Bank of Korea Releases November 2025 Consumer Survey Results

Tariff Deal and Stronger-than-Expected Q3 GDP Drive Rebound After Three Months

Housing Price Expectations Remain High, Slightly Down from Previous Month but Far Above Long-Term Average

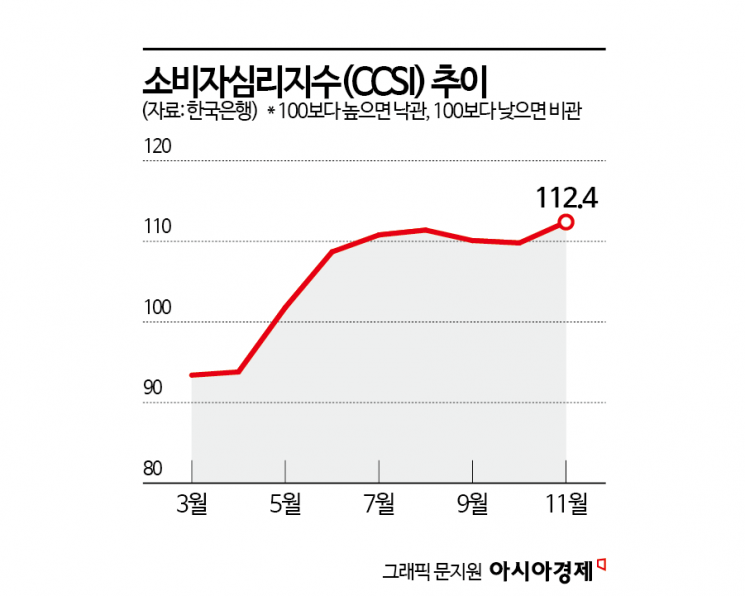

The Consumer Composite Sentiment Index (CCSI) for November reached its highest level in eight years since November 2017. This rebound, occurring for the first time in three months, was driven by the resolution of the Korea-US tariff negotiations and a third-quarter gross domestic product (GDP) growth rate that exceeded forecasts. Although expectations for housing prices eased slightly following the October 15 policy announcement, sentiment remains well above the long-term average, indicating continued optimism about further increases.

CCSI at 112.4... Highest in Eight Years

According to the “November 2025 Consumer Survey Results” released by the Bank of Korea on the 25th, this month’s CCSI stood at 112.4, up 2.6 points from the previous month. This is the highest figure since November 2017 (113.9). The CCSI is a comprehensive index reflecting consumer perceptions of the overall economy. It is calculated using six key indices that make up the Consumer Survey Index (CSI), including current living conditions, household income outlook, and consumer spending outlook. If the CCSI is above 100, it indicates that consumers’ subjective expectations about the economic situation are more optimistic than the historical average (from 2003 to December 2024), while a value below 100 signals pessimism.

The CCSI, which had remained above 100 until November last year, plunged to 88.2 in December due to the declaration of martial law, which dampened consumer sentiment, and continued to fall below the baseline until April this year. However, in May, the easing of trade risks following the US’s mutual tariff suspension and expectations for the launch of a new government pushed the index above the baseline. Supported by improvements in consumption and robust exports, the index hovered around 110 from July onward, before surging to its highest level in eight years this month.

Lee Hyeyoung, head of the Economic Sentiment Survey Team at the Economic Statistics Department 1 of the Bank of Korea, explained, “The CCSI hitting its highest level since November 2017 is largely due to the base effect after a sharp decline caused by the declaration of martial law at the end of last year and subsequent concerns over a worsening trade environment. During the survey period (November 11 to 18), the resolution of the tariff negotiations and the third-quarter GDP growth rate exceeding forecasts were highlighted, leading to this result.”

Expectations Remain for Rising Home Prices... Housing Price Outlook CSI Drops Just 3 Points

By sector, both the Current Economic Assessment CSI and the Future Economic Outlook CSI rose. The Current Economic Assessment CSI, which compares the present situation to six months ago, was tallied at 96, up 5 points from the previous month. While this is below the baseline of 100, it is still well above the long-term average of 72. Lee explained, “The index increased by 5 points due to the third-quarter GDP growth rate exceeding forecasts and robust exports.” The Future Economic Outlook CSI (102), which projects the economy six months ahead, jumped by 8 points due to the resolution of the Korea-US tariff negotiations and the easing of trade-related uncertainties, such as the US-China trade agreement.

The Housing Price Outlook CSI fell by 3 points from the previous month to 119. Expectations were dampened as the upward trend in apartment sales prices nationwide and in the Seoul metropolitan area slowed following the October 15 policy measures. However, the index remains well above the long-term average of 107, and compared to the sharp drop (11 points) in the Housing Price Outlook CSI after the June 27 policy announcement last July, the decline was limited, indicating that expectations for further increases remain strong. On this, Lee commented, “The index remains higher than after the June 27 measures, and expectations for housing prices are still high.” She added, “However, in July, the survey period was immediately after the June 27 policy announcement, whereas this time, four weeks had passed since the policy announcement, so the timing difference also had an impact. The future situation will need to be monitored.”

The expected inflation rate for the next year (2.6%) remained unchanged from the previous month, as the increase in the consumer price index was offset by the stability in the rate of increase in living costs. The expected inflation rates for three years and five years ahead both fell by 0.1 percentage points from the previous month to 2.5%.

The proportion of respondents who cited key items expected to impact consumer price increases over the next year was as follows: agricultural, livestock, and fishery products (51.0%), public utility charges (36.1%), and petroleum products (30.5%). Compared to the previous month, the share of petroleum products (up 6.0 percentage points) and rent (up 3.6 percentage points) increased, while the share of agricultural, livestock, and fishery products (down 2.8 percentage points) decreased.

Meanwhile, this survey was conducted from November 11 to 18, targeting 2,500 households in urban areas nationwide, with 2,276 households responding.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.