Average Inflation Rate Forecast for South Korea Next Year at 1.9%

Concerns Over High Exchange Rate Driving Price Increases Over Time

Falling International Oil Prices Expected to Limit Upward Pressure

Major global investment banks (IBs) have raised their forecasts for South Korea's consumer price inflation rate for next year. Despite the downward trend in international oil prices, the continued high exchange rate is expected to exert stronger upward pressure on prices than initially anticipated.

A visitor is selecting products at the imported fruit section of a large supermarket in downtown Seoul. Photo by Yonhap News Agency

A visitor is selecting products at the imported fruit section of a large supermarket in downtown Seoul. Photo by Yonhap News Agency

According to the International Finance Center on December 4, the average forecast for South Korea's consumer price inflation rate next year by eight major investment banks was 1.9% at the end of last month. This is an increase of 0.1 percentage point from the 1.8% average at the end of October.

Nomura raised its forecast from 1.9% to 2.1%, Barclays and Goldman Sachs from 1.8% to 1.9%, Citi from 1.7% to 1.8%, and JP Morgan from 1.3% to 1.4%. HSBC (2.0%), UBS (1.9%), and Bank of America (1.8%) maintained their forecasts.

The forecast for this year's consumer price inflation rate was also revised upward by 0.1 percentage point, from an average of 2.0% at the end of October to 2.1% at the end of November. Barclays, Citi, JP Morgan, Nomura, and UBS each raised their forecasts from 2.0% to 2.1%, while Goldman Sachs adjusted its forecast from 1.9% to 2.0%. HSBC (2.2%) and Bank of America (1.9%) kept their forecasts unchanged.

This upward revision in inflation forecasts reflects the impact of the high exchange rate. The won-dollar exchange rate averaged 1,460.44 won last month and continues to fluctuate in the upper 1,460-won range this month. As the exchange rate rises and prices of petroleum products or imported agricultural, livestock, and fisheries products increase, there is a lagged upward pressure on processed foods and dining-out prices as well. The easing of sluggish domestic demand was also cited as a factor for the upward revision in inflation forecasts.

The Bank of Korea also raised its forecasts for this year's and next year's consumer price inflation rates in its economic outlook released on November 27, from 2.0% to 2.1% for this year and from 1.9% to 2.1% for next year. On the same day, Bank of Korea Governor Rhee Changyong stated at a press briefing, "There are concerns that high exchange rates could lead to higher prices."

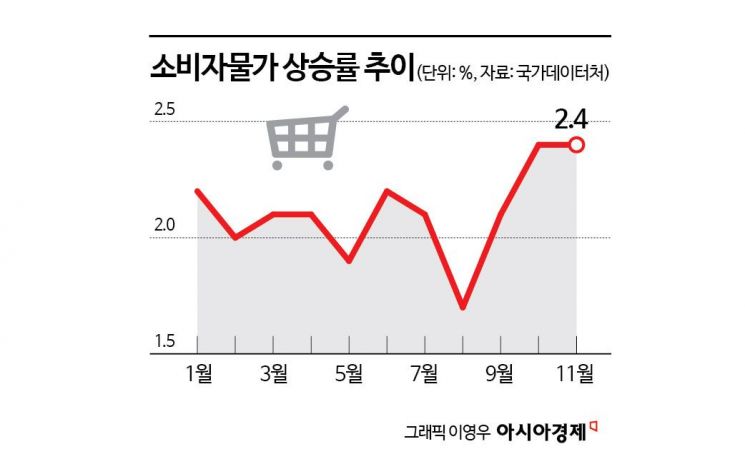

Meanwhile, on December 2, the National Data Office announced that the consumer price index for November rose by 2.4% compared to the same period last year. The upward trend has continued, with the rate rising from 1.7% in August to 2.1% in September and 2.4% in October. On the same day, the Bank of Korea, during a meeting to review price trends, pointed out, "It is necessary to further monitor the impact of the elevated exchange rate on future prices."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.