KRX Game Index Records -7% Return Over One Year, Lowest Among Sectors

Stock Prices Briefly Rise on New Release Hopes, Then Fall Again in Repeated Pattern

Although the KOSPI has shown a sharp upward trend this year, game stocks have remained stuck in a slump. Analysts say that additional momentum from new releases is needed to reverse the subdued investor sentiment.

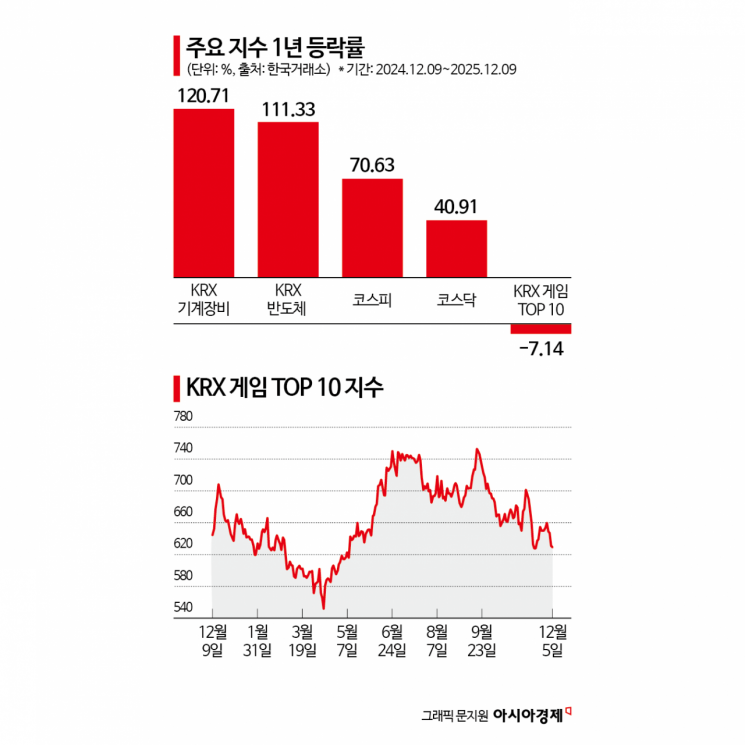

According to the Korea Exchange on December 10, the 'KRX Game TOP 10 Index' fell by about 7.14% over the past year, from December 9 of last year to the previous day. This is the lowest return among all indices calculated by the Korea Exchange and the only negative return among the KRX indices. In contrast, the KOSPI and KOSDAQ surged by more than 70% and 40%, respectively, during the same period.

Even large-cap game stocks, which possess both new release momentum and flagship IPs, have been unable to avoid the downturn. Krafton, currently the largest game stock by market capitalization in Korea, has seen its share price plunge by over 22% this year. NCSOFT, which had generated anticipation with its new title ‘Aion 2,’ saw its share price drop by nearly 15% on the day of release alone. The burden of short selling is also significant. As of December 8, the proportion of short selling in Netmarble’s total trading volume was 36.18%, ranking second among KOSPI-listed companies, while Kakao Games recorded 25.12%, the second highest among KOSDAQ-listed companies.

Some observers attribute this phenomenon to structural limitations in the growth of the gaming industry. Lee Hyojin, a researcher at Meritz Securities, commented, “The development period for new titles is getting longer and investment costs are rising, but for mobile games, the hit rate is declining and the monetization period after launch is getting shorter. If sequels are delayed after a new release, share prices tend to fall even further, creating a vicious cycle.” The rise of Chinese game companies, leveraging overwhelming capital and a large domestic market, is also a growing concern.

However, while there is consensus that the long-term investment appeal of game stocks has diminished, some believe that the sector’s position at the very bottom in terms of returns is excessive. The structural slowdown of the gaming industry and the drought of hit new releases were already present in 2023 and 2024, and it is pointed out that the industry has not deteriorated dramatically this year.

Choi Seungho, a researcher at DS Investment & Securities, said, “The recent underperformance of game stocks is best explained by a shift in capital flows as more attractive investment opportunities have emerged. For this year, 8 out of 14 companies are expected to see earnings growth, a slight improvement compared to last year. Statistically, it is rare to remain at the bottom for two consecutive years, so stock performance is expected to improve next year.”

The key factor that could reverse the subdued investor sentiment toward game stocks is momentum from new releases targeting the global market. Choi predicts, “In 2026, the superior strategy for game stocks will still be mid- to short-term trading based on new releases. If major new titles such as Pearl Abyss’s ‘Crimson Desert,’ NCSOFT’s ‘Aion 2 Global,’ and Netmarble’s ‘Monster Taming’ and ‘Seven Deadly Sins: Origin’ become big hits that exceed market expectations, investor sentiment toward game stocks could change.” He especially highlighted Netmarble, noting that its estimated price-to-earnings ratio (PER) for 2026 is around 10 times, at a historical low, making it his top pick among game stocks.

NCSOFT, which has presented an aggressive sales guidance of over 2 trillion won for 2026, will also be testing 5 to 7 new IPs next year, including ‘Sindercity.’ Lee Jongwon, a researcher at BNK Investment & Securities, estimates NCSOFT’s sales for the fourth quarter of this year at about 451 billion won (up 10.2% year-on-year) and operating profit at about 24 billion won (a return to profitability). He also expects that first-quarter sales next year will rise further, as the first full-quarter results of ‘Aion 2’ are reflected.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)