National Assembly Budget Office:

Tax Revenue Projected to Increase by 37.5104 Trillion Won Over Next Five Years Due to Tax Law Revisions

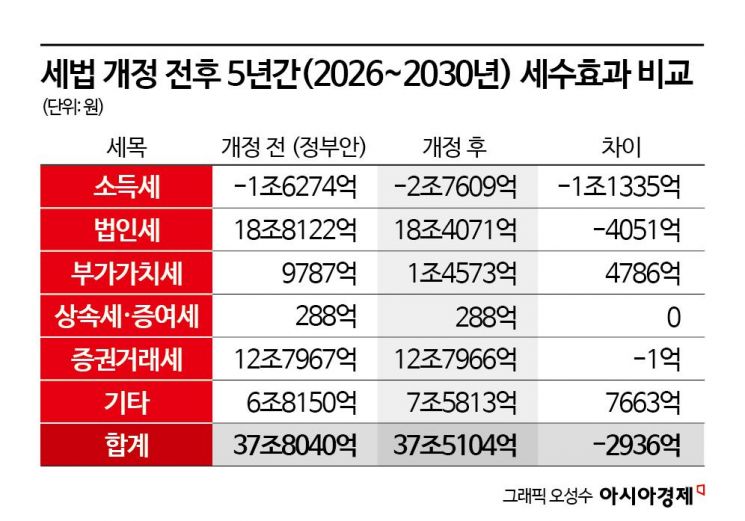

Tax Revenue Forecast Down by 293.6 Billion Won After Parliamentary Tax Law Review

Due to factors such as the reduction of the highest tax rate for separate taxation of dividend income, tax revenue is expected to decrease by 30 billion won over the next five years compared to previous forecasts. While income tax and corporate tax revenues are expected to decline significantly, the increase in revenues from value-added tax and other sources means the overall decrease in tax revenue will be relatively modest.

According to the analysis report "Results and Key Points of the 2025 Revised Tax Law Review" released by the National Assembly Budget Office on December 5, the revised tax revenue forecast following the National Assembly's amendment of the tax law is expected to be 3.75104 trillion won, down 293.6 billion won from the initial estimate of 3.78040 trillion won.

By category, income tax is projected to decrease by 1.1335 trillion won as a result of the National Assembly's tax law review. Corporate tax revenue is also expected to be 405.1 billion won less than the government's original proposal. There are several reasons for the decrease in tax revenue, but a key factor was the adjustment of the policy that initially planned to impose a maximum 35% tax rate on dividend income for shareholders of high-dividend companies. The rate has been changed to 25% for dividend income exceeding 300 million won up to 5 billion won, and 30% for income exceeding 5 billion won. In addition, the non-taxable benefit threshold for interest and dividend income received by quasi-members of mutual financial institutions such as agricultural and fisheries cooperatives has been raised from 50 million won to 70 million won, which also contributed to the decrease in tax revenue.

The National Assembly Budget Office expects value-added tax revenue to increase by 97.87 billion won over the next five years, but as a result of the revised tax law, tax revenue is projected to rise by 145.73 billion won. In other categories (such as education tax and special rural tax), revenue is expected to increase by 758.13 billion won over the next five years.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.