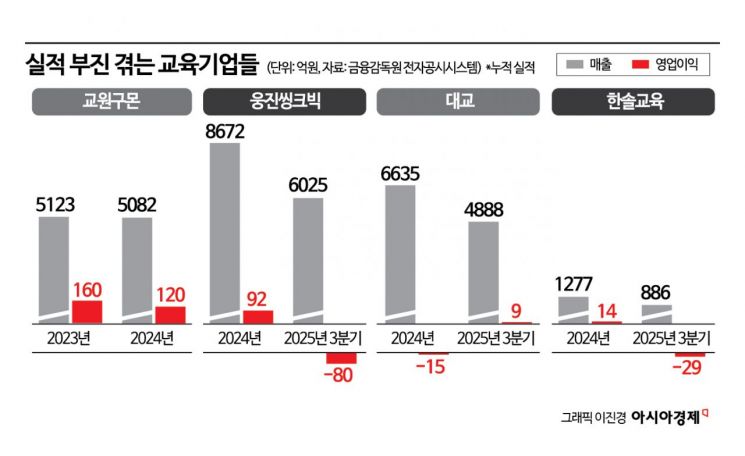

The background to these price hikes lies in the structural contraction of the market. As the number of births declines, the school-age population is rapidly shrinking, and the study material market continues to decrease in size. In addition, over the past few years, rising labor and paper costs have further increased operating expenses, causing profitability at educational companies to deteriorate rapidly. Hansol Education recorded a cumulative deficit of 2.9 billion won through the third quarter of this year. Kyowon Kumon's operating profit last year was only 12 billion won, down 25% from the previous year, while Daekyo and Woongjin Thinkbig both swung to losses in the third quarter of this year compared to the same period last year.

The costs associated with digital transformation are also significant. While the traditional home-visit study material market is shrinking, a new competitive market has emerged as mobile and tablet-based learning services have expanded since the COVID-19 pandemic. Moreover, even as the school-age population declines, the overall private education market in Korea has actually grown, intensifying competition in research and development (R&D) and marketing as companies race to secure new markets. According to the National Data Office, the size of the domestic private education market reached 29 trillion won last year, up 7.7% from the previous year.

As competition intensifies in the digital learning market, education companies are also striving to diversify their businesses. Woongjin has recently established a dedicated artificial intelligence (AI) division to strengthen its presence in the edtech sector, while Kyowon is developing rental and healthcare as new growth pillars. Daekyo has established a separate corporation, 'Daekyo Newif,' to expand into the senior business sector.

However, the industry consensus is that it will take time before new businesses begin to contribute significantly to profits. An industry official said, "With the profitability of core businesses deteriorating rapidly, price increases are an unavoidable choice," adding, "In the short term, the only option is to pass increased costs on to customers through higher prices."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)