Liquidity Expansion Driven by Global Rate Cuts

Semiconductor Supply Shortages... Super Cycle Continues

Defense, Holding Companies, and Cosmetics Also Worth Watching

As countries around the world lower interest rates and implement active fiscal policies, liquidity is increasing. This surge in liquidity is expected to continue into next year. However, many predict that the trend of base rate cuts will come to a halt in the second half of next year due to inevitable inflationary pressures that accompany expanded liquidity. With the Kospi index surpassing 4,000 points thanks to the Lee Jaemyung administration’s aggressive efforts to resolve the “Korea Discount,” there is growing speculation about whether the index can continue its upward trajectory next year.

On December 1, Daishin Securities set a Kospi index target of 5,300 points for 2026. The firm forecasts a differentiated upward trend, driven by a favorable external environment, the semiconductor cycle, and policy initiatives from the Lee Jaemyung administration. The leading industries identified are semiconductors, defense, holding companies, pharmaceuticals and biotech, cosmetics, and securities.

Semiconductors: Ongoing Supply Shortages Due to Exploding AI Demand

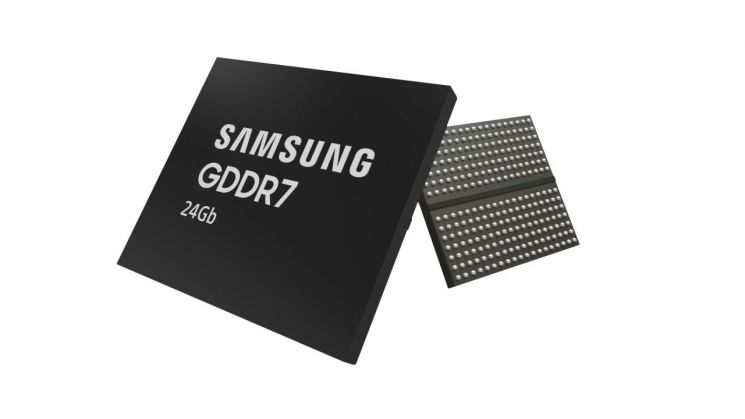

The expansion of the semiconductor cycle, fueled by surging AI-driven demand and supply bottlenecks, is expected to continue next year. Currently, industry inventory levels are about two to three weeks for DRAM and around six weeks for NAND. Even with an increase in capital expenditures (CAPEX) next year, DRAM and NAND production growth is expected to be only around 20 percent, making it highly likely that long-term contracts driven by supply shortages will persist into next year.

Daishin Securities stated, “There are risk factors such as the possibility of increased industry CAPEX based on optimistic demand forecasts, resulting production growth in 2027, the operation of two new plants in 2027, and competition from Chinese semiconductor companies.” The firm added, “However, based on past cycles, there are no signals such as a surge in industry CAPEX, order cuts from demand, or an economic slowdown that would indicate a peak in semiconductor stock prices.”

Defense Industry: Re-Armament in Eastern Europe and Self-Reliant Defense in the Middle East as Positive Catalysts

The defense industry, which led the market this year, is expected to retain its leading status next year, considering the ongoing trend of increased military spending and persistent military tensions. While discussions on ending the Russia-Ukraine war continue, Eastern European countries that have already secured orders are actively discussing re-armament, with full-scale factory construction scheduled to begin.

The Middle East and North Africa are also emerging as major players in the arms import market, with growing interest in joint development and production contracts to strengthen self-reliant defense capabilities. In addition, the Korean government has allocated 66 trillion won for next year’s defense budget, with a sharp 11.6 percent increase in spending for defense capability improvements, creating a favorable environment for the defense industry.

Holding Companies: Policy Momentum and Increasing Valuation Appeal

With the government’s third round of Commercial Act amendments and the implementation of separate taxation on dividend income following the first and second rounds, policy momentum is expected to keep investor interest in holding companies high. The stock market’s rise, led by large-cap stocks this year, has increased the net asset value (NAV) of major conglomerate holding companies, further enhancing their valuation appeal.

Daishin Securities predicts, “If voluntary changes by companies in response to government policies follow, the discount rate to NAV will shrink, providing additional upside potential.”

Biotech, Cosmetics, and Securities Also Worth Watching

For pharmaceuticals and biotech, key investment points include benefits from US interest rate cuts, reduced policy risk following the resolution of Trump-era drug price regulations and tariff issues, and increased demand for technology. With the US tightening regulations on Chinese biotech, Korean companies may benefit from supply chain and technology advantages.

Over the past three years, Korean cosmetics have moved beyond a China-centric market, establishing the K-Beauty category online in new regions such as the United States, thanks to innovative product capabilities and competitive pricing. Next year, as the reorder cycle accelerates, K-Beauty is expected to make a full-scale expansion from online to offline channels.

In the securities industry, favorable policies such as the third Commercial Act amendment and the implementation of separate taxation on dividend income are expected alongside a liquidity-driven rally from interest rate cuts. The investment banking market is likely to see an increase in large refinancing deals, and demand for corporate bonds is also expected to rise due to the interest rate cut cycle.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)