Public Offering for Retail Investors Draws 15.3 Trillion Won in Deposits

Market Cap Surges to 4.6 Trillion Won, Ranking 11th on KOSDAQ

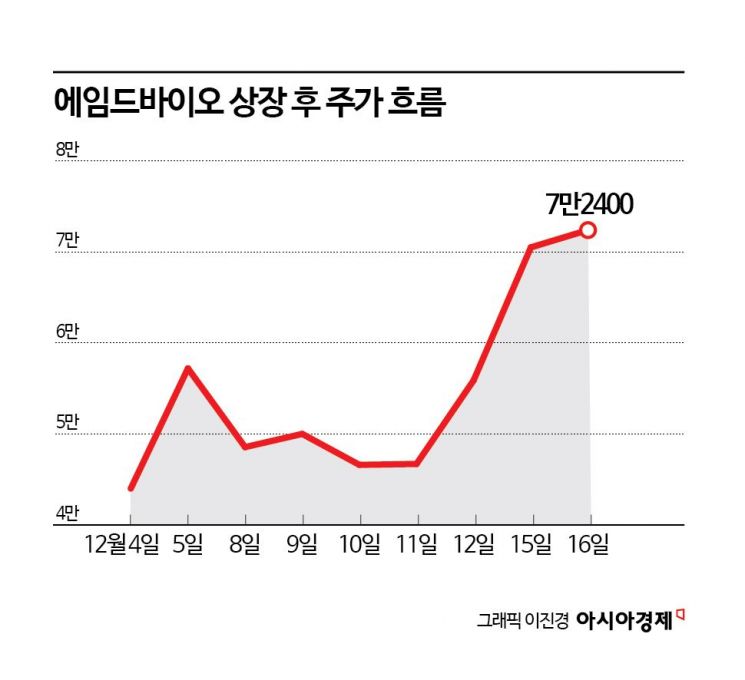

Aimed Bio, a company spun off from Samsung Medical Center, saw its market capitalization increase more than sixfold just nine trading days after its listing. Individual investors who have continued to "buy the dip" (purchasing additional shares during price increases) are currently recording a 30% return on investment.

According to the financial investment industry on December 17, Aimed Bio, which debuted on the KOSDAQ market on December 4, recorded a market capitalization of 4.6449 trillion won as of the closing price on December 16. This places it 11th in terms of market capitalization on the KOSDAQ market. Compared to its IPO-based market capitalization of 705.7 billion won, this represents an increase of 558%.

Since its listing, individual investors have accumulated net purchases totaling 123 billion won. The average purchase price per share was 54,700 won, and based on the closing price of 72,400 won on December 16, the return rate stands at 32%.

Aimed Bio was established in 2018 as a spin-off from Samsung Medical Center. The company is developing antibody-drug conjugate (ADC)-based anticancer drugs. ADCs are next-generation anticancer technologies designed to selectively deliver anticancer agents to cancer cells via antibodies, thereby maximizing therapeutic effects and reducing side effects compared to conventional chemotherapy drugs.

A key strength of the company is its differentiation in identifying unmet medical needs based on years of clinical experience and incorporating these into its new drug development strategies. By leveraging translational research capabilities using patient-derived xenograft models from the early stages of research, the company has been able to verify efficacy and safety, excluding candidates with low clinical success potential and thereby improving efficiency.

In 2023, the company garnered market attention by attracting investment from the Samsung Life Science Fund, jointly established by Samsung C&T, Samsung Biologics, and Samsung Bioepis. Last year, Aimed Bio signed a large-scale technology transfer agreement with U.S.-based Biohaven for 'AMB302,' and in October this year, it entered into a technology transfer agreement worth up to 1.4 trillion won with Germany's Boehringer Ingelheim. Even before its listing, the company had achieved technology transfer and joint development contracts totaling over 3 trillion won, drawing significant attention.

Lee Hocheol, a researcher at Shinhan Investment Corp., stated, "ADC is a next-generation anticancer modality that uses antibodies as a navigation system to ensure the drug selectively targets cancer cells rather than normal cells," adding, "The global ADC market is expected to grow from $17.3 billion in 2025 to $60.4 billion in 2032."

From November 12 to 18, the company conducted a demand forecast for institutional investors and finalized its IPO price at 11,000 won, the upper end of the desired range. Of the 2,414 institutions that participated in the demand forecast, more than 1,935 institutions-over 80%-committed to mandatory holding periods. The proportion pledging to hold for more than three months exceeded 50%.

The subscription competition rate for public investors was 1,737 to 1. The subscription deposit amounted to approximately 1.53552 trillion won, the largest among KOSDAQ IPO subscriptions this year. On its first day of listing, December 4, the stock closed at 44,000 won, up 300% from the IPO price. Since then, the stock has continued to rise, further increasing its market capitalization. At one point during the previous trading day, it reached 80,200 won, setting a new post-listing high.

Suh Geunhee, a researcher at Samsung Securities, commented, "The company succeeded in turning a profit last year through technology transfer. Although it will take considerable time to confirm clinical results for its pipeline, its sound financial status, with no debt, leaves room for additional technology transfer opportunities."

He added, "If the undisclosed pipeline yields positive clinical results, it will further validate the platform's technological capabilities and have a significant impact on the company's value."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.