Memory Spot Price Aggregation Website

DRAM Prices, a Sign of a Super Cycle

Retail Investors in Samsung and SK Hynix Also Show Interest

Recently, semiconductor-related stocks have been leading both domestic and international stock markets, drawing attention from individual investors in Korea to the Taiwanese semiconductor price tracker, DRAM Exchange. Investors are closely monitoring DRAM prices, which are the main products of Korean semiconductor companies such as Samsung Electronics and SK Hynix, to gauge future stock price trends in advance. The number of enthusiastic investors sharing daily updates on DRAM price trends in online investment communities is steadily increasing.

Website Showing DRAM Spot Prices... Retail Investors Take Notice

Mr. A, a 20-something office worker who invests in Samsung Electronics, checks DRAM prices on the DRAM Exchange website every morning. He explained, "I thought that if DRAM prices rise, Samsung Electronics' performance would also improve, and this would boost the stock price due to heightened expectations. Conversely, if DRAM prices start to slow down, I feel the need to exit quickly, so I check the prices every day."

In fact, more users in various investment-related online communities are mentioning DRAM price information. Some compare the speed of past DRAM price increases with current trends to assess the possibility of a 'memory semiconductor super cycle.' Others post semiconductor industry reports from domestic and international securities firms and share future target prices.

Sharp Rise in Memory Spot Prices, Signs of a Super Cycle

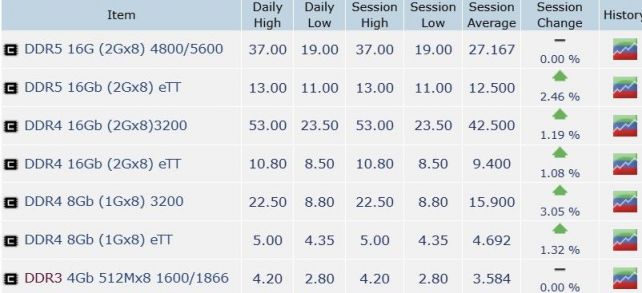

DRAM Exchange is a memory and storage-related semiconductor price aggregation website operated by the Taiwanese market research firm TrendForce. It mainly tracks spot prices for DRAM and NAND flash. For DRAM, it provides price trends for older generations like DDR3 and DDR4, as well as the latest generation, DDR5. While detailed information is available only through paid reports, anyone can view the general price trends.

The site was originally established for professionals such as computer parts retailers and the IT industry, but it has also attracted significant interest from securities firms and investors. Since DRAM is the main product of both Samsung Electronics and SK Hynix, the two pillars of the Korean semiconductor industry, DRAM spot prices are a critical variable for future performance.

Back in 2018, DRAM Exchange signaled a memory super cycle when the spot price of DDR4 DRAM soared to the seven-dollar range. The recent rallies in Samsung Electronics and SK Hynix have also coincided with increases in DRAM spot prices. In July and August, the spot prices disclosed on DRAM Exchange surged by 46.2%, and Samsung Electronics' stock price also rose during this period.

"Too Many Companies Requesting Memory... Concerned About How to Meet Demand"

Aerial view of the production line within SK Hynix's semiconductor cluster general industrial complex in Yongin. Provided by Yongin City

Aerial view of the production line within SK Hynix's semiconductor cluster general industrial complex in Yongin. Provided by Yongin City

The recent rise in DRAM prices is being driven by demand from artificial intelligence (AI) data centers. AI semiconductors require high-bandwidth memory (HBM), which can store massive amounts of data and transfer it to logic chips (such as CPUs and GPUs). This type of memory is manufactured by stacking multiple layers of DRAM. As big tech companies expand their AI data centers, DRAM consumption is increasing exponentially.

Some argue that the shortage of HBM, rather than GPUs, is the real bottleneck for data center expansion. On November 3, at the 'SK AI Summit 2025' held at COEX in Seoul, SK Group Chairman Chey Tae-won stated, "The supply of memory chips is being depleted at an unprecedented rate. This is now affecting the traditional memory chip markets for smartphones, PCs, and servers as well. We are receiving so many requests for memory supply from so many companies that we are concerned about how to meet this demand."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

!["The Woman Who Threw Herself into the Water Clutching a Stolen Dior Bag"...A Grotesque Success Story That Shakes the Korean Psyche [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)