Need to Boost Investment in Advanced Industries Such as AI and Semiconductors

"SK hynix Will Be a Major Beneficiary if Implemented"

Securities analysts have reported that expectations for the easing of the separation of banking and commerce regulations are flowing into the stock market.

On December 9, Park Kihun, a researcher at Korea Investment & Securities, stated, "Easing the separation of banking and commerce is a realistic alternative aimed at revitalizing private investment through deregulation, especially in the context of a tax revenue shortfall." He added, "A presidential work report by the Ministry of Economy and Finance and other major economic ministries is scheduled for December 11."

"Time to Select Potential Beneficiaries"

Researcher Park explained, "In recent years, the core issues have centered on the scope of banks' entry into lifestyle services and whether fintech companies can engage in financial businesses. However, the current focus has shifted to securing capital-raising channels to enhance competitiveness in advanced strategic industries such as artificial intelligence and semiconductors, rather than simply expanding the financial sector."

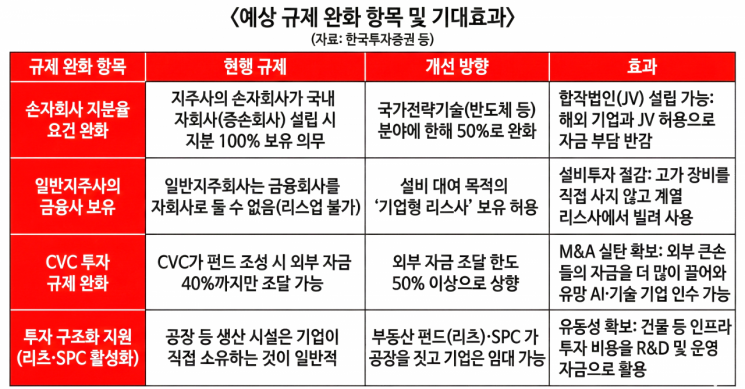

The main items under review are: ▲ easing the shareholding requirements for second-tier subsidiaries, ▲ revising regulations on corporate venture capital (CVC), and ▲ allowing holding companies to engage in leasing businesses. First, under the Fair Trade Act, the requirement for a holding company's second-tier subsidiary to hold a 100% stake when establishing a domestic third-tier subsidiary would be relaxed to 50% for national strategic technology sectors. Second, the external funding cap for CVC funds would be raised from the current 40% to over 50%. Finally, there are ongoing discussions to allow general holding companies to own financial leasing companies for the purpose of renting out production facilities.

As the most direct beneficiary, Park pointed to SK hynix. He explained that "the company could significantly reduce investment costs required for building the Yongin semiconductor cluster and expanding HBM (High Bandwidth Memory) facilities," adding, "Allowing holding companies to enter the leasing business would also be advantageous in terms of financial soundness, compared to directly purchasing expensive equipment."

"When Policy Visibility Improves, Time to Separate the Wheat from the Chaff"

He also highlighted secondary battery companies such as LG Energy Solution and POSCO Future M, noting that establishing joint ventures with overseas companies could help internalize supply chains by securing raw materials.

Companies such as GS and Celltrion were also mentioned as hidden beneficiaries of CVC regulation easing. Park noted, "In the case of GS Group, the holding company is positioning venture investment as a future growth engine. Raising the external funding cap for CVCs could enable the creation of large-scale funds to discover new businesses. For Celltrion, it would be positive for aggressive M&A and pipeline expansion to secure a leading position in the global bio market."

He added, "However, the work report on December 11 does not mean that deregulation will be confirmed immediately, so it is necessary to monitor the timeline until actual passage. Once policy visibility improves, it will be effective to focus on identifying leading companies in the related sectors."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.