Medical Spending Surges 63% by October... Rapid Growth Toward 2 Trillion Won

K-beauty and Advanced Medical Capabilities Combine to Absorb Global Demand

Qualitative Shift Needed Amid Market Concentration, Gaps in Aftercare, and Fragmented Policy

The amount spent on medical services by foreign medical tourists visiting Korea this year is expected to approach 2 trillion won, following last year’s record, when it surpassed 1 trillion won for the first time. As global demand for medical and wellness services rises in the wake of the COVID-19 pandemic, Korea is emerging as a major medical destination, leveraging the popularity of K-beauty, advanced medical capabilities for serious conditions, reasonable costs, and quick access to care. However, the concentration in cosmetic procedures and insufficient aftercare are cited as challenges that must be addressed for the industry’s sustainable growth.

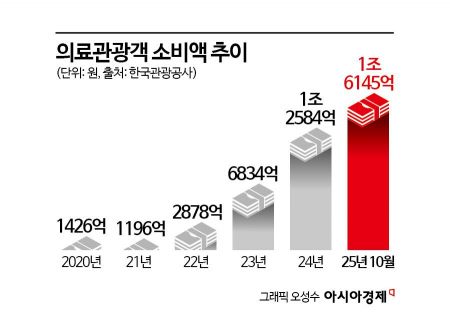

According to the Korea Tourism Organization on December 5, as of October this year, spending by foreign medical tourists reached 1.6145 trillion won, a 63% increase from the same period last year (990.6 billion won). Last year, the figure exceeded 1 trillion won for the first time, and this year it has already far surpassed that, with projections that it will approach 2 trillion won by year-end.

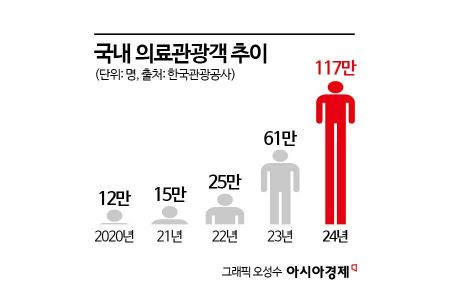

Since the pandemic, Korea has absorbed global demand for cross-border medical travel, maintaining strong growth. Last year, the number of foreign medical tourists visiting Korea reached 1.17 million, up 93% from the previous year. This is the highest since the institutionalization of medical tourism in 2009, and more than double the previous record of 497,000 in 2019 before the pandemic. This year, that record is likely to be broken again.

Population aging, the rise in chronic diseases, and the increasing burden of medical costs in advanced countries are also cited as factors driving demand for medical travel to Korea. In countries such as the United States, the United Kingdom, and Canada, long waiting times for treatment have led to an increase in “essential medical travel,” while Korea is recognized as a country that absorbs this demand, thanks to its relatively low costs, quick access to care, and positive treatment outcomes.

The most prominent sector is cosmetic and dermatological care. The popularity of K-beauty has translated into trust in Korean medical services, leading to increased demand for procedure-based treatments suited to short stays. This year, 56.7% of foreign medical spending was in dermatology, followed by plastic surgery at 23.6%. In total, more than 80% of all spending was in the cosmetic field. In particular, Japan and Taiwan have emerged as key markets, with demand increasing several dozen times compared to pre-pandemic levels. Although stays are short, the high rate of repeat visits is seen as forming the foundation for “sustained demand.”

Korea is also considered to have world-class competitiveness in high-difficulty areas such as cancer, cardiac surgery, and organ transplantation. It shows superiority in key indicators such as treatable mortality rates and cancer survival rates. By region, Seoul accounts for more than 85% of the total, indicating a heavy concentration, but cities like Busan and Jeju are demonstrating independent growth potential based on specialized models. Busan is developing specialized clinics focused on dentistry and orthopedics, while Jeju is expanding wellness and health screening programs leveraging its clean environment, thereby broadening the foundation for regional medical tourism.

Due to the nature of medical tourism, which involves “examination, procedure, recovery, and aftercare,” spending on accommodation, food and beverage, and shopping tends to follow. Average spending by foreign medical tourists is significantly higher than that of general tourists, and a high proportion of medical visits lead to increased interest in traveling to Korea.

However, there are also significant challenges. According to a survey by the Korea Health Industry Development Institute, foreign patients rated Korea’s medical technology, equipment, and hospital reliability highly, but “user convenience,” including hospital guidance, navigation, and cost explanations, ranked among the lowest. Many patients also reported inconvenience regarding recovery and consultation after returning to their home countries, with the lack of a remote management system between patients and doctors cited as an obstacle. The absence of a control tower, with functions such as visa issuance, promotion, and dispute resolution dispersed across different government agencies, is also seen as a challenge for the industry.

Lee Kwan-young, Associate Research Fellow at Yanolja Research, said, “Korea has a rare combination of strengths: K-beauty, advanced care for serious conditions, price competitiveness, and quick access. The turning point for industrialization will be whether the sector can expand beyond its current focus on cosmetic procedures to include health screening, rehabilitation, wellness, and advanced treatment, and whether it can transition toward an integrated patient experience.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)