Factories Running at Full Capacity... Strong Performance Expected in Q4

Dominant in Key Markets Such as AI Servers and Automotive Electronics

Direct Control Over Materials, Confident in Core Technology Internalization

Expanding Capital Investment... Annual Operating Profit Nearing 1 Trillion Won

Samsung Electro-Mechanics is aiming to return to the 1 trillion won range in operating profit by running its multilayer ceramic capacitor (MLCC) production lines at full capacity, driven by expanding demand for artificial intelligence (AI). Some analysts say the company has entered a long-term boom, not just a temporary rebound, thanks to its competitive edge in high-value-added sectors such as AI servers and automotive electronics.

According to Samsung Electro-Mechanics' third-quarter report released on November 24, the average operating rate of the Component Division's production facilities (with MLCC accounting for 90% of the business) reached nearly 99%. Given that the company typically takes a conservative approach to production capacity to account for demand volatility, this figure indicates demand pressure that effectively exceeds full capacity. Although the fourth quarter is usually a period of inventory adjustment for set manufacturers, Samsung Electro-Mechanics is expected to continue operating its factories at full capacity, having secured strong demand for AI servers and automotive electronics.

MLCCs, often called the "rice of the electronics industry," are used across all sectors, including industrial, automotive, and information technology (IT). Samsung Electro-Mechanics has a particular strength in MLCCs for AI servers and autonomous driving (ADAS), which require advanced technological capabilities.

The MLCC market for AI servers is experiencing the fastest growth. AI servers use up to 10 times more MLCCs per server compared to conventional servers. Typically, server MLCCs are required to meet higher standards for temperature and humidity reliability and durability due to their different operating environments from IT MLCCs. MLCCs for AI servers must also handle high computational performance, large-scale data processing, and the resulting voltage and heat. In addition, as autonomous driving becomes more widespread, the volume of automotive MLCCs installed in vehicles is increasing significantly, creating a supplier-dominated market structure.

According to market research firm MarketsandMarkets, the AI server market is expected to grow from $142.9 billion in 2024 to $837.8 billion (about 1,230 trillion won) by 2030. Business Research Insights projects that the MLCC market will expand from $34.9 billion last year to $109.2 billion (about 160 trillion won) by 2034, with an average annual growth rate of 13.5%.

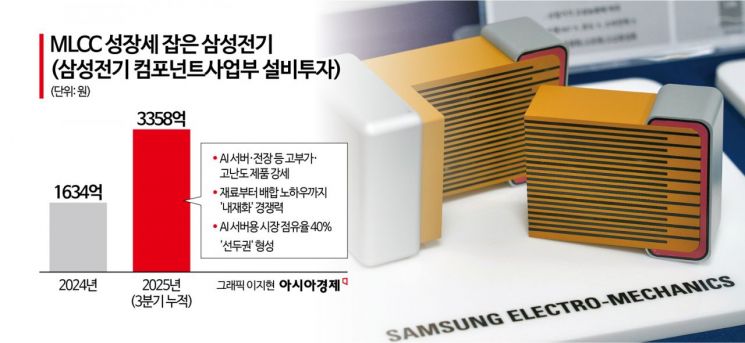

Having entered a full-fledged boom period, Samsung Electro-Mechanics is aggressively expanding production. As of the third quarter of this year, cumulative capital investment in the Component Division reached 335.8 billion won, already more than double last year's annual investment of 163.4 billion won. The Tianjin subsidiary in China serves as a large-scale mass production base, while the Suwon and Busan plants function as research and development hubs.

The reason Samsung Electro-Mechanics can increase its investments lies in its confidence in "core technology internalization." The MLCC production process, often described as "baking ceramics," relies heavily on know-how from material selection to blending. Rather than sourcing materials externally, Samsung Electro-Mechanics has secured proprietary material technologies, such as making dielectrics and electrodes thinner, to enhance its competitiveness. Only a handful of companies have internalized ceramic raw materials, and with a limited number of suppliers for server MLCCs, Samsung Electro-Mechanics is expected to continue benefiting as AI investment surges.

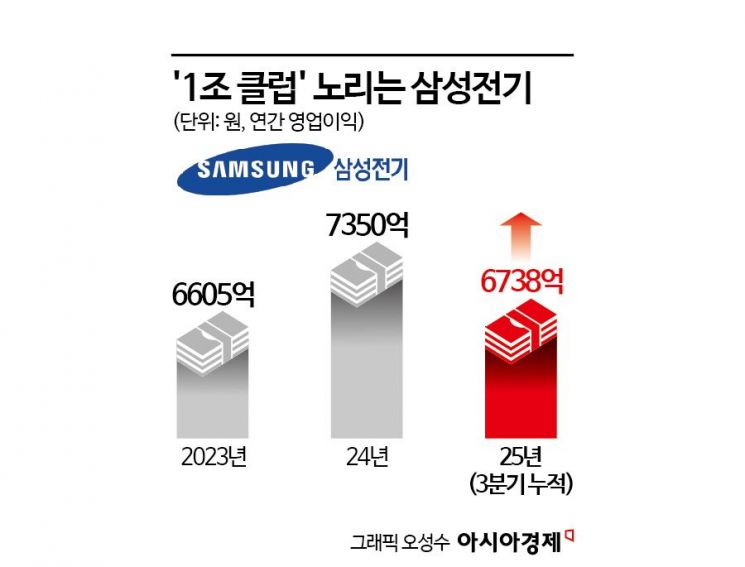

Samsung Electro-Mechanics is targeting a return to the "1 trillion won club" after three years. While it posted 1.4869 trillion won in operating profit in 2022, this figure dropped to the 600 to 700 billion won range in subsequent years. After surpassing 10 trillion won in annual sales for the first time last year, the company recorded cumulative operating profit of 673.8 billion won in the first three quarters of this year. With quarterly operating profits of 200.5 billion won in Q1, 213 billion won in Q2, and 260.3 billion won in Q3-showing growth rates of up to 20%-the company is expected to achieve annual operating profit in the 1 trillion won range.

Although the overall market share stands at around 40% for Japan's Murata and 25% for Samsung Electro-Mechanics, the company is vying for the top spot in key markets such as AI servers. An industry official stated, "Based on our competitiveness in materials and process technology, we are expanding our AI server lineup, which guarantees ultra-miniaturization, ultra-high capacity, high temperature, and high voltage," adding, "In the AI server market, we have secured about a 40% market share, establishing ourselves as a global leader."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)