This Year’s Comprehensive Real Estate Holding Tax Notices Up 6.1%

Government Cites Market Factors Behind the Increase

Average Housing Portion Tax Per Person Reaches 1.606 Million Won

This year, the number of people subject to the comprehensive real estate holding tax (629,000 individuals) and the total tax amount (5.3 trillion won) increased by 14.8% and 6.1%, respectively. This was due to market factors such as an increase in newly supplied housing, as well as rises in officially assessed prices and land values nationwide. The rate of increase in the notified tax amount was higher for single-home owners (43.8%) than for owners of multiple homes (29.7%).

Comprehensive Real Estate Holding Tax Notices Sent to 629,000 People... Government Projects "Final Tax Amount Will Increase"

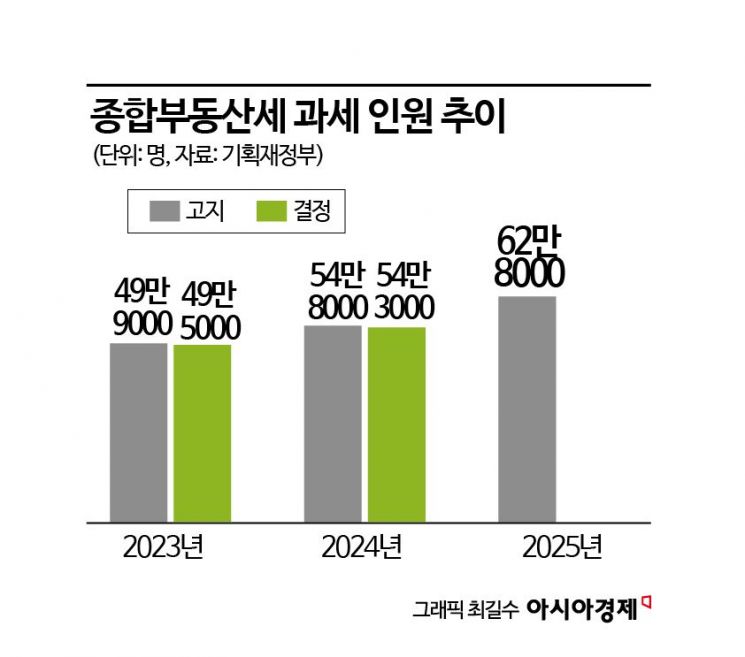

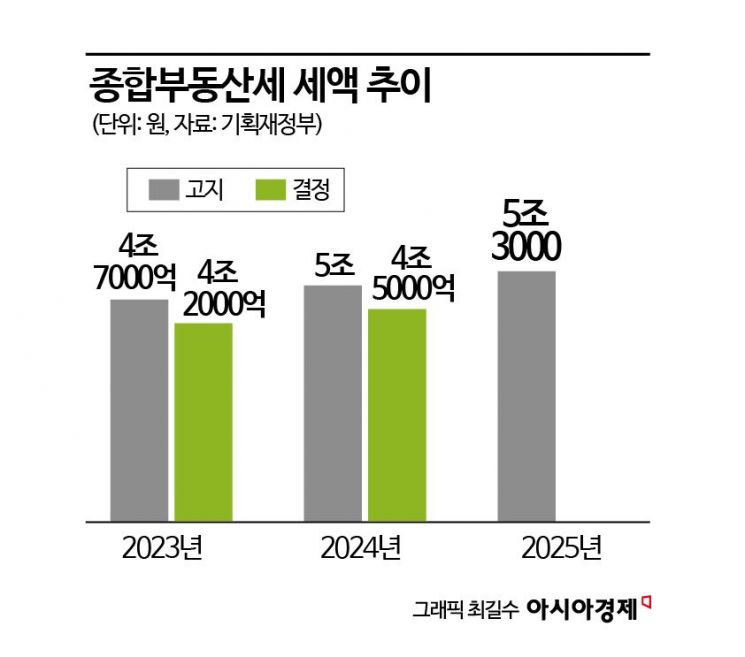

The Ministry of Economy and Finance announced on the 26th that it had sent comprehensive real estate holding tax (housing and land portions) notices to 629,000 people this year, amounting to 5.3 trillion won. Compared to the previous year, this represents an increase of 81,000 people (14.8%) and 300 billion won (6.1%).

The Ministry explained that, in the absence of significant changes to the comprehensive real estate holding tax system this year, market factors drove the increase. The rise in newly supplied housing and the nationwide increases in officially assessed prices for apartments and land were cited as key factors.

In fact, the number of apartment units subject to official price assessment increased by 350,000 units (2.3%), from 15.23 million last year to 15.58 million this year. Officially assessed housing prices and land values rose by 3.65% and 2.93%, respectively, this year. The regions with the highest increases in officially assessed apartment prices were Seoul (7.86%), Gyeonggi Province (3.16%), and Incheon (2.51%). The nationwide average was 3.65%.

A Ministry of Economy and Finance official stated, "Because many taxpayers apply for special exemptions after receiving their tax notices, the final tax amount typically ends up lower than the notified amount," and added, "Even taking this into account, the number of people subject to taxation and the total tax amount are expected to rise slightly compared to last year."

Last year, the total number of people who received comprehensive real estate holding tax notices (548,000) and the total tax amount (5 trillion won) increased by 9.8% and 6.4%, respectively. The rate of increase in the number of people was 5.0 percentage points lower than this year, while the tax amount growth rate was 0.3 percentage points higher. The final tax amount for that year was 4.5 trillion won, with 543,000 people subject to taxation.

Average Tax Per Person: 1.606 Million Won... Growth Rate for Single-Home Owners Exceeds That of Multiple-Home Owners

Breaking down this year’s comprehensive real estate holding tax, the number of people taxed for the housing portion was 540,000, an increase of 80,000 (17.3%). The tax amount rose by 100 billion won (6.3%) to 1.7 trillion won. The average tax per individual for the housing portion was 1,606,000 won, up 153,000 won (10.5%).

For individuals, the number of people taxed for the housing portion (481,000) and the tax amount (771.8 billion won) surged by 80,000 (19.9%) and 189.5 billion won (32.5%), respectively. The higher the comprehensive real estate holding tax base, the greater the increases in both the number of people and the tax amount. In fact, the number of people taxed with a base of 300 million won or less increased by 17.1%, while those with a base exceeding 2.5 billion won rose by 35.5%.

For single-home households, the number of people subject to taxation (151,000) and the tax amount (167.9 billion won) jumped by 23,000 (17.8%) and 51.1 billion won (43.8%), respectively. In contrast, for owners of multiple homes, the number of people subject to taxation (330,000) and the tax amount (603.9 billion won) increased by 57,000 (20.9%) and 138.4 billion won (29.7%), showing a relatively lower growth rate.

The number of corporations subject to the housing portion of the tax was 59,000, a decrease of about 146 (0.2%). The tax amount also fell by about 88.3 billion won (8.6%) to 900 billion won. A Ministry of Economy and Finance official projected, "The final tax amount and the number of corporations subject to taxation this year will be similar to last year."

By region, the number of people subject to the comprehensive real estate holding tax increased in all areas. The increase was particularly high in the Seoul metropolitan area, where officially assessed prices rose sharply. In Seoul, the number of people who received tax notices was 328,000, up 21%. The tax amount rose by 17.6% to 825.3 billion won. In Gyeonggi Province, the number of people who received tax notices (113,000) and the tax amount (319.2 billion won) increased by 15.7% and 4.3%, respectively.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.