Perplexity and OpenAI Rank First and Second, Respectively

Both Companies See Skyrocketing Valuations Amid the AI Boom

OpenAI's Losses May Determine the Fate of Big Tech

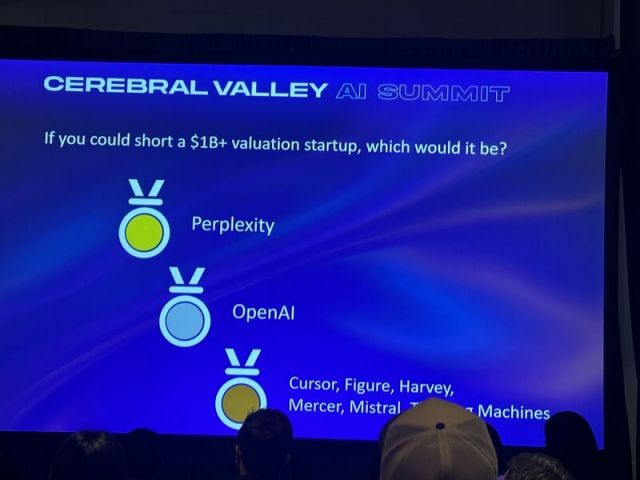

On November 15 (local time), at the "Cerebral Valley Artificial Intelligence (AI) Summit" in Silicon Valley, which gathered over 300 tech entrepreneurs, a provocative question was posed: "Which startup would you most like to short sell?" This was an unofficial, anonymous survey conducted at a time when concerns about an AI bubble are rising. The results showed that Perplexity, an AI browser company, ranked first, followed by OpenAI in second place.

Two Companies with Soaring Valuations, Heightened Industry Anxiety

In a survey identifying the AI companies people most want to short sell, Perplexity and OpenAI ranked first and second respectively. LinkedIn screenshot

In a survey identifying the AI companies people most want to short sell, Perplexity and OpenAI ranked first and second respectively. LinkedIn screenshot

Perplexity, which was ranked first, was founded in 2022 by computer scientist Aravind Srinivas, a former Google DeepMind intern. Within just two years of its founding, the company secured funding from prominent figures and investors in the U.S. IT industry, achieving unicorn status. Perplexity brands itself as an "AI browser service." When a user enters a question in the search bar, an AI model scours portals and summarizes only the most useful information. However, instead of using its own AI model, the company provides its service by utilizing models from competitors.

Controversy surrounding Perplexity began this year. In May, the company received a $500 million investment from venture capital firm Accel, causing its valuation to skyrocket to $14 billion. Last month, reports emerged that multiple investors had recognized its valuation at $50 billion. According to U.S. media outlet Business Insider, quoting VC investors, Perplexity's soaring valuation is a "classic case of FOMO (fear of missing out)." It was pointed out that investors are rushing to invest in order to secure even a small stake in rapidly appreciating unlisted stocks.

Growing Doubts over OpenAI's "Snowballing Deficits"

OpenAI, already proven in terms of technology and marketability as the developer of ChatGPT, is currently working on the massive Stargate data center project with numerous big tech companies. Nevertheless, within the AI industry, there is a widespread skeptical outlook on OpenAI's future.

In a podcast interview with investor Brad Gerstner, OpenAI CEO Sam Altman sharply responded with "Stop it" when asked about financial capacity. YouTube capture

In a podcast interview with investor Brad Gerstner, OpenAI CEO Sam Altman sharply responded with "Stop it" when asked about financial capacity. YouTube capture

One of the reasons fueling the OpenAI bubble theory is its ballooning deficit. According to OpenAI's financial report obtained by The Wall Street Journal on November 10, OpenAI is projected to record an annual operating loss of $74 billion by 2028. This is the result of developing new models and aggressive investments in data centers. The projected loss is more than five times this year's expected revenue of $13 billion.

However, CEO Sam Altman has not offered any concrete solutions to OpenAI's deficit problem. Brad Gerstner, one of OpenAI's early investors, recently invited CEO Altman to his podcast and asked, "How can a company with $13 billion in annual revenue continue to invest over $1 trillion?" CEO Altman responded, "If you want to sell our shares, I'll connect you with a buyer," and sharply retorted, "Enough."

"We May Reach the Promised Land, or Witness a Global Economic Downturn"

If the bubbles around AI companies such as Perplexity and OpenAI burst, the impact could spread to other companies as well. Previously, OpenAI pledged to invest $1 trillion while pursuing the Stargate project. In the process, it signed supply contracts with major U.S.-listed tech companies such as Nvidia, AMD, Oracle, and CoreWeave. The performance and stock prices of these companies have soared, but if OpenAI is unable to continue with its planned investments, the industry could deteriorate rapidly.

Warning signs are already appearing. According to a Financial Times report on November 18, Oracle's cash flow has worsened due to its expansion of data center facilities, and its net debt is projected to more than double by 2030. To avoid being overwhelmed by debt, Oracle must realize its $300 billion total data center lease agreement with OpenAI. As debt concerns have grown, Oracle's stock price has dropped by about 38% from its September peak to the present.

Stacy Rasgon, an analyst at global financial analysis firm Bernstein Research, warned investors in a letter, "Depending on the actions of CEO Altman and OpenAI going forward, we may reach the promised land, or we may witness the collapse of the global economy," adding, "At this point, no one knows what the future holds."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.