Financial Income Reaches 49.1 Billion Won as Operating Profit Plummets

Manages 259.7 Billion Won in Financial Assets

Samsung Electronics Newly Added to Portfolio in Q3

Stock Trading Suspended for Three Months Amid Executive Embezzlement and

Seohui Construction has reportedly been generating substantial profits by investing company funds in external stocks such as Tesla. This stands in stark contrast to growing investor anxiety, as the company's main business-regional housing cooperative projects-faces negative perceptions from the current administration, and the company is at risk of delisting due to a series of adverse developments, including the suspension of stock trading following allegations of embezzlement by a current executive.

According to the Financial Supervisory Service’s electronic disclosure on November 27, Seohui Construction’s operating profit for the third quarter of this year was 28.3 billion won, while its financial income reached 21.9 billion won. Financial income nearly matched operating profit. The cumulative financial income for the first to third quarters was 49.1 billion won, up 112% from 23.1 billion won in the same period last year. In contrast, operating profit fell 31.3%, from 172.2 billion won to 118.3 billion won during the same period. Financial income, which is classified as non-operating income, is making a significant contribution to the company’s finances.

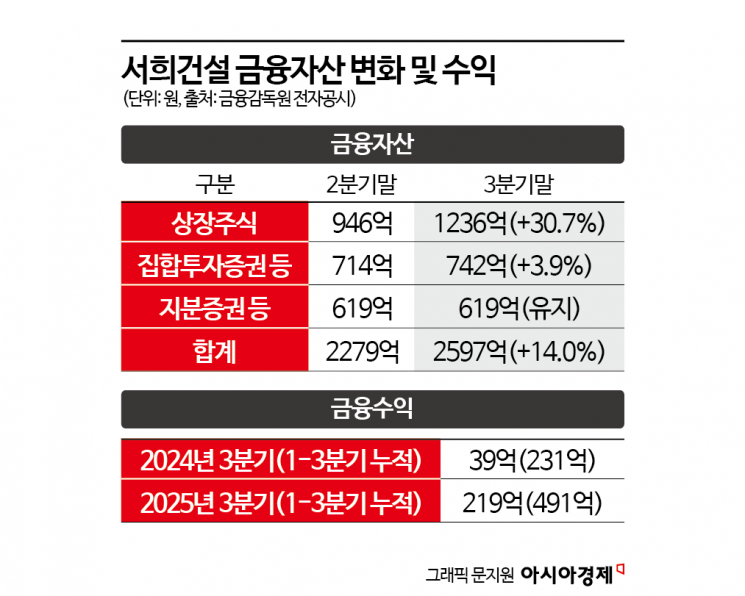

As of the end of the third quarter, Seohui Construction’s fair value through profit or loss (FVPL) financial assets amounted to 259.7 billion won, representing about 25% of its total equity (1.0406 trillion won). This is the highest level in the company’s history and is an unusual scale for a construction company. Compared to the previous quarter (227.9 billion won), this represents a 14.0% increase. Listed stocks rose from 94.6 billion won to 123.6 billion won, a 30.7% increase, while collective investment securities increased from 71.4 billion won to 74.2 billion won, up 3.9%. Non-current equity securities remained unchanged at 61.9 billion won.

Within the overall portfolio, the main stocks are Tesla (29.1 billion won), Palantir (24.2 billion won), and Samsung Electronics (19.4 billion won). During the third quarter, Seohui Construction sold all of its holdings in SK Hynix, Nvidia, and Microsoft. Meanwhile, it newly acquired 232,359 shares of Samsung Electronics. The company maintained its positions in Tesla and Palantir while restructuring the overall portfolio. An asset management firm CEO commented, "It is rare for a company to independently manage over 100 billion won in stocks. The strategies of selling Nvidia and SK Hynix and newly adding Samsung Electronics demonstrate investment acumen comparable to that of professional asset managers." He further explained, "In the third quarter of this year, the inclusion of Samsung Electronics, which was perceived as undervalued compared to Hynix, was a strategy to maximize returns."

Since around 2020, Seohui Construction has been flexibly adjusting its investment portfolio in line with market trends, boosting its performance. This asset management is reportedly overseen by Chairman Lee Bonggwan’s three daughters: Vice President Lee Eunhee, Chief Financial Officer Lee Sunghui, and Head of Strategic Management Lee Dohui. All three serve as inside directors and participate in management. In particular, it is said that the youngest daughter, Lee Dohui, holds the leading role in investment management.

A former Seohui Construction official stated, "After the in-house stock expert who previously managed the portfolio left the company, the third daughter was effectively given full authority over investment management and has taken a leading role. Even within the company, there were frequent remarks that it seemed more like an investment firm than a construction company."

In contrast, Seohui Construction’s core construction business is facing a structural crisis. The company relies on regional housing cooperative (jihujtaek) projects for over 90% of its total orders. However, these projects now face significant uncertainty due to the government’s announced plans for regulatory reform. The company’s project financing (PF) payment guarantees amount to 1.3706 trillion won, and external variables such as delays in obtaining permits and worsening marketability could significantly affect project viability.

Moreover, Seohui Construction’s stock trading is currently suspended. In August, the Korea Exchange halted trading after the company disclosed that a current executive had admitted to embezzling 1.375 billion won, and the company became subject to a special investigation regarding allegations of providing an expensive necklace to First Lady Kim Keonhee. The Korea Exchange determined that grounds for a substantive review of listing eligibility had arisen. Even after three months, Seohui Construction’s share price remains frozen at 1,623 won.

Minority shareholders are unable to recover their investments amid fears of delisting. As of the end of last year, Seohui Construction had approximately 25,000 minority shareholders, collectively holding 21% of the total shares. The Seohui Construction discussion board on Toss Securities is flooded daily with criticism. One investor said, "This company has taken a lot of money from cooperative members who dreamed of owning their own homes. Both members and shareholders have suffered significant losses." Another shareholder commented, "Corruption has erupted not just at one or two sites, but across the country. Rather than blaming the construction market, it was inevitable that a company chasing only blind profits would eventually face a reckoning."

Meanwhile, the improvement period for Seohui Construction to resolve the grounds for delisting runs until April 17 of next year. The Korea Exchange is currently reviewing the company’s improvement plan and will decide on the delisting in the future. The company’s financial status and audit results will serve as key criteria, and if the improvements fail to pass the exchange’s review, delisting will be finalized.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)