Stock Up 53% This Month; Market Cap Surpasses 5.7 Trillion Won

Share Price Surges Eightfold Since Trading Resumption

Osteoarthritis Drug Clinical Trial to Conclude in March Next Year

Kolon TissueGene, which is developing an osteoarthritis treatment using cell and gene technology, has reached a new 52-week high in its stock price. According to the financial community in Yeouido, the value of its knee osteoarthritis treatment (TG-C) is driving up the stock price, and there is a strong outlook for clinical success.

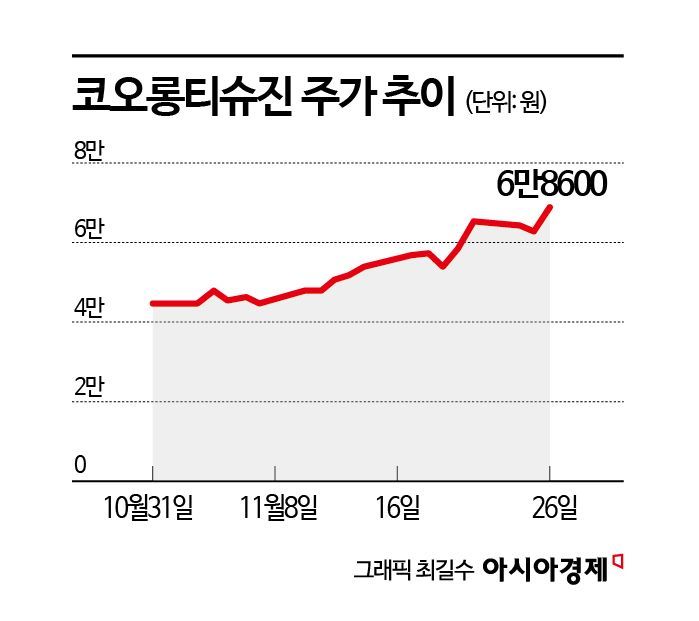

According to the financial investment industry on November 27, Kolon TissueGene's stock price has risen by 53% this month. At one point during trading the previous day, the price climbed to as high as 70,000 won. The company's market capitalization surpassed 5.7 trillion won. Foreign investors and institutional investors have been buying Kolon TissueGene shares, fueling the stock's rise. Foreign investors recorded a cumulative net purchase of 49.7 billion won this month through the previous day. The average purchase price per share was 55,920 won, resulting in a return of 22.7%. During the same period, domestic institutions also purchased 4.2 billion won worth of Kolon TissueGene shares.

After trading resumed on October 25, 2022, Kolon TissueGene's stock price trended downward for about a year. On October 27, 2023, it fell to as low as 7,710 won during trading. Since then, the stock began to rebound, and over the past two years, the price has surged by 790%.

The variable with the greatest impact on the stock price trend is the expectation of clinical trial success for the osteoarthritis treatment. Optimistic forecasts ahead of the clinical trial's completion in the first half of next year are influencing the stock price.

Kolon TissueGene is conducting a Phase 3 clinical trial with the U.S. Food and Drug Administration (FDA) for the knee osteoarthritis indication. The company plans to apply for product approval in the first quarter of 2027. Seo Geunhee, a researcher at Samsung Securities, explained, "The clinical trial will be completed in March next year," and added, "We expect to announce topline results in June next year." She also stated, "There may be an update on the results at the Osteoarthritis Research Society International (OARSI) in April next year," and added, "A review paper on pipelines aimed at structural improvement for osteoarthritis confirmed the competitiveness of TG-C."

Wi Haejoo, a researcher at Korea Investment & Securities, analyzed, "Considering TG-C's mechanism of action, consistent clinical efficacy, reduction in the frequency of total knee arthroplasty (TKA), and safety, the likelihood of clinical success is high." She further explained, "Because TG-C is a cell and gene therapy, its proprietary cell line acts as a barrier to entry, eliminating concerns about generic competition, which is also an advantage."

Korea Investment & Securities has valued TG-C's U.S. knee osteoarthritis market potential at 8.3 trillion won. Wi Haejoo assessed that, given the increasing number of patients, the fact that injections are administered to both knees, and the assumption of repeated dosing every two years, the value of TG-C could be raised to as much as 28 trillion won.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.