Stock Up 64% This Year

Q3 Operating Profit Reaches 11.2 Billion Won, Up 38.7% Year-on-Year

Expectations for Increased Market Share in the U.S.

EasyBio, a producer of compound feed and feed additives, has once again reached a new 52-week high. The company's strong performance in the third quarter, along with expectations for solid results in the fourth quarter of this year, has led to a rise in its stock price.

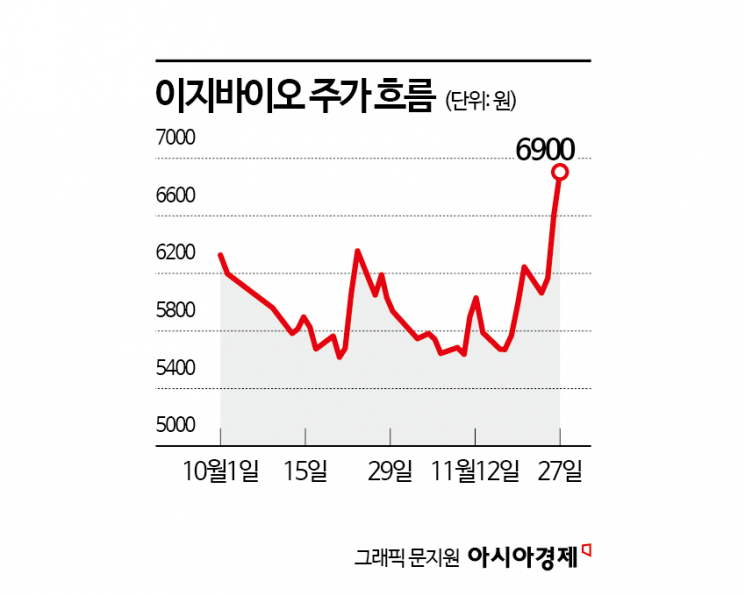

According to the financial investment industry on November 28, EasyBio's stock price has risen by 63.9% so far this year. In comparison, the KOSDAQ index has only increased by 29.8% during the same period. Institutional investors have led the stock's upward trend, recording a cumulative net purchase of 13.1 billion won this year. EasyBio's market capitalization has grown to 228 billion won.

As of the third quarter of this year, EasyBio posted cumulative sales of 347.6 billion won and operating profit of 31.4 billion won, up 30.3% and 32.8%, respectively, from the same period last year. In the third quarter alone, sales reached 116.9 billion won and operating profit was 11.2 billion won. Operating profit increased by 38.7% compared to the same period last year.

Heo Junseo, a researcher at Eugene Investment & Securities, estimated, "In the fourth quarter of this year, EasyBio is expected to achieve sales of 124.3 billion won and operating profit of 13.5 billion won," explaining that this represents an increase of 5.7% and 54.9%, respectively, compared to the same period last year.

Last year, EasyBio acquired Devenish Nutrition. Devenish supplies pig and cattle feed mainly in the Midwest region, including Iowa and Minnesota, in the United States. Before the acquisition, Devenish's operating profit margin was in the 4% range, but in the third quarter of this year, it rose by 2 percentage points to 6%. Devenish is working to increase its market share in the United States.

Researcher Heo analyzed, "The size of the feed industry market in each U.S. state is similar to that of individual Southeast Asian countries," adding, "Every time the company expands its business into a new state, it can achieve growth comparable to entering a new country."

Demand for feed additives in the U.S. market is expected to increase. As grain prices, the main raw material for feed, decrease, purchasing power for functional additives rises. As of September, the United Nations Food and Agriculture Organization (FAO) grain price index stood at 105, the lowest since September 2020. After the outbreak of the Russia-Ukraine war in 2022, prices of the three major grains surged, but have recently been stabilizing at lower levels. In contrast, domestic beef prices in the United States have reached historic highs.

With the full-fledged impact of the Devenish acquisition, the trend of improved performance is expected to continue. Along with business expansion, synergy effects such as strengthened competitiveness in operations and distribution networks are also anticipated. Eugene Investment & Securities has maintained its target price for EasyBio at 10,000 won.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.