Domestic Equities Yield 47.3% Return

Driven by AI and Value-Up Effects

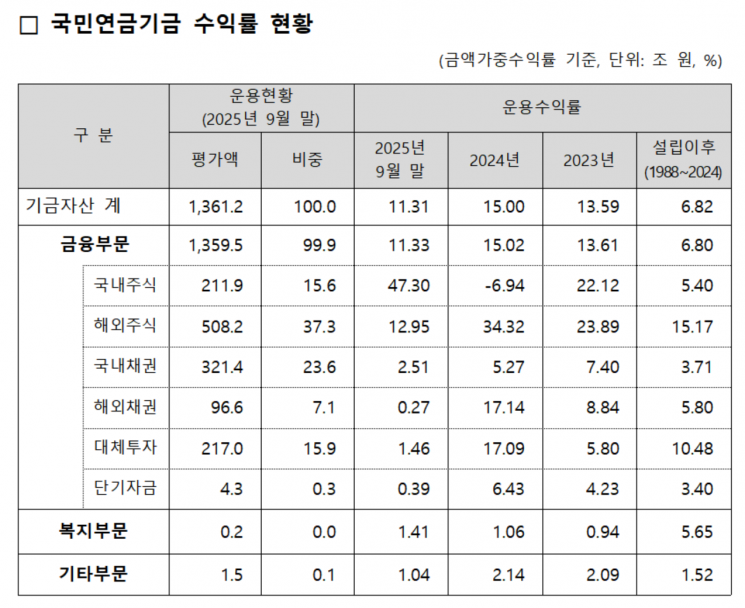

The National Pension Service recorded a fund management return rate in the 11% range as of the end of September this year, increasing its reserves by more than 148 trillion won compared to the end of the previous year.

On November 28, the Fund Management Headquarters of the National Pension Service announced that from January to the end of September this year, the National Pension Fund's reserves reached 1,361 trillion won, an increase of 148.4 trillion won from the end of the previous year. The return rate was provisionally tallied at 11.31% (based on money-weighted returns).

Stocks related to artificial intelligence (AI) and semiconductors performed strongly in both domestic and overseas markets, driving the overall return rate.

The asset class with the highest return was domestic equities, which posted an overwhelming return of 47.30% as of the end of September. This was followed by: ▲ overseas equities at 12.95% ▲ domestic bonds at 2.51% ▲ alternative investments at 1.46% ▲ overseas bonds at 0.27%.

Domestic equities achieved a return rate close to 50% due to expectations for new government policies and a rally led by semiconductor and technology stocks. Overseas equities also delivered double-digit returns, as AI and technology stocks showed notable strength amid the resumption of interest rate cuts in the United States.

Domestic bonds recorded a return of 2.51%, fluctuating in line with the economic recovery after two benchmark interest rate cuts in the first half of the year. Overseas bonds posted the lowest return of 0.27%, despite the rise in bond values due to falling interest rates amid concerns over an economic slowdown.

Alternative investments yielded a return of only 1.46%. This result mainly reflected interest and dividend income, as well as foreign exchange gains and losses due to currency fluctuations. Fair value assessments were not included in this performance.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.