Request to Extend Temporary Increase in 'Strategic FX Hedging' Ratio Through Year-End

NPS, Major Player in FX Market, Now Holds More Overseas Assets Than National FX Reserves

Up to $52 Billion Could Be Supplied to Market if Fully Implemented

As part of its measures to stabilize the value of the Korean won, the government has requested that the National Pension Service expand the foreign exchange hedging ratio for its overseas investment assets to a maximum of 10%. If the National Pension Service implements foreign exchange hedging for its overseas assets up to this maximum limit, it is estimated that approximately 52.1 billion US dollars could be supplied to the market. Given the significant impact that the actions of the National Pension Service, as a public investment institution, have on exchange rate volatility, the government believes the fund should play a role in supplying dollars to the market through foreign exchange hedging of its overseas investment assets.

According to relevant ministries on November 25, the Ministry of Economy and Finance has requested that the National Pension Service and its supervising ministry, the Ministry of Health and Welfare, extend the temporary increase of the strategic foreign exchange hedging ratio to 10% until next year. A government official stated, "We are seeking to extend the temporary period for adjusting the strategic foreign exchange hedging ratio, which is set to expire at the end of this year, until next year," adding, "Depending on the decision of the National Pension Service, we will also discuss extending and expanding the limits of the foreign exchange swap agreement with the Bank of Korea."

The National Pension Service plans to finalize the amendment to its fund management plan, which includes this proposal, after review by the Fund Management Working-Level Evaluation Committee and final deliberation and approval by the highest decision-making body, the Fund Management Committee. The previous day, the Ministry of Economy and Finance held the first meeting of a four-party consultative body with the National Pension Service, the Ministry of Health and Welfare, and the Bank of Korea to discuss ways to utilize the National Pension Service’s overseas investments to stabilize the foreign exchange market. The government maintains that since the National Pension Service’s overseas investments can increase demand for US dollars and thus drive up the exchange rate, it is necessary for the fund to contribute to stabilizing the foreign exchange market to some extent.

At the request of the Ministry of Economy and Finance, the National Pension Service first included in its investment guidelines in 2022 a clause allowing the temporary increase of the strategic foreign exchange hedging ratio from the previous 0% to up to 10%, depending on market conditions. However, there has not yet been an officially confirmed case of this being implemented. Since 2018, the National Pension Service has maintained a 100% currency exposure strategy for its overseas assets, focusing on maximizing returns on overseas assets rather than actively hedging against exchange rate fluctuations. Currently, the fund’s foreign exchange risk management is only applied to ‘tactical’ foreign exchange exposure management, with a limit of 5%. If the strategic foreign exchange hedging limit of 10% is added, hedging would be possible up to a total limit of 15%.

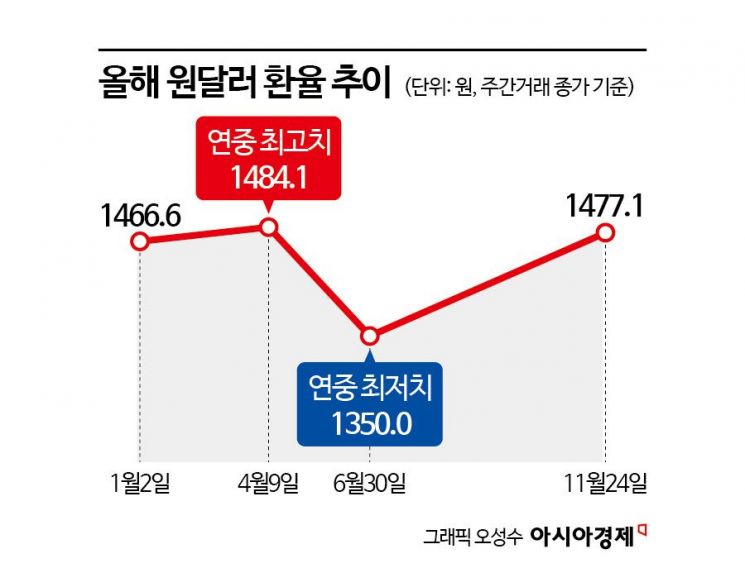

Strategic foreign exchange hedging is a method by which the National Pension Service preemptively sells its overseas assets if the value of the Korean won falls below a pre-determined level for a certain period of time. Market participants view the trigger for strategic foreign exchange hedging to be around 1,480 won per dollar. If the National Pension Service implements foreign exchange hedging for its overseas investment assets up to the maximum limit, the additional supply of US dollars to the foreign exchange market could reach as much as 52.1 billion dollars (77 trillion won, based on assets held as of the end of August). Considering that the average daily won-dollar trading volume in the domestic foreign exchange market (including NDF) is around 30 to 50 billion dollars, this is a significant amount.

The reason the foreign exchange authorities are seeking cooperation from the National Pension Service for exchange rate stabilization is because the fund has become a major player in the foreign exchange market. As of the end of August, the National Pension Service’s investments in overseas assets such as foreign stocks and bonds amounted to 771.31 trillion won. This exceeds Korea’s foreign exchange reserves, which stood at 428.82 billion dollars (about 632 trillion won) as of the end of September. Overseas investments account for 58.34% of the National Pension Service’s total financial assets, and this proportion is increasing every year.

This is also the background behind the government’s activation of an emergency cooperation system with the National Pension Service for foreign exchange market stabilization. The psychological defense line for the won-dollar exchange rate, as seen by the government, is 1,480 won. The previous day, the won-dollar exchange rate closed at 1,477.1 won in weekly trading, up 1.5 won from the previous session, approaching the 1,480 won level. The value of the won is at its lowest since April 9, when it hit 1,481.1 won. Taking into account purchasing power, the real effective exchange rate of the won stood at 89.09 at the end of last month (2020=100), the lowest in 16 years and two months since August 2009, during the financial crisis, when it was 88.88. Foreign exchange authorities believe that the deepening weakness of the won has been influenced not only by external factors such as changes in global interest rate trends but also by the increase in overseas investments by Korean residents.

Along with foreign exchange hedging, the government is also expected to utilize the 65 billion dollar currency swap line between the National Pension Service and the Bank of Korea, which is set to expire at the end of this year. To prevent the National Pension Service from directly sourcing US dollars from the market for overseas investments-which could impact the exchange rate-the Bank of Korea has been providing dollars through a swap agreement, which is renewed annually using its foreign exchange reserves.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)