Sharp Drop in Number of Investments and Concentration on a Few Companies... AI Investment Polarization Deepens

'Winner-Takes-All' Structure in B2B Sector Drives Funding to Leading Companies

"Support Needed for Early-Stage and Small AI Firms... Essen

Recently, as the trend of concentrated investment in the artificial intelligence (AI) sector becomes more pronounced in the venture capital (VC) industry, a clear distinction is also emerging among AI startups as investors increasingly seek to identify the most promising companies.

According to The VC, a venture investment information platform, as of November 2025, four out of the top ten domestic startups and small and medium-sized enterprises (SMEs) by investment amount were AI technology-based companies, indicating that the focus on AI investments continues.

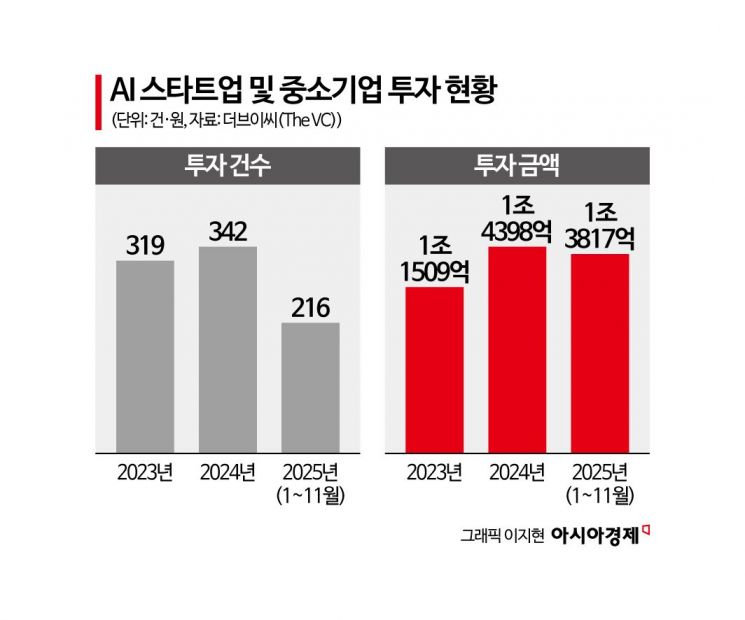

What stands out is the gap between the number of investments and the total investment amount in AI companies. As of the same month, the cumulative number of investments in unlisted domestic AI startups and SMEs was 216, which is about two-thirds of the previous year's 342 cases. However, the cumulative investment amount reached 1.3817 trillion won, or 96% of last year's total. If investments made in December are included, it is highly likely that the total investment for this year will surpass last year's figure.

Even within the AI sector, the trend is shifting from quantitative expansion to more selective investment. Investors tend to favor areas with high technological barriers and proven monetization potential, such as AI semiconductors, cloud infrastructure, and B2B (business-to-business) solutions. In particular, the nature of B2B solutions-where companies find it difficult to switch once a solution is adopted-adds to their appeal for investors. The structure of the AI industry, which requires large-scale funding from the early stages for data, computing resources, and model advancement, has also contributed to this concentration of investment.

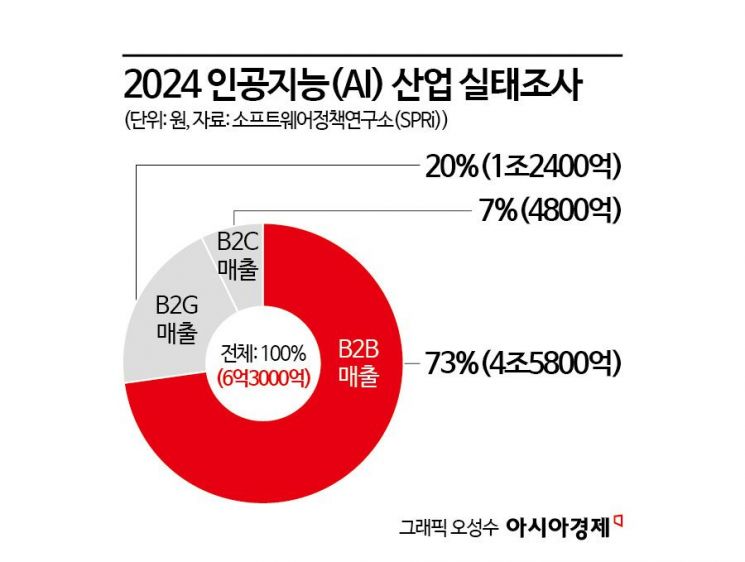

This trend is also evident in the industry structure. According to the Software Policy & Research Institute's (SPRi) "2024 AI Industry Survey" released in April, the total revenue of the domestic AI industry last year was 6.3 trillion won. Of this, B2B sales accounted for 73% (4.58 trillion won), while B2C (business-to-consumer) made up only 7% (480 billion won). The overwhelming majority of AI industry revenue is generated from B2B. As a result, companies that have secured technological capabilities, infrastructure, core talent, and references are rapidly widening the gap, intensifying the 'winner-takes-all' dynamic. In contrast, B2C models with less differentiation, such as generic chatbots or simple automation tools, are gradually being deprioritized by investors.

Lee Gidae, Head of Startup Alliance, described this polarization of investment as a natural phenomenon. He said, "The AI industry is centered on B2B, so the likelihood of a winner-takes-all outcome is much higher, and the leading companies have already begun to emerge. These companies are also highly likely to become global players." He added, "Now, AI companies require large-scale funding for GPUs, cloud infrastructure, and talent acquisition."

The industry expects this trend of large-scale investments focused on a small number of companies to continue. As the distinction among startups intensifies, the role of the government in mitigating this trend is also drawing attention. Industry experts emphasize the importance of providing growth opportunities to relatively marginalized early-stage and small AI companies, as well as offering customized support at each stage of growth, to ensure balanced development of the AI industry ecosystem.

Jeon Hwaseong, Chairman of the Early Investment Accelerator (AC) Association, said, "In addition to expanding policy finance and infrastructure support for early and mid-stage AI companies, the government should establish institutional frameworks such as performance disclosure systems based on demonstration and verification. Furthermore, by encouraging participation from a diverse range of investors-including accelerators and regional VCs-the government can help alleviate investment concentration and foster a healthier AI ecosystem."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)