According to the results of the '2025 Content Usage Behavior Survey' released by the Ministry of Culture, Sports and Tourism and the Korea Creative Content Agency, 9 out of 10 people in Korea use online video services (OTT), subscribing to an average of 2.1 services.

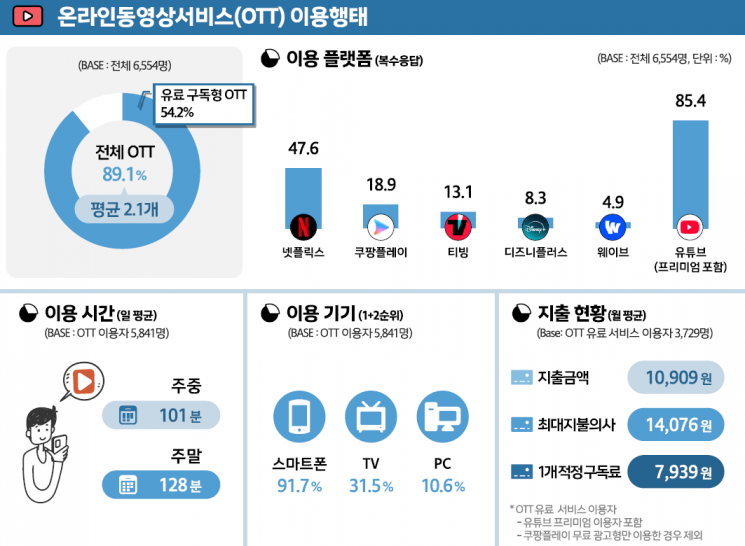

OTT Usage Rate at 89.1%, Paid Subscription at 54.2%, Average of 2.1 Services Subscribed

According to the 2025 Content Usage Behavior Survey published by the Korea Creative Content Agency on December 15, the overall OTT usage rate stands at 89.1%, indicating that 9 out of 10 people use OTT services. On average, users subscribe to 2.1 services, and the usage rate for paid subscription-based online video services is 54.2%.

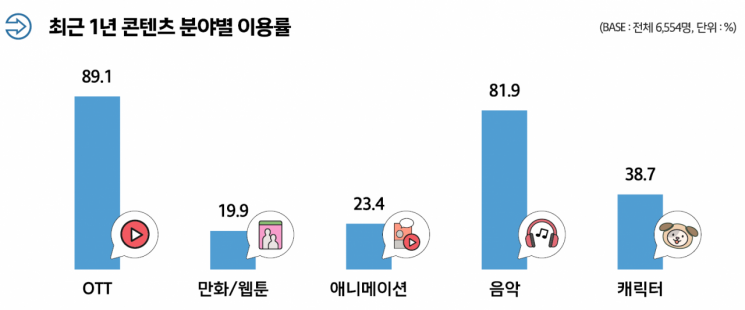

This survey marks the agency's first independently approved national statistics, conducted through face-to-face interviews with 6,554 people aged 10 and older nationwide over approximately three months starting in July. Focusing on OTT and new media video content, the survey comprehensively analyzed usage behaviors across five categories: comics/webtoons, animation, music, and character content.

By platform, usage rates were as follows: YouTube (85.4%), Netflix (47.6%), Coupang Play (18.9%), and TVING (13.1%). By device, the rates were: smartphone (91.7%), TV (31.5%), and PC (10.6%). The average viewing time was 101 minutes on weekdays and 128 minutes on weekends.

34.8% Choose Ad-Supported Plans, 87.3% Want to Continue Using Them

The average monthly expenditure for paid service users was 10,909 KRW, with the maximum amount they were willing to pay per month at 14,076 KRW. The amount considered appropriate for a single service subscription was 7,939 KRW. This suggests that users tend to reduce subscription costs through partnerships or discounts. In fact, 64.7% of users reported using OTT services with a focus on cost-effectiveness by leveraging such offers.

This cost-effective usage pattern is also evident in the selection of ad-supported plans. Among Netflix and TVING users, 34.8% chose ad-supported plans, and 87.3% of these users stated they intend to continue using them. After Coupang Play introduced a free ad-supported plan in June 2025, 26.9% of its existing paid users switched to the ad-supported model.

Notably, the usage rate for YouTube Premium reached 20.6%, a 6 percentage point increase from the previous year. Additionally, YouTube is increasingly recognized as an "all-in-one platform" offering video, music streaming (YouTube Music), and short-form content (YouTube Shorts) in an integrated manner. This reflects a growing preference among cost-conscious consumers for a single subscription to a unified platform.

'Short-form' Usage Rate at 58.6%..."No Burden Because It's Short"

The usage rate for short-form content was 58.6%. The reasons for watching were: "no burden because it's short" (76.0%), "to watch only the interesting parts" (51.4%), and "because of the recommendation algorithm" (47.0%). By platform, YouTube Shorts led with 93.4%, followed by Instagram Reels (30.9%), TikTok (21.1%), and Naver Clip (6.7%). The most preferred content types were: entertainment/variety show highlights (62.1%), drama highlights (38.1%), lifestyle/information (36.9%), news/current affairs (31.8%), and movie highlights (29.3%). There was a clear trend of consuming repackaged existing content in short-form formats.

Among short-form users, 33.3% had accessed shopping links embedded in videos, and 31.4% of these users actually made purchases, confirming that short-form content is also functioning as a pathway to product purchases. Meanwhile, usage rates by content category outside of OTT were: music 81.9%, character content 38.7%, animation 23.4%, and comics/webtoons 19.9%.

Yoo Hyunseok, Acting President of the Korea Creative Content Agency, stated, "With the spread of OTT and short-form content, the boundaries between content categories are becoming increasingly blurred. We have established nationally approved statistics that comprehensively capture actual user behavior," adding, "We will continue to advance data production to support not only the formulation of broadcast and new media video content policies, but also the analysis of structural changes across the entire content industry."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.