Hansol and Moorim See Sales Drop in Q1-Q3

Exports Fall by 4.3% and 6.7%, Hurting Performance

White Paperboard and Corrugated Cardboard Also Struggle Amid Domestic Slump

"Recovery Likely to Remain Limited Even in the Traditionally Strong Fourth Quarter"

The domestic paper industry, which had been seeking breakthroughs by turning to overseas markets, has now fallen into a deep slump due to global economic instability and the imposition of U.S. tariffs. The industry had been defending its performance through printing paper exports, but as even this is now faltering, pressure on overall management and sales is mounting. Recovery for white paperboard and corrugated cardboard, which mainly rely on the domestic market, also appears distant, leading to predictions that the industry will remain in a 'long tunnel' for some time.

Moorim Paper Jinju Plant. The Asia Business Daily DB

Moorim Paper Jinju Plant. The Asia Business Daily DB

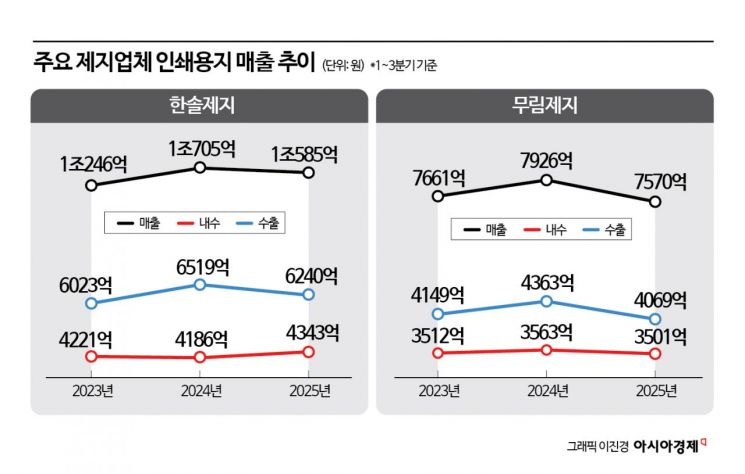

According to industry sources on November 24, sales of printing paper-the core product of the paper industry-have been on a continuous decline for the first time in two years. For the first to third quarters of this year, Hansol Paper, the largest domestic paper company, recorded 1.0585 trillion won in sales of printing and specialty paper, a 1.1% decrease from the previous year (1.0705 trillion won). During the same period, Moorim Paper's printing paper sales also dropped by nearly 4.5%, from 792.6 billion won to 757 billion won. Both companies saw a slight increase in printing paper sales last year due to price hikes and recovering domestic demand, but sales have now turned downward after two years.

It is widely analyzed that the decline in export volume, which had served as a 'pillar' for printing paper, played a significant role. While both companies' domestic sales remained similar to or slightly higher than previous years, exports fell by 4.3% and 6.7%, respectively. A representative from the Korea Paper Association explained, "While almost all product categories, including packaging paper, have performed poorly due to the sluggish domestic market, even printing paper and thermal paper-which had been holding up thanks to exports-have now declined simultaneously."

The domestic paper industry, faced with plummeting paper demand due to digitalization, population decline, and a sluggish domestic market, turned to overseas markets for new opportunities. In particular, they expanded their base by targeting the North American and Southeast Asian markets, where there is strong demand for high-quality art paper and printing paper.

However, since April, high tariffs have been imposed on printing and specialty paper bound for the United States, resulting in an overall reduction in orders. Although the Korea-U.S. summit last month led to a reduction in U.S. tariffs on printing paper from 25% to 15%, the industry continues to face a heavy burden due to the emergence of new costs that did not previously exist. Given the nature of the paper business-with thin margins and high sensitivity to external price fluctuations-along with fierce price competition with Canada and the European Union, the impact of the tariffs is considered significant.

The outlook is even gloomier for white paperboard and corrugated cardboard, which target the domestic market. For Clean & Clean, whose main business is white paperboard, sales for the first to third quarters of this year fell by 4% compared to the same period last year, with operating losses widening. During the same period, Asia Paper, a leading domestic corrugated cardboard company, saw its sales and operating profit drop by 8.9% and 15.9%, respectively.

Industry insiders believe that a clear recovery will be difficult even in the fourth quarter, which is traditionally considered the 'peak season.' An industry official stated, "The fourth quarter is usually a period of increased printing and publishing demand due to orders for New Year calendars and diaries, but with the continued impact of U.S. tariffs and ongoing global consumer weakness, it will be difficult for export volumes to rebound." The official added, "Structural downward factors outweigh potential rebound drivers, so even if there is a recovery, it is likely to be limited in scale."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.