Jeonse Supply-Demand Index Hits 48-Month High After October 15 Policy

Shortage of Jeonse Listings, Jeonse Prices Rise for 42 Weeks... Surge in Credit Loans

As the jeonse loan balances at the five major commercial banks have declined for three consecutive months, instability in the jeonse (long-term rental deposit) market is growing due to strengthened jeonse regulations and the expansion of land transaction permit zones. Analysts say that the tightening of jeonse loan regulations has made it more difficult for tenants to secure funds, and the expansion of the land transaction permit system has further reduced the supply of new jeonse properties, intensifying the so-called 'jeonse crisis.' Experts are concerned that this trend is likely to continue through the spring moving season next year.

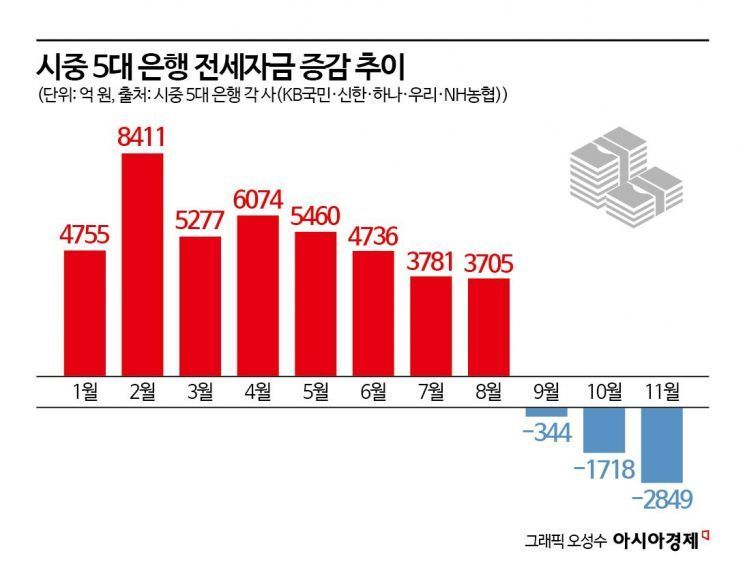

According to the banking sector on December 4, the outstanding balance of jeonse loans at the five major commercial banks (KB Kookmin, Shinhan, Hana, Woori, and NH Nonghyup) stood at 12.32348 trillion won as of November, down 284.9 billion won from the previous month. Jeonse loans have been declining for three consecutive months since September (-34.4 billion won) and October (-171.8 billion won). This is a stark contrast to February, when jeonse loans increased the most this year (+841.1 billion won). February is typically a peak season for jeonse loans, as it precedes the new school year and the spring moving season.

The main reason for the decline in jeonse loans in November is attributed to the tightening of regulations following the October 15 measures. Jeonse loans for single-home owners, which had previously been exempt from regulations, are now subject to the Debt Service Ratio (DSR) rule, resulting in reduced loan limits. In addition, regulations targeting gap investment (buying homes with jeonse tenants in place) have dampened some demand. As the number of people using jeonse loans to secure rental deposits has decreased, the downward trend in jeonse loan balances has become more pronounced.

The expansion of the land transaction permit system appears to have affected the supply side of the jeonse market. Under the October 15 measures, the government designated all of Seoul and 12 areas in Gyeonggi Province as regulated areas, speculative zones, and land transaction permit zones. In particular, with the entire city of Seoul designated as a land transaction permit zone, buyers of new homes in these areas are now required to live in the property for a certain period, making it difficult to lease out the property as jeonse for at least two years after purchase. As a result, the supply of new properties available for jeonse has decreased, reducing the market’s overall supply capacity.

With both loan regulations and supply restrictions in effect, the imbalance between jeonse supply and demand is worsening. According to the Korea Real Estate Board’s Weekly Apartment Price Trends, Seoul’s jeonse supply-demand index for the fourth week of November was 104.4. An index above 100 indicates that demand exceeds supply. In October, the index reached 105.0, the highest level since November 2021 (108.3), marking a near four-year high.

The shortage of jeonse properties is leading to rising jeonse prices. According to the Korea Real Estate Board, Seoul’s apartment jeonse price index rose by 0.14% in the fourth week of November compared to the previous week, marking 42 consecutive weeks of increases. Even though some of the existing jeonse demand is shifting to monthly or deposit-based monthly rentals due to loan restrictions, the faster decline in supply is putting upward pressure on prices.

As jeonse loans become harder to obtain, some tenants are turning to unsecured loans as an alternative. In November alone, the outstanding balance of unsecured loans increased by 831.6 billion won, surpassing the increase in mortgage loans (639.6 billion won) during the same period. Over the past two months, the increase in unsecured loan balances has reached 1.7567 trillion won. This trend is attributed to borrowers who need to secure jeonse deposits but are unable to do so through jeonse loans, turning to unsecured loans to make up the shortfall.

An official at a major commercial bank said, "With the October 15 measures, loans for gap investment purchases have been virtually blocked. Although some relief has been provided by allowing jeonse move-out loans, the limit is capped at 100 million won, so for tenants, it feels as though jeonse loans are effectively unavailable. As a result, more people are trying to secure the shortfall in jeonse funds through unsecured loans and other means."

Ham Youngjin, head of Woori Bank’s Real Estate Research Lab, said, "Following the October 15 measures, the trend toward monthly rentals and the decrease in jeonse properties in the rental market are likely to continue for some time. While the restrictions on jeonse loans will reduce abuse by gap investors, the contraction in new jeonse supply due to the expanded land transaction permit system will continue to put upward pressure on jeonse prices."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)