Continued Recovery in Consumption and Easing Construction Slump

Growth Driven by Domestic Demand Expands

Exports Slow Due to U.S. Tariffs

Semiconductor Sector Remains Robust

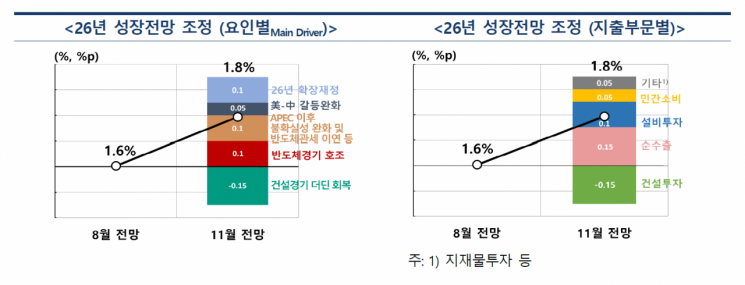

The Bank of Korea, in its revised economic outlook for November, projected South Korea's economic growth rate for next year at 1.8%. This is an upward revision of 0.2 percentage points from its August forecast of 1.6%. The current account surplus is expected to reach a record high, with projections of 115 billion dollars this year and 130 billion dollars next year.

Lee Chang-yong, Governor of the Bank of Korea, is speaking at a press conference held on the 27th at the Bank of Korea in Jung-gu, Seoul. Photo by Yonhap News Agency, Joint Press Corps

Lee Chang-yong, Governor of the Bank of Korea, is speaking at a press conference held on the 27th at the Bank of Korea in Jung-gu, Seoul. Photo by Yonhap News Agency, Joint Press Corps

Fourth Quarter Rises by 0.2%, Annual Growth at 1.0%... "1.8% Growth Next Year"

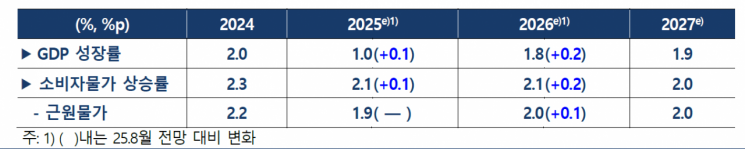

According to the Bank of Korea's November economic outlook released on the 27th, both this year's (1.0%) and next year's (1.8%) growth rates are expected to exceed the August forecasts (0.9% and 1.6%, respectively). In 2027, the growth rate is projected to slightly increase to 1.9% compared to 2026.

The Bank of Korea expects the growth rate for the fourth quarter of this year to be 0.2%. This is anticipated to be significantly lower due to the base effect of the sharp growth in the third quarter (1.2%) and a slowdown in exports, particularly for items subject to tariffs.

For next year, the Bank of Korea expects domestic demand-driven growth to expand as the recovery in consumption continues and the construction sector's slump eases. While exports are expected to slow due to U.S. tariffs, the semiconductor sector is projected to remain robust. By 2027, with strong domestic demand and an increase in exports driven by a global economic recovery, the growth rate is forecast to reach 1.9%.

The 0.2 percentage point upward revision in next year's GDP growth rate is attributed to several factors: the slow recovery in the construction sector (around -0.15 percentage points); the global semiconductor market's strong performance (around 0.1 percentage points); the easing of uncertainty following the Asia-Pacific Economic Cooperation (APEC) summit and the postponement of semiconductor tariffs (around 0.1 percentage points); the government's expansionary fiscal policy (around 0.1 percentage points); and the easing of U.S.-China trade tensions (around 0.05 percentage points).

Inflation at 2.1% This Year and Next Year... Impact of High Exchange Rates

The consumer price inflation rate is expected to be 2.1% both this year and next, slightly higher than the previous forecasts of 2.0% and 1.9%, respectively. In 2027, inflation is projected to reach the target level of 2.0%. The core inflation rate is expected to remain at 1.9% this year, while next year's forecast has been raised by 0.1 percentage points to 2.0% from the previous 1.9%.

Consumer prices are expected to rise by 2.1% in the fourth quarter, as the high exchange rate persists and some personal service prices increase. In October, consumer price inflation reached 2.4%, driven by higher prices of agricultural, livestock, and fisheries products due to the autumn rainy season, as well as a surge in travel demand that pushed up related personal service prices.

Next year, despite downward factors such as a decline in international oil prices, the inflation rate is expected to remain at 2.1% due to the impact of the elevated exchange rate and the easing of sluggish domestic demand. In 2027, inflation is forecast to slightly decrease to 2.0%.

Current Account Surplus: 115 Billion Dollars This Year, 130 Billion Dollars Next Year... Consecutive Record Highs Expected

The current account surplus is projected to reach 115 billion dollars this year, an upward revision from the August forecast of 110 billion dollars. If realized, this would mark the largest surplus on record. Next year, the surplus is expected to rise further to 130 billion dollars.

The goods balance surplus is expected to increase due to a sharp rise in semiconductor prices driven by growing demand for AI and general servers, as well as improved terms of trade resulting from stable international oil prices. The primary income balance is also expected to continue its trend of widening surplus.

The number of employed persons is projected to increase by 180,000 this year and 150,000 next year. While employment in the construction and manufacturing sectors is expected to decline this year due to sluggish construction investment and uncertainties in the trade environment, service sector employment is anticipated to continue growing, supported by government job policies and improved consumption, bringing the overall employment level close to its trend. Next year, the increase in employment is expected to be smaller than this year due to a decline in the working-age population, but private sector employment is likely to improve thanks to better conditions in the service sector and a moderation of the construction sector's downturn.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.