Share Prices Rebound for Second Consecutive Day, Raising Hopes for Recovery

All Four Major Entertainment Stocks Post Double-Digit Declines This Month

Current Valuations Seen as Excessively Low Given Record Earnings Expected Next Year

BTS Returning as a Complete Group Next Year

BTS Returning as a Complete Group Next Year

Entertainment stocks, which had been undergoing a correction, have recorded two consecutive days of gains, raising expectations for a recovery in share prices. Despite expectations of benefiting from the recent escalation of tensions between China and Japan, known as the "Hanilryeong" (Japan restriction order), and forecasts of record-breaking earnings next year, share prices have fallen to historically undervalued levels. Experts view the current situation as an excessively undervalued phase and recommend an aggressive buying strategy.

According to the Korea Exchange on the 28th, HYBE continued its two-day upward trend, coming close to recovering the 300,000 won mark. It rose 6.06% over two days. YG Entertainment also gained 5.96% in two days, SM Entertainment rose 6.01%, and JYP Entertainment increased by 3.49%.

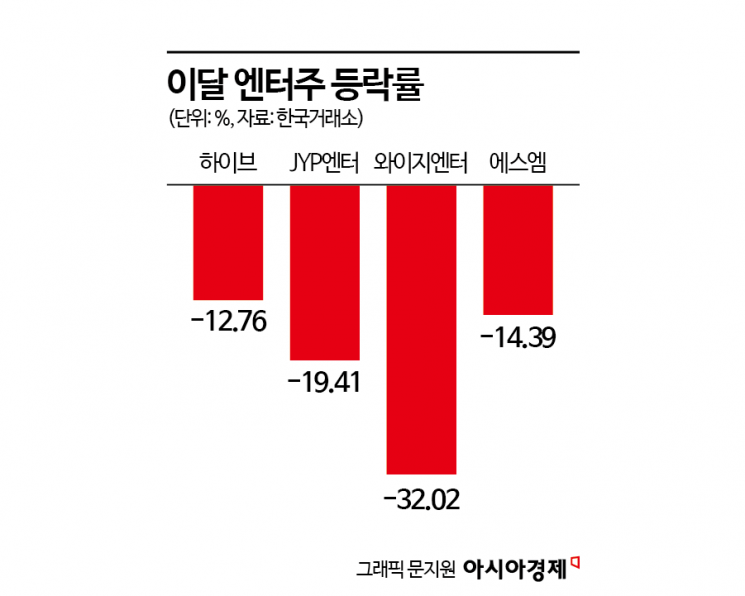

With entertainment stocks posting significant gains for two consecutive days, expectations for a recovery in share prices are growing. Entertainment stocks saw continued weakness after the announcement of disappointing third-quarter results this year. In November, HYBE fell by 12.76%, JYP Entertainment by 19.41%, YG Entertainment by 32.02%, and SM Entertainment by 14.39%. During the same period, the KOSPI declined by 2.94%.

As the weakness in share prices persists, analysts are describing the situation as an excessively undervalued phase. Lee Gihun, a researcher at Hana Securities, stated, "While investors are seeking beneficiaries of the Hanilryeong, the K-pop industry has dropped to valuation lows seen during previous events such as the 'Hanhallyeong' (Korea restriction order), the Burning Sun scandal, and the 'No Japan' movement." He added, "Although third-quarter results were clearly disappointing, it is surprising to see shares fall to lows witnessed only three times in the past decade, especially when record-high earnings are expected in 2026." He continued, "Even excluding those events over the past decade, a forward price-to-earnings ratio (PER) of 15 to 16 times has always marked the bottom for entertainment stocks. In 2026, with BTS and Big Bang returning, the K-pop industry is expected to post record earnings, while EXO and NewJeans will also make comebacks and NCT's Taeyong will return from military service. Despite this, shares of SM Entertainment, YG Entertainment, and JYP Entertainment have plummeted over the past month due to poor earnings, with PERs dropping to 17 to 18 times-an excessively low level."

Jang Minji, a researcher at Kyobo Securities, also commented, "The recent decline in share prices is excessive, making this a very attractive valuation zone." She added, "Currently, the 12-month forward PER for SM Entertainment, YG Entertainment, and JYP Entertainment is similar to the level seen in 2024, when concerns about K-pop peaking out were prominent. The important difference is that, unlike 2024, K-pop has now entered a phase of structural growth."

Given the strong growth outlook, some experts argue that an aggressive buying strategy is warranted. Jang added, "The entertainment sector has strengthened its fundamentals based on expanding global market penetration and the simultaneous growth of both mature and newer intellectual property (IP). The gap between share prices and fundamentals has widened, so at current levels, aggressive buying is recommended."

Next year, album and digital music sales are expected to approach historic highs. Lim Sujin, a researcher at Kiwoom Securities, forecasted, "Album sales next year are expected to reach 63.18 million units, up 16% year-on-year, driven by new releases from Blackpink and BTS, as well as growth in album sales from newer IPs." She added, "The decline caused by weakening competition among fandoms, which started in 2024, appears to be ending. In particular, with consumption shifting toward digital music, digital music sales are expected to increase by 17% to 1.7 trillion won, matching the record-high level seen in 2023."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)