Despite the Leak of 33.7 Million Records, Coupang Remains Unshaken

Powerful Rocket Delivery Means 'Talpang' Exodus Likely Limited

Fifteen Years of Offline Regulation Paved the Way for a Retail Giant

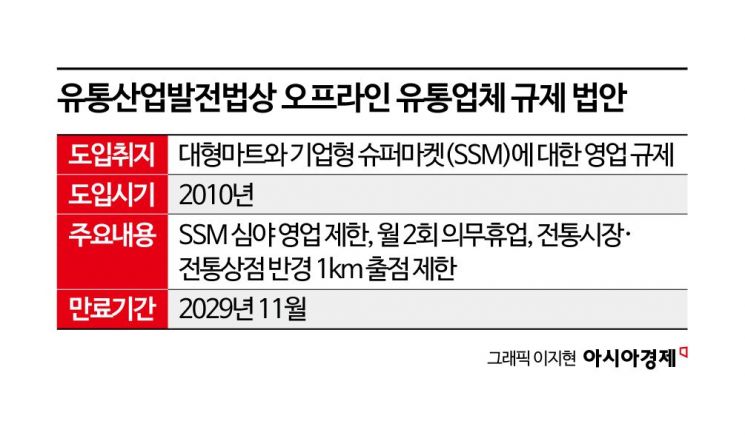

As the Coupang incident, which resulted in the leakage of 33.7 million cases of personal information, continues into its second week, the prevailing view is that Coupang's dominant position in the domestic retail industry will remain unshaken. This is due to the powerful "customer lock-in effect" established through its "Rocket Delivery" service. While Coupang has spent astronomical sums over the past decade to build logistics centers and establish a dawn delivery system, thereby increasing its market dominance, major retail conglomerates have been unable to become viable competitors in the e-commerce sector due to regulations prohibiting late-night operations at large supermarkets and super supermarkets (SSMs). Critics point out that these offline regulations, which have persisted for over a decade, have exacerbated the current situation.

According to the retail industry on December 5, Shinsegae Group's e-commerce platform SSG.com launched the "BaroQuick" service in September, offering delivery of Emart store products within about an hour. The service covers nearly 9,000 items, including Emart's private label "5K Price" products-fresh food and all items priced under 5,000 won-as well as ready-to-eat meals. However, this service is only available from 10 a.m. to 10 p.m. This is because, under the Distribution Industry Development Act implemented since 2013, large supermarkets and SSMs operated by major corporations are prohibited from operating between midnight and 10 a.m.

Just as Walmart in the United States leveraged its nationwide stores to enhance its online delivery competitiveness, retailers in Korea could also use their nationwide outlets as logistics hubs. However, due to these late-night operation restrictions, domestic retail companies are unable to enter the dawn delivery market.

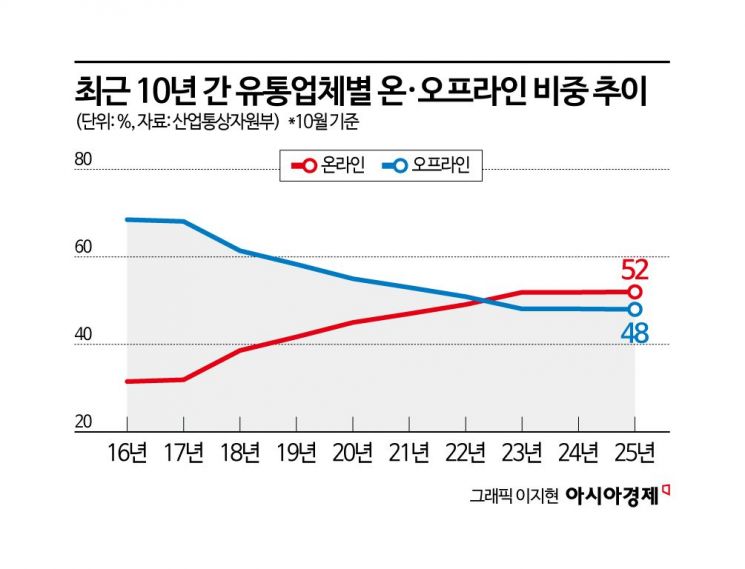

As a result, while the online market experienced rapid growth during the COVID-19 pandemic, domestic retail giants were reluctant to invest in e-commerce. According to the "October 2025 Major Retailers' Sales Trends" report released by the Ministry of Trade, Industry and Energy, the share of online sales in the domestic retail market has surpassed half, reaching 52%. This represents a sharp increase of 20 percentage points compared to ten years ago. In contrast, offline channels such as large supermarkets, SSMs, and department stores have seen their sales share drop significantly.

The driving force behind Coupang's rapid growth has been its "Rocket Delivery" service. Over the past ten years, Coupang has invested 6.2 trillion won to build more than 100 logistics facilities across 30 regions nationwide. The company has established a system capable of delivering most products, especially fresh food, quickly-either by dawn or on the same day.

During this period, large supermarkets lost their competitiveness due to structural constraints, including restrictions on store openings and operating hours under the Distribution Industry Development Act. In contrast, Coupang filled the gaps left by large supermarkets and grew into a "lifestyle infrastructure." Coupang's sales, which were 1 trillion won in 2016, soared to 41.3 trillion won last year-an increase of nearly 40 times. In the same period, Emart's standalone sales grew from 14.8 trillion won to 15.6 trillion won, an increase of less than 1 trillion won (5%). When accounting for inflation during this period, this essentially amounts to negative growth.

In fact, Homeplus, which was once the second-largest hypermarket operator, filed for corporate rehabilitation earlier this year and has continued restructuring and store closures. Recently, due to delivery delays with major suppliers, the company announced the closure of five additional stores: Gayang in Seoul, Jangnim in Busan, Ilsan and Woncheon in Gyeonggi Province, and Buk-gu in Ulsan. Industry insiders now assess that Homeplus is effectively facing "voluntary dissolution."

This domestic retail structure is the key factor enabling Coupang to secure its monopoly position. In a report published after Coupang's large-scale personal information leak, global investment bank JP Morgan diagnosed, "Coupang enjoys a unique position in the (domestic) e-commerce market, so the impact will be limited." A retail industry official commented, "Even if some consumers declare 'Talpang' (quitting Coupang), it will be difficult for them to give up the convenience of Rocket Delivery. If Coupang offers membership waivers or additional compensation, customer attrition may be even more limited."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.